70% of $60 Billion for Disney Parks Expansion, And More From Bob’s Big Earnings Call

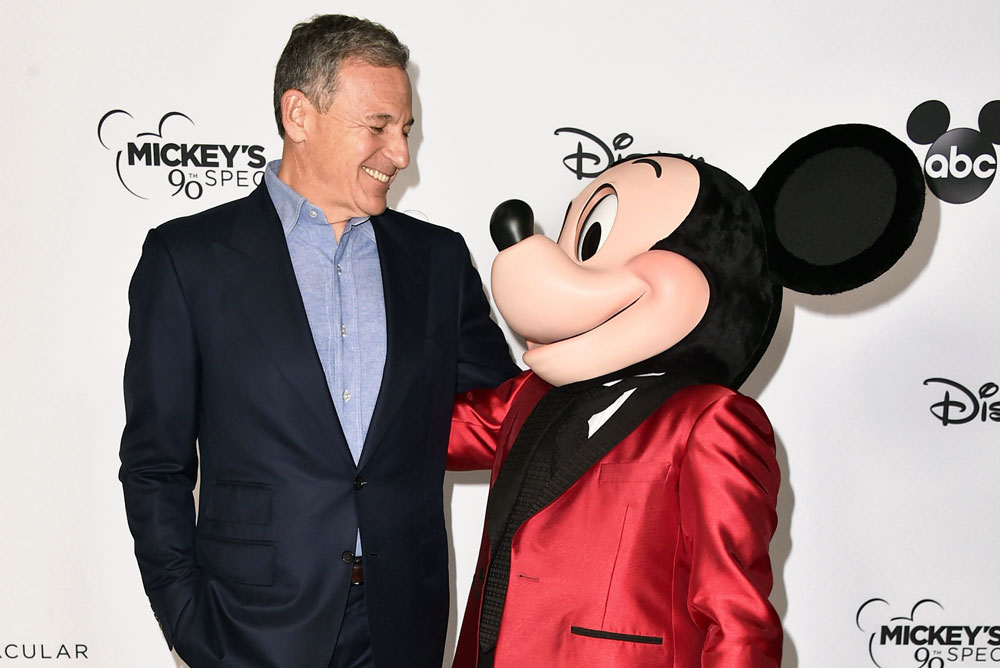

Never bet against Bob Iger (or James Cameron, but he’s not relevant for the purposes of this post). After several rough quarters and a turnaround process that hasn’t been nearly as smooth as anticipated, the 2024 fiscal first-quarter earnings call was Vintage Bob. This post shares some of the big-picture results and why they matter, before turning our attention to Walt Disney World, Disneyland, and the rest of the Parks & Resorts division.

Disney had a huge beat on earnings, reporting much better than expected results. Earnings per share were $1.22, versus the 99 cents expected by Wall Street. Revenue was about flat at $23.55 billion, compared with $23.51 billion in the year-ago quarter. The first number obviously far surpassed expectations, whereas the revenue number actually fell slightly short. However, that’s only part of the picture–as Disney narrowed its losses considerably.

To that point, net income rose to $1.91 billion, up from $1.28 billion in the prior-year period. That’s in large part thanks to the company’s cost-cutting measures–Disney said it’s on pace to meet or exceed its goal of at least $7.5 billion in savings by the end of fiscal 2024. Streaming is also starting to pick up some slack, as Disney’s direct-to-consumer (DTC) unit reported a $138 million loss in the quarter ($216 million once including ESPN+, which is part of a different division now). That’s still a lot of money, but it’s also to be expected–and a massive improvement from $1.05 billion loss in the prior-year period.

Even more notable are Disney’s forward-looking expectations. The company stated that it expects fiscal 2024 earnings per share of about $4.60, which would be at least 20% higher than the last fiscal year. Disney expects to generate around $8 billion in free cash flow for the fiscal year.

As a result, Disney increased its dividend by 50% versus the last dividend paid in January, to $0.45 a share. This is still only about half of the 2019 dividend, but a marked improvement over the previously-suspended ($0.00) dividend under the Chapek regime. In fairness, that occurred for good reason, as theme parks and theaters were closed and the company was making massive investments to scale up streaming.

