Disney Parks Profitable, Delta Variant Impact & Guest Spending “Very, Very Strong”

Disney reported its third quarter earnings for April through June and forecast for rest of 2021, including the start of Walt Disney World’s 50th Anniversary on an investor call held by CEO Bob Chapek. In this post, we’ll cover the good & bad of these results, anticipated impact of the Delta variant on attendance, growth in per guest spending, and more.

I’ve been anxiously awaiting this earnings call for a couple of reasons. One is the aforementioned Delta variant, as it has come up with regularity on other recent corporate earnings calls. Per CNBC, few companies fielded questions about or mentioned the Delta variant when corporate earnings season began. The shift came after the CDC changed its mask guidance and recommended that fully vaccinated people should wear mask indoors in areas with high transmission rates, with 85% of questions or mentions of the variant coming after that date.

Given the billions of dollars that Disney’s theme parks lost last year during the closures and reopening process, the Delta variant is undoubtedly on the mind of a lot of Disney investors when it comes to the continued recovery. Anecdotally, we’ve heard reports of a new wave of cancellations from from travel agents and other third party vendors with regard to Walt Disney World. Anecdotally, crowds have felt much lower in the parks over the last several days, as well…

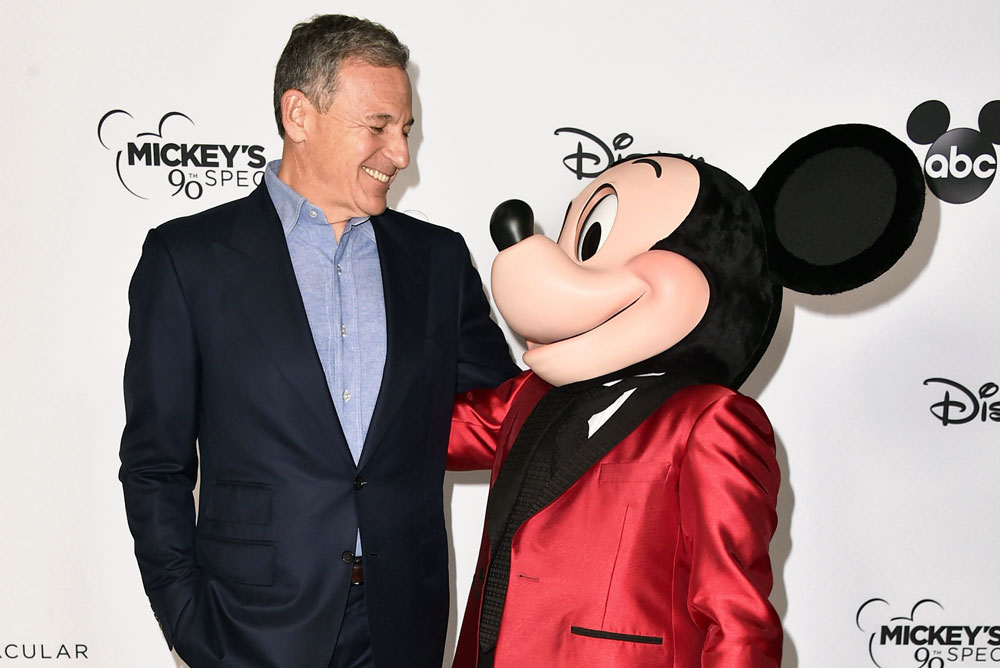

Other other area of interest could best be described as “palace intrigue.” Shortly before the last quarterly earnings call, Variety published a story titled “Disney’s New World Order Leads to Confusion and Bruised Egos.” Since then, there have been several more articles about the tensions between Bob Iger and Bob Chapek.

If these rumors are to be believed, this has been exacerbated by the bombshell Black Widow lawsuit filed by Scarlett Johansson against Disney, with insiders blaming CEO Bob Chapek for the handling of that embarrassing incident. (Note: that article can be read free on Apple News.) Those are all fascinating stories, but also mostly gossip that cannot possibly be confirmed–or refuted.

