Disney & Trian Trade Languid Letters in Latest Fight

You could say that the shareholder proxy fight between Disney and activist investor Nelson Peltz’s Trian Group is heating up ahead of the company’s annual shareholder meeting. (I wouldn’t say that, but you could.) The latest update comes as the two have once again traded letters as they gear up for showdown; we’ll cover those along with commentary in this post.

It’s been over two weeks since the last major development, which we covered in Disney Fights Back at “Restore the Magic” Campaign. At that time, the company released a Powerpoint presentation (in the form of an SEC filing) to plead its case and push back against Peltz. In that, Disney argued that its Board of Directors is independent, highly qualified, and has provided strong oversight focused on delivering superior, sustained shareholder value.

Disney also touted CEO Bob Iger’s track record of growth, and the transformative purchases of Pixar, Marvel, and Lucasfilm, while also arguing that even the 20th Century Fox acquisition was strategically significant. Humorously, Disney also dug at Nelson Peltz, contending that he doesn’t understand Disney’s businesses, lacks the skills and experience to assist the board, and doesn’t have any real plans for change. In so doing, Disney effectively used Peltz’s own words against him, citing fumbled responses he made during a CNBC interview.

Prior to that, we covered Peltz’s initial slide presentation to “Restore the Magic,” which sounds to us like a “Save Disney” remake–minus having Roy E. Disney as the face of the campaign. In that, Trian made a more detailed and nuanced case in contending that many of Disney’s struggles are self-inflicted.

Trian and Peltz pointed to mismanaged succession planning, both in the way Iger v. Chapek was handled and also how prior CEO candidates were pushed aside. They also argued that Disney’s streaming strategy lacked focus and resulted in runaway spending and underperformance relative to Netflix, despite best-in-class IP.

Most notably from our perspective as Walt Disney World and Disneyland fans, the group contends that Disney’s recent approach to Parks & Resorts was unsustainable, with the domestic parks “over-earning” in order to subsidize streaming losses. Here, Trian’s core thesis is that price increases and nickel & diming is short-term thinking that puts the brand value and long-term health of Disney’s theme parks business at risk. All of this is explained in greater detail in the aforementioned posts, but that’s the saga thus far in a nutshell.

All of that activity occurred within the span of less than a week, and seemed to set the stage for a bonafide battle that would see Peltz and Disney trading blows. The company made proactive changes both with its Board of Directors and theme park policies to position itself to rebut Trian’s contentions. For his part, Peltz had embarked on a marketing and media blitz suggesting it would be a unrelenting offensive.

Since then, I can’t really say I’ve seen anything from either side that has made a strong impression, and that includes the latest letters. To be sure, there’s marketing for “Restore the Magic” everywhere. If you somehow aren’t seeing these online advertisements, either you’re not a true fan (kidding) or you’ve somehow outsmarted the system of contextual advertising. I’m seeing two-dozen “Restore the Magic” ads per day, easily. (Honestly, probably many more–but I’ve developed some degree of ‘ad blindness’ because I’m seeing the same ones over and over again.)

The problem? The ads suck. As I’ve made clear, I’m at least superficially receptive to the “Restore the Magic” campaign and think there’s at least some value to the battle for Walt Disney World and Disneyland fans. The more compelling the case, the stronger Disney’s response will need to be. However, outside of that initial slide deck, I cannot say I’ve seen anything even remotely resembling a persuasive or cogent case.

Honestly, even the slide deck is far from great. Perhaps foolishly, I assumed that to be an opening salvo, with Trian and Peltz refining and narrowing their focus once Disney responded. It’s possible that’s still coming, but thus far, I’ve yet to see anything compelling from that camp. The advertising is vague and all over the place, and every single Peltz appearance that I’ve seen in the media has been bad. It wouldn’t surprise me in the least if he doesn’t do further interviews because they’ve been self-defeating.

It’s not as if the Walt Disney Company has executed a masterclass in rebuking Trian. Their first SEC filing was hardly ironclad. They left ample opportunity for critique of the current Board of Directors, among other things. The critical distinction is that Disney doesn’t need to make a killer case.

At this point, the company can sit back and play it safe. Trian’s arguments thus far have been unfocused and inconsistent, Peltz’s interviews have made him come across as a chaos agent, and “Restore the Magic” has lost whatever momentum it had thanks to a “so what?” marketing push.

On top of that, Disney’s stock is up over 25% in just the last month. In fairness, the broader market is also up considerably during that time, but it’s still a point in Disney’s favor when it comes to this campaign. It’s a lot easier to convince individual shareholders that the company needs to reduce runaway spending or reinstate the dividend when the stock is plummeting. Not so much when it’s surging. Quite simply, the status quo is much more appealing now than it was a couple months ago.

Nevertheless, the latest update comes as Trian and Disney have traded tepid letters. Trian asserted in an SEC filing that Disney shareholders should vote to remove Michael Froman from the company’s board and replace him with Nelson Peltz. In that, Trian reiterated the case it previously made on the “Restore the Magic” slide deck, while also narrowing the focus of its proxy fight to a specific seat.