Other big news is that the board approved plans for up to $3 billion in share repurchases. This will mark Disney’s first buyback program since 2018 fiscal year. Honestly, I could do without this (and the dividend, for that matter). I’m not categorically opposed to buybacks, but view them as a more appropriate way of returning capital to shareholders when there aren’t better avenues for growth. Disney has plenty of paths to growth–but the stock arguably is undervalued, so there’s also that.

Regardless, the numbers alone and Disney’s plans should silence the chorus of critics who keep chirping, “Disney is bRoKe!” (Who am I kidding, they’ll find something else–or claim that the numbers are fudged or contort this to paint it as bad news. How dare I dispute the wisdom of random YouTube ragebaiters?!)

Wall Street certainly sees these as strong results from Disney. Shares immediately jumped 7% in after-market trading after the results. As of the time of this post on February 8, 2024), Disney is up 12% on the day. It wasn’t just the numbers themselves, though. It was a number of new announcements meant aimed at exciting fans and shareholders, while also delivering a clear vision for the future that would silence the critics. In this case, not the randos on YouTube–but the activist investors who are waging proxy fights.

Before the earnings call even began, Bob Iger appeared on CNBC to break the news that Disney is taking a $1.5 billion stake in Fortnite studio Epic Games. We are big fans of this announcement, which shouldn’t be surprising to regular readers given that 2 weeks ago we called video games the company’s biggest blind spot and something that should be remedied ASAP before acquisition costs increase further.

Suffice to say, Disney needs the mindshare of younger audiences and this is the perfect way to accomplish that. I personally have zero interest in Fortnite or an adjacent Disney-universe, but I can recognize its influence and popularity–and that not everything needs to be aimed at me. This is a big deal for the future of Disney and the longevity and brand awareness of these characters.

Disney also announced that it’ll launch its flagship ESPN streaming service in Fall 2025. This is not to be confused with the currently-existing ESPN+ streaming service or the new sports streaming joint venture ‘bundle’ featuring Fox, Warner Bros. Discovery, and ESPN coming later this year that was announced the day before the earnings call.

If you’re wondering why we haven’t covered that news in a standalone post, it’s because I’m honestly not sure what to make of it. As a sports consumer and cord-cutter, I’m happy to finally have Fox Sports without using my mother-in-law’s cable login (don’t tell anyone). I think it’s probably also good for Disney and Warners, but both also have their scaled-back streaming versions of their own networks (Max has B/R now).

I’m skeptical as to how ‘big’ this will be, and think that largely depends upon cost. If it ends up being over $40 per month, how many people is it going to attract who don’t already have cable or something like YouTube TV? There’s also the very real possibility of consumer confusion once there are 3 different ESPN-adjacent apps on the market. So I think the jury is still out on this. (What really needs to happen is sports rights contracts need a reality-check. Those numbers are not sustainable in a non-growth environment, except as loss leaders.)

In addition to this, Iger shared more news about the upcoming film slate and shared a couple of surprises. The Moana series that had been in development for Disney+ is going to be released theatrically as Moana 2. In a nod to Steve Jobs, he delivered an “…and one more thing” announcement that Taylor Swift’s The Eras Tour concert film is coming to Disney+.

A lot of this probably won’t resonate with Walt Disney World or Disneyland fans, but it was an avalanche of announcements that signal the end of the ‘course-correction’ and start of a new phase of expansion. Again, it was Vintage Bob, sounding like the CEO of 2019 and earlier. Finally.

Although none of this pertains to parks directly, the indirect ramifications are huge. As we’ve said repeatedly, all of Disney’s woes are relevant to future Walt Disney World and Disneyland expansion because fixing the problems is a necessary prerequisite to growth. Well, mission (at least partially) accomplished.

