Money Saving Tips for Discount Disney Gift Cards

This covers our best money-saving tips for buying discount Disney gift cards via Target, Kroger, Meijer, Sam’s Club, Best Buy, and beyond. Some deals offer big savings for your Walt Disney World vacation, while others are modest but easier. (Updated December 11, 2023.)

Since we are pretty big on stretching our vacation dollar with all sorts of travel hacks, we thought we’d share some of the best methods for scoring discounted Disney gift cards. Some of this might sound complicated and intimidating, but it’s really easy once you get the hang of it, and the upside is so tremendous that it makes the effort of learning well worth it.

With that said, I understand that this is not going to be for everyone. If you don’t have a credit card or are uncomfortable making online purchases, this definitely isn’t for you. While there are a few 101 level travel hacks here, a couple of the tricks are more 404 level.

As good deals come and go, we update this post with the best options for saving money on Disney gift cards. (If you see a “last updated” date at the top of this post, it’s because we’ve found a new limited time deal.) Some of them are convoluted and have limited applicability. Others are open to everyone but have stricter purchase limits.

Regardless, this is one of the easiest way to save money on Walt Disney World vacations–and one of the few that is “stackable” with other discounts. Subscribe to our free email newsletter for a heads up if or when more Disney gift card deals go live.

With that said, here are the various options for saving money on Disney gift cards. Note that these are not always available–they come and go. If you click a link and full price gift cards come up, you’re not missing anything–the deal isn’t being offered!

Costco

Costco Wholesale currently is selling $250 Disney eGift Cards for $225 (deal available as of December 11, 2023–no end date is known). You need to be an active Costco Member and signed in to your account to purchase at sale price. This is delivered via email, so the recipient’s email address must be supplied in email field on the Shipping Address page.

There’s a limit of 2 Disney gift cards per membership, meaning $500 for the price of $450. These can be combined with other gift cards via Disney’s online management tool. We’ve seen scattered reports (with hit or miss results) of some Costco members being able to make two different transactions, each with 2 gift cards in them.

It seems like you’re more likely to be successful if you have a membership with multiple members on it, each having a unique ID. Or if you place one order one day, and another the next. Regardless, don’t be surprised if your second transaction is unsuccessful. (We haven’t heard of anyone managing 3 or more orders. Two is the max.)

Sam’s Club

From time to time, Sam’s Club members may purchase Disney gift cards for 10% off, to be delivered electronically. When offered, these deals are online only and while supplies last; prices may vary in club. The last time we saw this offered was at the start of the Christmas 2023 shopping season.

Note that this is an eGift card, and it will be emailed within 48 hours of purchase. It’s also worth noting that Sam’s Club is available via various credit card and online cashback portals. Almost all of those explicitly exclude gift card purchases from receiving cash back, but it still doesn’t hurt to try. Might get through and end up saving even more money!

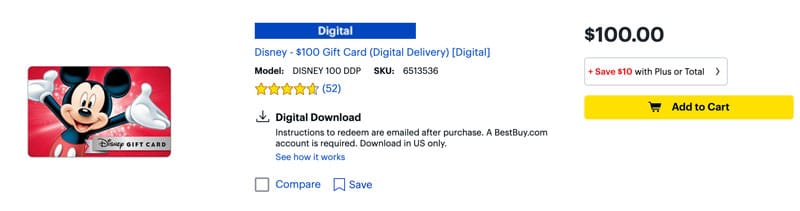

Best Buy

Another currently unavailable but frequently repeated discount is Best Buy offering 10% discounts to My Best Buy Plus or Total members. For those who are unfamiliar with it, this is essentially their version of Amazon Prime, offering expedited shipping and access to exclusive sale prices.

It’s also not uncommon to find discount Disney gift cards are sold at Best Buy without the need for a BB+ membership. That’s happened multiple times for Black Friday or Cyber Monday, with the retailer selling $50 Disney gift cards for $45, or a savings of 10% off.

Where this deal gets really sweet is if you have If you have any Chase credit or debit cards (or the Best Buy card), as many of these have targeted offers for 10% cashback at Best Buy. That should be stackable with this offer, making the discount even better.

In terms of fine print, you’re limited to one Disney gift card per transaction and account, although some people have reported success placing 2 separate orders or buying more with different accounts. Others have had their subsequent order(s) cancelled, not that we know from personal experience or anything. Basically, it’s YMMV after the first order.