In their letter, Trian contends that Disney’s executives and directors do not want Nelson in the boardroom because “they don’t want to be challenged, answer hard questions, or have robust debates.” Trian goes on to contend that Peltz is experienced enough, committed enough and objective enough to insist that Disney live up to its full potential.

They argue that Peltz wakes up daily focused on Trian’s investments, whereas the current Disney directors “wake up with challenging day jobs: building cars, selling clothing, processing credit card transactions, sequencing genes. All important things.” (Okay, that did make me chuckle, but it’s probably a tad too subtle of a jab at the board’s lack of experience.) Trian claims the board’s lack of focus means they’re unable to ensure that 2023 and 2024 are nothing like 2022. (Whereas Peltz can.)

“Trian Group believes Mr. Froman has no experience as a public company director outside of Disney,” the firm said in a statement Thursday. “In contrast, Nelson Peltz has served on numerous public company boards over the last several years.” Trian further contends that this whole costly battle could’ve been avoided: Disney could have made room for Nelson before it decided to decrease its Board from 12 to 11 directors. Instead, it chose to shrink the Board.

“To help ensure the election of Nelson Peltz it is ESSENTIAL that Disney shareholders vote ‘FOR’ Nelson Peltz and ‘WITHHOLD’ on Michael B.G. Froman. If you do not ‘WITHHOLD’ on Michael B.G. Froman, this could jeopardize the goal of electing Nelson Peltz to the Board, even if you vote ‘FOR’ Nelson Peltz.”

All things considered, there’s nothing particularly noteworthy about this filing; this was an inevitability, as the focus of the fight would necessarily need to be narrowed to a specific seat that Peltz could (theoretically) take from a current Disney board member. It’s hard to see anything consequential in this filing.

Shortly thereafter, Disney’s Board of Directors issued a letter in response indicating that it does not endorse Nelson Peltz or his son as nominees (obviously). The board “believes the election of either Mr. Peltz or his son would threaten the strategic management of Disney during a period of important change in the media landscape.”

The letter continues: “Inexplicably, Trian seeks to replace Michael Froman, a highly valued member of the Board with deep background in global trade and international business, who the Board believes is far better qualified than either Mr. Peltz or his son to help drive value for shareholders. Neither Mr. Peltz nor his son offer skills or experience additive to the Disney Board that replace the decades-long experience of Mr. Froman.”

The rest of the letter continues by laying out Michael Froman’s decades of experience in business and international affairs, explaining how that’s critical to helping Disney assess the risks and opportunities in an increasingly complex global marketplace. Mr. Froman has an impressive background–it’s a good response. (There’s a lot more to the letter, but it essentially retreads ground that has already been covered.)

Ultimately, it’s starting to feel like Peltz already ‘shot his shot’ and is willing to rest on the laurels of the initial pitch and the marketing campaign as a means of convincing individual investors–perhaps fans and employees disillusioned with the last few years–to vote for him to have a seat on Disney’s Board of Directors. It’s possible that this is entirely calculated–that he believes his argument is sufficient to sway enough individuals, especially when paired with the support of Ike Perlmutter, one of Disney’s largest shareholders.

To me, that seems far-fetched. For one thing, there’s nothing to suggest Trian’s proxy battle is carefully calculated–not Peltz’s interviews, the advertising push, or even the slide deck on the “Restore the Magic” website. It’s all very scattershot, and if Trian has already put forth its best case, my bet is that it’s a losing case. On top of that, Perlmutter isn’t the only large individual investor–Laurene Jobs and George Lucas also have huge stakes. Not only are they more likely to be supportive of Iger, but so too are most employees and many fans who have stakes in the Walt Disney Company.

Increasingly, it feels like Peltz was gearing up for a battle with the unpopular CEO Bob Chapek with Disney’s stock price under $90, a looming recession, and disillusioned fans and employees. Literally all of those circumstances are different now, but by and large, Peltz still seems stuck in early November of last year. I’m still curious as to how this all plays out–and potentially benefits fans–but it’s looking less and less like Disney is going to need an aggressive effort to fend off the fight. Here’s hoping that Iger and co. seek to ‘restore the magic’ of their own volition, and there are certainly signs of that happening.

Need Disney trip planning tips and comprehensive advice? Make sure to read 2023 Disney Parks Vacation Planning Guides, where you can find comprehensive guides to Walt Disney World, Disneyland, and beyond! For Disney updates, discount information, free downloads of our eBooks and wallpapers, and much more, sign up for our FREE email newsletter!

YOUR THOUGHTS

What do you think about the “Restore the Magic” Campaign and Disney’s responses to it? In your view, which side has made the more compelling case…or have both been relatively weak? What about this week’s new filings–do you agree with our characterization of these as “languid letters” or do you think one side has a strong point? Think this fight will be beneficial for the company and fans at the end of the day, or is it already over? Optimistic that this will push Iger to finally get serious about choosing a successor or focus on improving guest satisfaction in the parks? Thoughts on anything else discussed here? Do you agree or disagree with our assessment? Note that neither Disney nor Peltz brought up politics or culture wars in their presentations; as such, all off-topic comments about either will be deleted.