Turning to Parks & Resorts, the news is fairly familiar. Disney’s new “Experiences” division saw a 7% bump in revenue to $9.13 billion, which was an all-time record. Disney Parks & Resorts also set all-time records for operating income and operating margin in the first quarter, thanks in large part to the well-received openings of World of Frozen at Hong Kong Disneyland and the Zootopia land at Shanghai Disneyland.

This came despite a decrease in operating income at the domestic parks, which was largely offset by higher results at Disney Cruise Line. Lower results in the current quarter compared to the prior-year quarter were due to a decrease at Walt Disney World Resort reflecting a modest decrease in revenues and higher costs. Walt Disney World saw further decreases in attendance and occupied room nights, both of which reflected the tough comparison to the 50th Anniversary and period of pent-up demand in the prior-year quarter.

Other headwinds were higher costs due to inflation, partially offset by cost saving initiatives and lower depreciation. There was also another increase in per guest spending due to higher average ticket prices, partially offset by lower average daily room rates (due to significantly improved discounting).

Results at Disneyland Resort were comparable to the prior-year quarter as revenue growth was largely offset by an increase in costs. These impacts were attributable to increased guest spending primarily due to higher average ticket prices, continued attendance growth, and higher costs driven by inflation. Growth at Disney Cruise Line was due to increases in average ticket prices and passenger cruise days, partially offset by higher costs.

Again, all of this is unsurprising and familiar to anyone who has listened to the last 3 earnings calls or read these recaps. Disneyland and Disney Cruise Line continue to outperform Walt Disney World, which the company has previously attributed to both “lapping” the 50th Anniversary and also Florida seeing earlier pent-up demand than California or cruising, and thus it fizzling out faster. There is the expectation, at least with Disneyland, that this lagged pent-up demand will start exhausting itself sometime this year. (If it happens on a timeline comparable to Walt Disney World, expect it to occur in April.)

Some have interpreted this to mean that Walt Disney World is struggling or that the parks are going to be “dead” as a result. It’s hard to tell whether this is purposefully in bad faith, but that’s not accurate (at all). Walt Disney World is down as compared to 2022…when revenge travel was off the charts, discounting was minimal, and the 50th Anniversary–underwhelming as it might’ve been to longtime fans–was a marketable and major draw.

Walt Disney World is still way up as compared to 2019, the last year when things were “normal.” It’d be like improving from .500 one year to going undefeated and winning the Super Bowl to “only” finishing 12-5 but still winning the Super Bowl in the following year. That third year wasn’t as good as the second, sure, but it was still a fantastic result especially considering the first year. Such is the story of Walt Disney World and, hopefully, the Detroit Lions.