We have opinions on the Bobs, but as explained in our commentary about last year’s news of Bob Iger abruptly stepping down as CEO, we try to refrain from offering commentary about executive leadership at the Walt Disney Company because it’s tough to do so from the outside looking in. Quite simply, fans see what we want to see. We view things in reductionist terms, and can be manipulated by agendas both internal and external to the company.

Consequently, it’s easy to paint leadership in the familiar terms of Disney fairytales. Among fans, Bob Chapek is routinely perceived as the “villain.” I’ve seen fans blame him directly for decisions he definitely did not make. (Dude’s the CEO of one of the world’s largest companies, with diverse businesses ranging from ESPN to Disney Cruise Line. He’s not the one who decided to raise the price of popcorn.)

In my view, some of the things fans lament are more systemic. They are symptoms of the same type of priorities, corporate culture, and management philosophy that began late in Eisner’s tenure, accelerated under Iger, and appear poised to kick into even higher gear under Chapek. Even with those specific leaders removed from the equation, the outcomes would likely be more or less the same since the motivations and structure would remain intact. But that’s all well beyond the scope of this corporate earning analysis. (With that said, obligatory plug for DisneyWar.)

On that note, let’s start with a look at the earnings results…

The third quarter of the Walt Disney Company’s fiscal year (or the second quarter of the calendar year) is the first quarter of truly positive results. The script flips, as it’s the first time the previous year offers the abysmal comparison. April to June of last year saw all of Disney’s parks closed, and this April to June saw all of them open!

Against that backdrop, let’s start with a look the Walt Disney Company’s fiscal third quarter 2021 financial results. This was better than expected. Forecasts called for revenue of $16.76 billion, but the actual total was just over $17 billion. Earnings per share for the quarter were 80 cents versus 55 cents expected in a survey of analysts.

Unsurprisingly, Disney+ was once again highlighted during the earnings call, with 116 million subscribers. Disney reported 174 million subscriptions across Disney+, ESPN+ and Hulu at the end of its third quarter. Revenue for its direct-to-consumer segments increased 57% to $4.3 billion.

However, average monthly revenue per subscriber for Disney+ dipped 10% year-over-year to $4.16. The company attributed the dip to a higher mix of Hotstar subscribers compared to the prior-year quarter. This is because the Disney+ and Hotstar bundle that continues to grow in Indonesia and India has a lower price per paid subscriber than traditional Disney+ in other markets, pulling down the overall average.

Of particular interest to us is Parks, Experiences and Products (or Parks & Resorts). Revenue for this segment jumped 307.6% to $4.3 billion, compared to $1.1 billion in the prior-year quarter. Segment operating results increased by $2.2 billion.

Breaking things down a bit further, the domestic parks just barely eked out a profit, earning $2 million; the international parks lost $210 million; consumer products earned $564 million. That puts the entire segment at a positive $356 million–the first profitable quarter since the closure began.

Unsurprisingly, growth at theme parks was due to the reopening. Walt Disney World and Shanghai Disney Resort were open for the entire quarter. In the prior-year quarter, Walt Disney World was closed for the entire quarter and Shanghai Disney Resort was only open for 48 days.

Hong Kong Disneyland was open for 72 days in the current quarter and 10 days in the prior-year quarter. Disneyland and Disneyland Paris were open for 65 days and 19 days respectively, during the current quarter, whereas these businesses were closed for all of the prior-year quarter. (Tokyo Disney Resort is not owned by Disney and thus is not discussed on earnings calls.)

The earnings document also revealed that capital expenditures decreased from $3.3 billion to $2.5 billion year-over-year, driven by the temporary suspension of certain capital projects.

While this is a year-over-year downturn, spending has increased in the last couple of quarters as projects have started to resume and kick into higher gear. Work has resumed at Epcot and on Tron Lightcycle Run. For the international parks, the Zootopia expansion at Shanghai Disneyland, Arendelle: World of Frozen at Hong Kong Disneyland, and the expansion of Walt Disney Studios Park at Disneyland Paris are all underway again.

While discussing the theme parks business, Chapek was asked about the impact of the Delta variant. In response, he said: “In terms of Delta variant, we see strong demand for our parks continuing. The primary noise that we’re seeing right now is around group or conference cancellations. Right now we’re seeing [reservation demand] above the Q3 attendance levels, they were pretty darn good. We’re still bullish about our park business going forward.”