Kroger Fuel Points

For those of you near Kroger grocery stores, this is one of the better “everyday” ways to save on Disney gift cards (well, technically, you’re saving money on gas, but it’s because of the gift cards). Normally, every dollar you spend at Kroger earns 1 fuel point, or 2 fuel points on gift card purchases. On occasion, Kroger offers 4X fuel points (sometimes it’s for a period of weeks, sometimes for a single day), which really sweetens the deal.

For every 100 fuel points you redeem, you save $0.10 off every gallon of gas (up to $1/gallon off) you purchase on a single fuel purchase. The precise value of this deal varies based upon how large of a gas tank you’re filling (and how empty your tank), so obviously those with trucks and larger vehicles are going to do better here.

Let’s say your gas tank has 25 gallons of empty space: the normal offer could be worth $25 for every $500 spent (5% savings). With the 4X deal, you’re looking at 10% savings. Stack this with a credit card that earns extra at grocery stores, and this can be one of the best deals out there when the 4X bonus is available.

While we use this for Disney gift cards, like many of the offers here, the same theory can be applied to a variety of other stores, including Target, Lowe’s, Southwest Airlines, GAP, iTunes, and Visa. Note to be mindful that the generic ‘Visa’ gift cards have an activation fee, which more or less kills the deal.

Target REDCard

The Target REDcard gets you an automatic 5% discount on any purchase at Target, including gift cards. Among other things, Target sells Disney gift cards both online and in-store, making for a simple way to save 5% on your Walt Disney World vacation.

If you don’t have a Target Red Card it might be worth getting one just to take advantage of this deal. Consider this: many Disney fans are Disney Visa cardholders (a fairly crumby credit card, honestly) because of the Disney perks. However, by virtue of this one deal, the Target Red Card is unquestionably a better card from a rewards perspective for Disney fans.

It may not have Mickey Mouse’s picture on the card, but the Target REDcard gives Disney fans (who know how to use it) greater rewards. You can also take advantage of it with the Target Red Debit Card, which can be a good option for those who don’t want a credit card…or another one.

Meijer Mperks

If you live in the Midwest or one of the other regions in the United States with Meijer stores, they often run $5 off $50 promos on gift cards. When available, this is limited to a total of 10 rewards purchases–or $500 in gift cards–per Mperks account. (Meijer routinely runs this offer, usually multiple times per year.)

This means you can purchase a single Disney gift card for $500 and you’ll earn ten rewards of $5 (or $50 total) to use on future purchases. This essentially makes it identical to the BJ’s deal, albeit without the membership and Chase Freedom credit card requirements–the only catch here is that not everyone has Meijer stores near them. Sadly, we don’t!

BJ’s Wholesale Club

Another good deal available from time to time is via BJ’s Wholesale Club. Members can purchase a $500 gift card for a discounted amount, sometimes as low as $469.99 during sales. This savings isn’t huge on its own, but it’s sometimes the best option–and it can be “sweetened” for some Chase credit card holders.

That’s because if you have a Chase Freedom credit card, the quarterly 5% bonus category can include PayPal purchases, and you can use pay on the BJ’s site using PayPal linked to your Chase Freedom credit card. In that scenario, the effective cost ends up being under $450 for the $500 Disney gift card. Double win!

Warehouse Clubs

Even easier than the Kroger Fuel Points is the discounted Disney gift cards Sam’s Club and Costco sometimes sell. These gift cards (or packs of gift cards) aren’t always available, and when they are, the savings are usually 4-6%, but if you’re not too keen on the other methods (or don’t have Kroger near you), it can be a “better than nothing” scenario.

This deal can be sweetened if you have a Chase Freedom credit card, as wholesale clubs are one of the rotating 5X categories (this quarter, in fact). Speaking of credit cards, make sure you have the correct credit card when visiting your warehouse club of choice (Sam’s Club now accepts Visa; Costco stopped accepting AmEx). You don’t want to have to pay in cash, causing you to lose out on that bonus!

Cashback Portals

Another way to sweeten the deal is by combining the gift card churning with cashback shopping portals. There are a variety of these, and the percentages of cashback they offer can vary based upon what promos they’re offering, and the product purchased. I like to use cashbackmonitor.com or evreward.com for a quick “at a glance” comparison of the cashback portals.

I use cashback portals fairly regularly, but this typically does not hold true when it comes to gift card churning. Many retailers exclude gift cards from their cashback offers, and while you can still game the system to get cashback on gift card purchases (although they are technically excluded, the retailers and cashback sites often do not effectively communicate as to the substance of the order), it’s inconsistent.