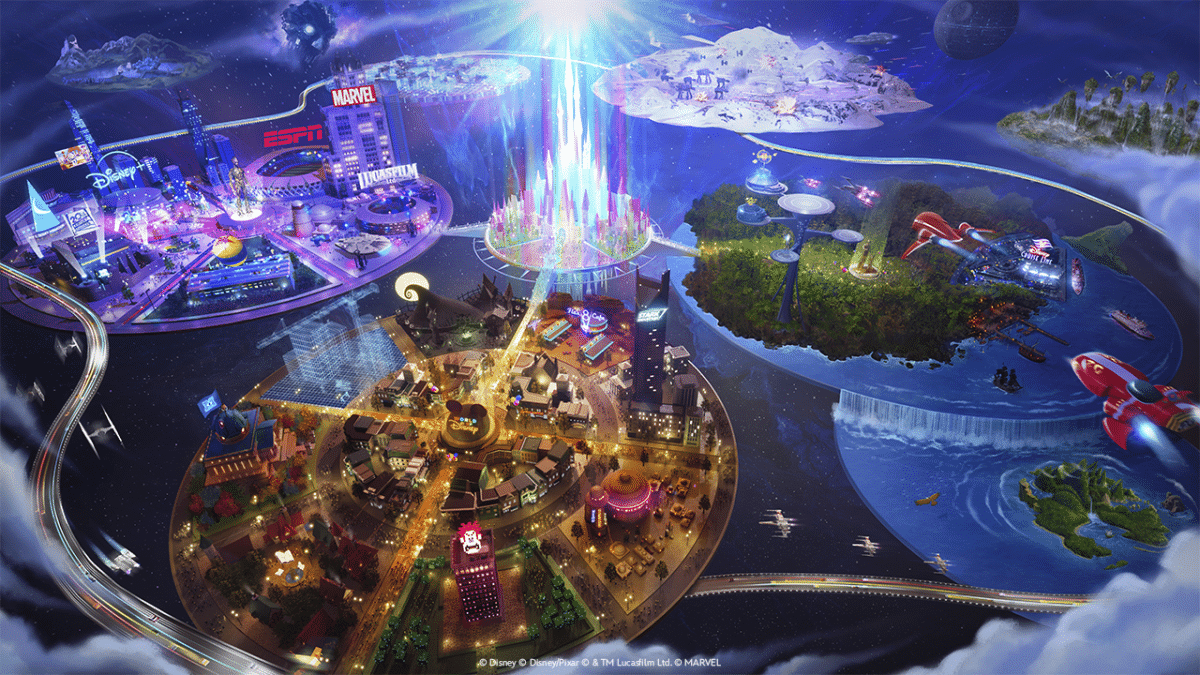

More interestingly are some of the forward-looking remarks during the prepared comments and the Q&A. Earlier in the call, the new CFO Hugh Johnston said that Disney plans to invest approximately $60 billion into the business over the next 10 years, “of which approximately 70% is earmarked for incremental capacity expanding investments around the globe.”

Asked for more commentary about that during the questions, Bob Iger said the following: “We’re already hard at work at basically determining where we’re going to place our new investments and what they will be. You can pretty much conclude that they’ll be all over, meaning every single one of our locations will be the beneficiary of increased investment and, thus, increased capacity, including on the high seas, where we’re currently building three more ships.”

Iger added: “I’m not going to really give you much more of a sense of timing, except that we’re hard at work at getting these things basically conceived and built. And we’ve got a menu of things that will basically start opening in 2025, and there’ll be a cadence every year of additional investment and increased capacity.”

This tells us more than we already know, but only slightly. The analyst who asked the question specifically asked about a 5th gate at Walt Disney World, saying there’s been speculation about one. That’s a bit, uh, curious as there really hasn’t. At least, not credible speculation. Disney has suggested repeatedly and consistently that the plan is to build out the existing gates ‘beyond the berms’ and even the blue sky daydreaming reflects this. (See Why a 5th Theme Park Will NOT Be Built at Walt Disney World in the Next Decade for further commentary.)

In any case, 70% of this $60 billion going towards capacity-expanding investments is good news. For those wondering what this means, it should suggest that Disney is going to focus on building new lands and attractions (and cruise ships) rather than refurbishing existing things or spending money on placemaking. But it’s probably a bit more complicated than that in actuality.

Reimagining Splash Mountain to Tiana’s Bayou Adventure is not capacity-expanding. Neither is redoing Rock ‘n’ Roller Coaster Starring Aerosmith into a theoretical ‘Taylor’s Version’ of the ride or one set in Wakanda. However, the overhauls from Maelstrom to Frozen Ever After or Ellen’s Energy Adventure to Cosmic Rewind arguably were capacity-expanding for EPCOT, because they took underutilized capacity (meaning rides that were dispatching with empty seats) and converted them into far more popular ones.

The same could be said for a project like the Sunshine Plaza to Buena Vista Street conversion at Disney California Adventure. In isolation, that did not expand the capacity of the park. But in aggregate, the whole DCA overhaul significantly increased attendance and thereby utilization of the park.

The EPCOT Central Spine overhaul, on the other hand, did not increase capacity unless you’re comparing the 2024 version of that area to the 2021 version, which was a sea of walls. However, an update to the Play Pavilion (or whatever it ends up being called) would be added capacity since it hasn’t been an attraction in ages.