However, this seems slightly disingenuous, as capacity was constrained to 35% for part of the prior quarter. Demand exceeded supply on numerous occasions, as evidenced by the fully booked park days. In other words, actual attendance was artificially limited by lower capacity caps.

Now, the Disney Park Pass reservation calendar is mostly wide open–by and large, anyone who wants to visit can on any given day. That was not the case in the previous quarter. Accordingly, it would be interesting to know what has actually happened with cancellations, but we recognize that Disney wants to paint things in the best light to shareholders.

Disney CFO Christine McCarthy stated that at Walt Disney World, guest spending per capita again was “very, very strong” in addition to improved yield management.

She indicated that these numbers were “exceptional,” saying spending was even stronger than the double-digit gains reported in the last quarter. “Walt Disney World [has] been open now for over a year, we’re still seeing extremely strong per cap growth continue in the park. In addition to all of the technology things that we’re implementing and reservation and dining apps, we’re seeing the consumer behavior be very favorable and the guest experience is something that we’re going to be focused on especially as we continue to re-open.”

McCarthy also fielded a question about operating expenses, which are at 80% of 2019 levels, versus revenue, which is at about 60% of 2019 levels. In response to this inquiry about profitability improvements, she offered some insight into returning operations to 100% at Walt Disney World.

She indicated that Walt Disney World currently has 70% of available rooms open for booking, but that number would be closer to 100% by the end of the year. Specifically, McCarthy said, “as we scale our business and get up closer and closer to 100% capacity, our efficiencies and operating become much, much higher. I think you’ll see disproportionate benefit as we go from here on.”

McCarthy also stated that Disney plans on monitoring trends and what’s going on with the Delta variant. She also stated that they’re expecting the parks to be fully staffed by the end of this calendar year. “We’re going to be increasing capacities as we have the demand and we’re also being able to thoroughly train our employees as they come back in.”

She continued: “This is an ever-changing landscape with COVID. We’re going to be particularly careful and also going to bring our capacity online aggressively and measured. We’re not going to just open up the doors and fling them open. We’re doing this in the measured fashion for the health and safety of not only our guests, but also our Cast Members in the parks.”

To Disney’s credit, this is exactly what we’ve observed at Walt Disney World. Crowds have been growing and complaints have increased about lines, wait times, shorter hours, and the absence of FastPass–all of which are entirely valid. There is definitely room for improvement and Disney could be doing better in several–if not all–of these regards.

However, we’ve also been visiting Universal Orlando regularly since reopening, where the approach is decidedly less “measured” and more “aggressive.” While we praised Universal’s reopening decisions at the outset, the guest experience was miserable last month as crowds overwhelmed the park, which is also understaffed. This is not intended to knock Universal or praise Disney–both have made good and bad moves throughout the last year. It’s more to illustrate the reality that this is a pervasive problem in the hospitality industry, and Walt Disney World is hardly alone in attempting to strike the right balance in scaling up operations.

Ultimately, the financial results were about on par with what was anticipated. Familiar beats were hit–the success of and enthusiasm for Disney+ and consumer products, with continued improvements following the closure of the theme parks as operations scale back up. Some results were better than expected, others were slightly worse. All things considered, it was a fairly good earnings call.

With that said, for most Walt Disney World fans, these sessions are less about the financials and more about the trajectory and future prospects of the parks. More of that was covered during the Q&A, which covered the debut of the Disney Genie app for Walt Disney World. More on that shortly…

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of Walt Disney Company’s third quarter earnings and future forecast? Are you likewise optimistic for October 2021 and beyond, or think the Delta variant might spoil the party and depress attendance? Are you worried about the future of Walt Disney World, Disneyland, or the company in general? Excited by Disney+ continuing to grow its subscriber base? Think things will continue improving in 2021 or 2022? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!