Always admire the awesome alliteration, Tom. Humbly submitting for your consideration for the title: “Lackluster” instead of “Languid”? 🙂

The chaos of Peltz’s life is showing up in the bizzare planning of his daughter’s recent marriage to David Beckham’s son.

Peltz the billionaire is suing a wedding planner – for a lousy 100 K for some irritation..

They fired a couple planners, sounded like a complete egotistical s### show.

If you check the UK press you will find the story.

All lives are complicated but a Disney board member should be held to a high standard in all aspects of their lives. This guy does not cut it.

This little slap fight is thus far far, far less compelling than Succession is, for those with HBO!

D+ does have some serious flaws in its interface which are inexcusable and maddening. Normal streaming (i.e. everyone else) has features like a Resume button, a Start From Beginning button, remembering where you last were in a show and most importantly in lists when looking for movies or series versus having it start at the top with the generic new releases or recommended fluff. Disney’s IT products went to absolute crap as soon as they outsourced to China. Mydisneyexperience hasn’t worked anywhere close to 100% since then and continues to be glitchy all the time…

In the defense of Disney+, I can’t think of a single streaming service that I’d consider to have perfect or even great UI.

I’m currently “battling” with Peacock, trying to figure out why the Office–and only the Office–keeps turning on descriptive audio every single time I start a new episode! I also hate that so many of them loudly start a preview when I hover too long over a title, among other things.

I’d say My Disney Experience is far, far worse than Disney+ (but maybe that’s just me, and the fact that I use MDX much more than D+).

Agreed, they all have their faults! And yes, MDX seems to just languish, with no fix in sight…

In my opinion, any outside investor such as Peltz is only in it for their benefit, not the betterment of the customers. That said, wouldn’t it be great to have a Disney fan who also was a successful business person (NOT a professional investor) on the Board? Someone who could lobby for the customers and fans, not the stockholders. True, any corporation has to pay attention to their stock price, but Disney was able to do this for a long time while taking care of its theme park customers. Disney’s focus seems to be inordinately high on its streaming service, rather than the parks. Bluntly, I don’t give a rip about the Disney streaming service. To me, a long time, although no longer, parks fan, it appears Disney is using Disney World particularly as a cash cow to finance other things, and the customers can go whistle in wind if they don’t like it. If Peltz had any sense, he would harness the discontent among the hundreds of thousands of long time Disney park fans and use that in his publicity campaigns. He wouldn’t even have to talk – just show interviews with fans who have been alienated by recent Disney changes and are now leaving in droves.

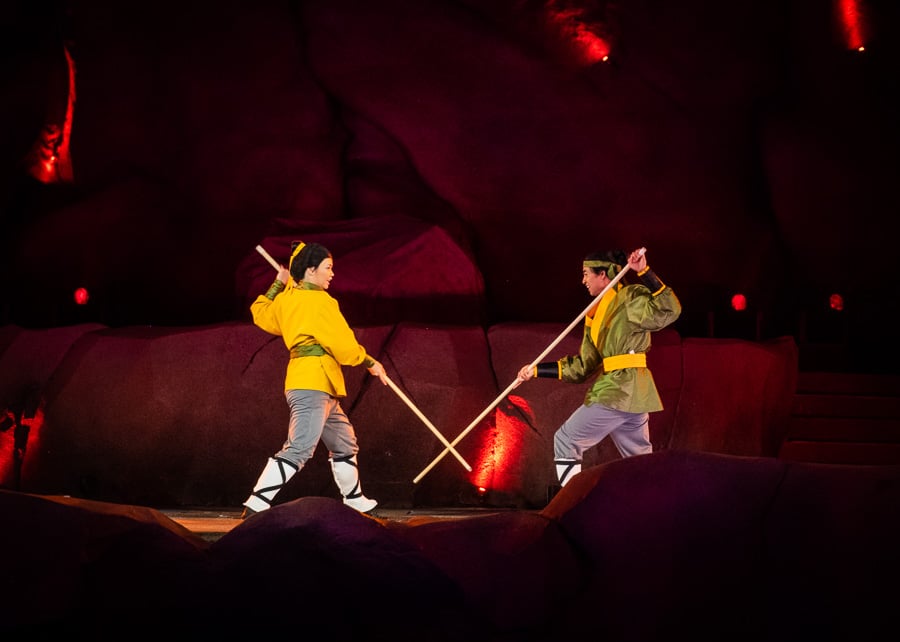

Your pairing the images with the prose game has gotten strong, and seems to show no signs of relenting. Great read. Thank you!

It has gotten to the point that I now have a growing list of photos that I need to take to pair with certain commentary and topics. Some of them are a bit weird, others are things I feel like I should already have (and might–but can’t find).

I’ve also edited another dozen “Umbrella Chapek” photos and am anxiously awaiting an excuse–any excuse–to unleash them. 😉