The point is that the definition of capacity-expanding is a bit nebulous and open to (Disney’s) interpretation of what that means. In any case, it definitely does not just mean a bunch of brand new lands and rides. In addition to all of the above, it could also mean new hotels and Disney Vacation Club additions–those expand capacity of the Parks & Resorts, too. C’mon, you didn’t really think we aren’t getting more resorts…right?! I fully expect to be setting foot in Reflections Lodge, or whatever it ends up being called, within the next 5 years.

All of this bears mentioning, I think, because what we’re going to see in the first half of the decade is going to be fairly heavy on reimaginings, regardless of these remarks. Zootopia in the Tree of Life, Indiana Jones Adventure replacing DINOSAUR, and other yet-to-be-announced transformations. (As I’ve said before, my money is on Rock ‘n’ Roller Coaster being next up, and possibly Journey into Imagination.)

This is almost necessarily the case if Bob Iger’s comment about an annual cadence is correct. We’ve all seen how “quickly” Disney builds new lands and attractions. Even if construction started today on a Villains Lair beyond Big Thunder (it won’t), the opening date wouldn’t be until 2027 at the absolute earliest. By contrast, they could close DINOSAUR towards the end of this year or early 2025 and have Indiana Jones Adventure ready by 2026. Whatever the plan is for Rock ‘n’ Roller Coaster could be accomplished even faster.

None of this should be a huge surprise. Iger previously indicated that the $60 billion in spending on Parks & Resorts over the next 10 years would be backloaded. Josh D’Amaro has made comments that they want to grow the footprints of the parks while also improving utilization within them. We’re absolutely going to get reimaginings–and some of those will count as increased/improved capacity. Just want to temper expectations a bit here.

Personally, I still think this is a fairly positive tidbit. That 70% of $60 billion is still a fairly high number, and we also know that $17 billion of that is earmarked for Walt Disney World. After accounting for inflation, that’s about on par with the decade that brought us Pandora, Toy Story Land, Star Wars: Galaxy’s Edge, Cosmic Rewind, and TRON Lightcycle Run.

Also in that same decade, untold sums were spent on road and other infrastructure work as well as (figuratively and literally) dumped into a pit at EPCOT. It wouldn’t surprise me in the least if the amount spent on things that did not expand capacity at Walt Disney World over the last decade was above 40%.

Also, we should want to see some ride reimaginings. If done right, who among us doesn’t want an updated Spaceship Earth or Journey into Imagination (the latter probably counts as capacity-expanding to some extent, as it would go from a walk-on part of the time to having an hour wait)?!

Ultimately, this was a very good earnings call not just in seeing Vintage Bob and the Walt Disney Company starting to get back on track and building again, but also what this means for the future of Parks & Resorts. I know that’s probably going to be an unpopular opinion among jaded fans who want splashy theme park news commensurate with the other announcements, and I also know I’m more bullish than the average fan who has been burned before and is now (understandably) in wait and see mode.

However, I also think my expectations are appropriately tempered (see above), and I’m playing the long game. A couple more quarters like this, and the stage is set for an absolutely colossal 2024 D23 Expo. One with more than just a bunch of “what ifs?” or daydreaming–and instead actual concrete announcements and timelines. Of course, that assumes all goes well with the proxy fights and Iger’s turnaround continues at its current trajectory. The former seems like a sure thing after this earnings call, whereas the latter is far less certain. Time will tell, I suppose.

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of Walt Disney Company’s first quarter 2024 earnings and future forecast? Surprised that Disney outperformed expectations on earnings per share and is increasing the dividend and buybacks as a result? What about per guest spending at Walt Disney World and Disneyland, or other theme park results? Excited that 70% of the “turbocharged” investment of $60 billion in Parks & Resorts will be on capacity-expansions? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!

Appreciate your commentary and optimism Tom. Put me in the camp of “I’ll believe it’s happening when they actually break ground.” Too much talk by Disney, not enough action.

Basically, Iger said basically a lot. I basically never noticed that as his chosen basic filler word.

Honestly, if most of that 30% is spent on park-related infrastructure the public can notice – upgrading Disney IT, changes that allow for superior maintenance and upkeep, and further transportation improvements – we would be thrilled, since WDW needs all of these.