More importantly (for me, at least), I’ve heard stories of people being blacklisted from certain online retailers as a result of “manipulating” the cashback portals for their gift card purchase rackets. This is another “your mileage may vary” situation, so consider giving it a try for greater savings.

This is another option that can be leveraged in myriad different ways, and with cards that have nothing to do with Disney. If you’re really serious and/or crazy, you could go full circle and apply the principles gleaned here to do manufactured spends. I’m not going to go into further detail on that, as the line between that type of churning and “gift card laundering” is a thin one. Both sides of that “line” are totally legal, the latter might cause some headaches.

With all of these strategies, I’d recommend not doing this too far in advance of your trip; if you’re doing any of this 3 years in advance, you aren’t beating the system at all–you’d be better off making actual investments given typical ROI and the time value of money.

I’d also recommend not tying up more money than you can afford to be stuck in limbo; if you’re paying interest on credit cards to fund this, you’re also losing in the grand scheme of things. Finally, be careful. While all of this is perfectly legal, businesses aren’t exactly “fans” of customers exploiting their policies. If you are cycling a lot of money through any retailer solely in gift card purchases, you might draw some attention to yourself, and risk catching their ire.

With all of that said, good luck leveraging these Disney gift card hacks to save a little more money on your Walt Disney World vacation! With a little work, these strategies can be incredibly valuable and make those exorbitant prices a little more palatable. Once you learn the ropes with using these tactics for Disney, think bigger picture. There are entire blogs and websites devoted to travel hacks, including churning, manufactured spends, etc. Once you get the hang of it, the possibilities are almost endless.

Likewise, if anything sounds confusing, feel free to ask questions–everyone starts from the beginning, and my explanations as someone who has been ‘hacking’ for a while might be insufficient for walking beginners through these processes from start to finish.

Need Disney trip planning tips and comprehensive advice? Make sure to read Disney Parks Vacation Planning Guides, where you can find comprehensive guides to Walt Disney World, Disneyland, and beyond! For Disney updates, discount information, a free download of our Money-Saving Tips for Walt Disney World eBook, and much more, sign up for our free monthly newsletter!

Your Thoughts

Have you tried purchasing “discount” Disney gift cards to cut the cost of your vacation? Any other strategies you’ve used to save for a Walt Disney World trip? Questions about any of the techniques we’ve shared? We love hearing from readers, so please share some of your favorite ways to save, or any other thoughts or questions you have, in the comments!

The Costco deal is 2 per membership per purchase. We bought two gift cards on two separate occasions this week.

yes, I can second this. I was able to purchase 8 GCs, 2 at a time.

The Chase Freedom cards also have Costco as one of their bonus categories this quarter (4Q2023). So if you activate that offer, haven’t met the $1,5000 maximum spend threshold, and use your Chase Freedom card that brings it down to $213.75 (after accounting for the 5% back on your $224.99 purchase) for a $250 gift card. Do it twice and you’re sitting pretty good.

the Blood Connection ((SC, GA) is giving $50 egift cards for blood donations. The cards are for a company that lets you choose what card you want and Disney is included. Got the link and selected card within 1-2 hours of my donation. Transferred the value to my physical gift card (Bantu Credit coin) on disney gift card app. 100% discount for a pint of blood.

Tom, you’re the exact person who’d know this: Which purchases at WDW qualify for the Chase Freedom 5x points this quarter? Tickets only, or dining, merch, etc?

We’re midwesterners who are able to take advantage of the Meijer offer! They are currently offering 10,000 Mperks points for every $50 in gift card purchases up to $250/50,000 point. These Mperks points can be redeemed in a variety of ways but the best deal is for $1 off per gallon up to 30 gallons at Meijer gas stations.

Thanks for this! Came here looking for more details on the bounceback offer, but definitely excited to see this, I would have missed it! Heading to Meijer today. 50,000 points can also be used for $50 off your total purchase, for those unfamiliar with mperks!

Target Red Card is good for the 5% off Disney gift cards but be careful getting the electronic E card. Many of the Disney restaurants couldn’t scan the bar code at the table and needed to take my phone in the back or to a register to scan. Kinda a nuisance. I prefer the physical gift cards instead mainly for this reason .

All you need to do is transfer the e-card to a physical card- Just use the disneygiftcard site- it’s so easy! You do need to have a physical card to do this! You can also transfer smaller cards ($25) to one card, so you are not carrying around so many cards.