Brilliant information you are giving me. Meant to be coming from England next April. But with the American travel ban on our travel agent doesn’t think its going to improve this year…. as for next… can only hope

@Tom, oh yeah, John Candy was huge. Stripes, Summer Rental, Planes, Trains…, Uncle Buck, all of them. The days when SNL was actually funny, with Belushi, Steve Martin, Candy, Murray, all those clowns. While Cobain was fairly popular, he wasn’t the innovator Jimi was. Though grunge had a good run, I don’t see it as industry-altering. I’m much more saddened by Dusty Hill dying than ole Kurt. We all have our favorites!

Great info Tom. I always love your post-earnings take on things. It’s interesting you bring up the guest experience at Disney vs Universal. We went to both in late April, and beforehand I kept hearing how Universal was doing everything right and Disney was doing everything wrong… and yet our experience was very much the opposite. Crushing crowds, meal-time pandemonium and ornery employees at Universal. Busy but manageable crowds, a fully functioning mobile meal service option with plenty of seating, and strict, but kind and respectful cast members at Disney. While we enjoyed Universal overall, our guest experience was much more positive at Disney.

@Tom I feel the same about Jimi Hendrix and John Belushi too. No telling what we might’ve gotten.

While I enjoy both, they’re before my time–Kurt Cobain and John Candy were the devastating (comparable) losses of my youth.

I can attest to the cancellations from a personal perspective, although anecdotal. We are pro-mask, however we aren’t all that interested in masking outdoors…in Orlando…in August. We had a trip planned later this month but we moved it out to November when the masking rules changed. I know masks aren’t required outside generally but they are required in the queues and that’s just too much for us in this heat. We’ll visit in November when it’s a little more manageable. I suspect there were a lot of cancellations after that change by people, regardless of where they fall on the mask debate. Masking outdoors in the heat is no fun at all!

I can’t recall how I stumbled on to your neck of the internet but I am glad I did. I have been going to Disney for most of my 54 years and consume my fair share of Disney news on the net. I have to say the writing and editing on here is top notch, thanks for the effort and the excellent work.

Thank you Tom, love the site! However, I’m wondering if you are going to address the correction that the State of Florida is asking the CDC to make on the reporting of it’s COVID case numbers. Accident or not, I think it would be important to report the actual lower daily numbers from the last weekend report for those who are basing their travel plans on COVID concerns. Thanks again for all the amazing info!

Our last COVID update was published a few hours prior to the data mistake and ‘dispute’ between Florida and the CDC. As such, there’s nothing to correct–the article is entirely accurate.

With that said, it’ll be addressed in next week’s COVID update, so stay tuned.

Tom, I can’t keep track of the moving boxes on the Disney corporate organization charts any more, I really appreciate you taking the time to show why specific groups beat expectations.

In one of the COVID reports, did you mentioned that the local counties report tax revenue by month? Is WDW large enough that one could use that as a way of track Park revenue trends in between quarterly reporting?

(Good catch with noting that some Disney+ international account growth appears to be InStar/Star related conversions!)

You know, if only Frank Wells hadn’t been killed in that stupid crash, things would be a lot different. Michael Eisner was a huge champion of the parks and Imagineering before that. I know a lot of Disneyites hate him because of the cutbacks in custodial and such, but he did a lot for the parks. Hell, he saved the whole company, twice. Iger has done some great things and some…not so great. As a stockholder, I want the company to make huge revenues and reinvest them into the parks. As a lifelong WDW fan, I want the parks to grow but retain the atmosphere and feel I’ve always known there. And yes, I do miss the big planters with trees that used to be in what is now the absurdly monstrous Hub area…

“You know, if only Frank Wells hadn’t been killed in that stupid crash, things would be a lot different.”

100%.

More than any other single event after Walt Disney’s death, this altered the course of the company’s trajectory. Can’t help but wonder how different things would be today had that not occurred.

Great article- I feel like the writing has been crushing it lately. Really enjoyed this and your covid related updates.

That being said, Chapek is clearly driving popcorn, churro, and soft pretzel related price increases. I saw this dude on YouTube who made this sick edit using these confidential documents that were posted to FaceTokGram. Blew my mind- he’s basically the popcorn king.

Other than that- real good post.

Thank you, Tom. Love to see how Disney profits and what they feel is important to customers and investors . Would love to be a fly on the wall in their board meetings! I am sure you can become a board member to represent all of us ? 😉