Something that I personally want for me that won’t expand capacity would be to modify the Star Tours queue, so someday when I need to use a wheelchair I can just wait in line with everyone else. I enjoy that queue but we couldn’t use it when my wife had hip problems a few years back. That should be technically straightforward, yet possibly still a pricey fix.

(Yes, it does help that Entertainment streaming should be profitable by the end of March. It’s interesting that ESPN+ was actually profitable from July-Sept though not from Oct-Dec, but logical given that there are quite a few football games currently available on the service.)

Regarding the 17 billion when adjusted for inflation being on par with the decade that brought us Pandora, Toy Story Land, Star Wars: Galaxy’s Edge, Cosmic Rewind, and TRON Lightcycle Run, another way of saying this would be to say “ the decade that brought us 8 rides. I’m happy with great additions that add to much needed capacity but still wish it was being implemented by an “Eisner” type and not “vintage Bob” who’s team has dismantled so much of what Walt, Roy and Eisner did. I know my feelings are exaggerated but I really look forward to when Iger and his team is gone. Also, a lot of the great profits are due to price increases, more paid parties, paid Lightning Lanes and cutbacks (dream lights, night parades, Magic express, shorter park hours, random characters, park to resort purchase delivery ).

I concur with your observations.

During Iger’s previous tenure, i didn’t pay much attention daily DIS operation, as we weren’t visiting the parks then. But for the past several years, as our visits ramped up I began to participate in chat boards, visit the various blogs, and kept up with operations via the business press – WSJ, NYT, CNBC, etc. I’ve also read a couple dozen bios and histories of the company.

Iger’s return hasn’t impressed me at all. He’s too smooth and polished by half. I wouldn’t buy a used car from him.

I love spaceship earth so would hope it’s mostly upgrading the ride system and the sky and onboard computers. The figment ride we did for first time this week and it is pretty horrible- hopefully thats first for a redesign

I’m very wary of the eventual SE update. I recognize it needs it, but it’s hard for me to imagine Disney NOT injecting characters into scenes, which would be horrendous. Like what they did with Disneyland’s Small World but much more egregious.

I love SE and it’s one of the last vestiges of Epcot Center. I want to see it get the attention and care it deserves I’m just very concerned it’ll be forever ruined.

I completely hear you, and sadly, I think some degree of that is inevitable.

My perspective is that the alternative is running the ride to the point of no return, and losing it entirely. So assuming that’s the actual alternative–rather than a perfect update that exists in my head–I’ll take the ‘character compromise.’

I fear this as well and will be devastated if they ruin this ride. It should be in the same category as Pirates or Haunted Mansion. It should never be rethemed, just restored to an updated version of it’s original state, eg: all effects fixed, descent scenes brought back (it’s rumored they’re still there behind scrim) a new scene at the top, new narration and, of course, track work. I’d like to see classic Epcot Center attractions treated with the same respect as most original Disneyland/Magic Kingdom attractions although I understand why they haven’t been over the years due to most of them having a heavy focus on technology that didn’t always age well. I think that issue is pretty easily rectified with Spaceship Earth. I’m glad that covid spared us from planned “story light” nonsense conceived during the Cheapek era.

I am always interested in these updates but do not have the time or patience to deal with it all. Your summaries of these topics are very much appreciated! And your commentary is realistic and has a great track record. I have to admit I have the same feeling about updates for Spaceship Earth and Journey….I love that they are so accessible now and vintage E.P.C.O.T., but they are worthy of updates and lines to follow.

Your analyses of these earnings calls are always really thoughtful. It really demonstrates your deep and long knowledge of TWDC, and it is very impressive!

Thanks Tom, I always love the earnings call updates!

I would LOVE updates to Spaceship Earth (or even all of it functioning) and Journey Into Imagination! Both are what I think of as classic Epcot and I love them. Admittedly, this means I’d have to wait in line (instead of hitting them mid-afternoon and walking on). But it could be great!!!