5 Businesses Disney Should Buy or Sell

Since Disney’s Bob Swap–firing Chapek and rehiring Iger–new details and rumors have emerged about what led to the CEO change and the board’s goals for Bob Iger in the next two years as CEO. This post delves into one such topic, which has been mergers & acquisitions, and the business units and companies that Disney might buy or sell in the near future.

Even Disney employees and Cast Members seem to believe that more dealmaking is in the cards for Bob Iger. During the recent Town Hall, Iger was asked multiple questions about what Disney might buy–and sell. Always playing his cards close to the vest, Iger indicated that Disney has a “great set of assets” but offered the caveat that “nothing is forever.”

This only added fuel to the fire among Wall Street analysts, investors, and Disney fans that more mega deals are on the horizon. Understandably so, as the Mouse House that Bob Iger built is largely predicated on huge IP acquisitions. His first major move as CEO was acquiring Pixar for $7.4 billion in 2006. He followed that up with the masterful moves (with the benefit of hindsight) of acquiring Marvel for $4 billion in 2009 and Lucasfilm for $4 billion in 2012.

Then there was perhaps Iger’s most dubious decision–aside from naming Chapek his successor–in acquiring 21st Century Fox for $71.3 billion in 2019. Disney still hasn’t properly “digested” that last deal, and its after-effects have been significant. (One could argue, quite convincingly, that the Fox debt was a catalyst for many of Chapek’s unpopular decisions, which also set in motion his eventual downfall.)

Nevertheless, here are the deals that CEO Bob Iger might make–or that we think he should make–to continue his mostly-impressive run of big bet and mega deals for Disney…

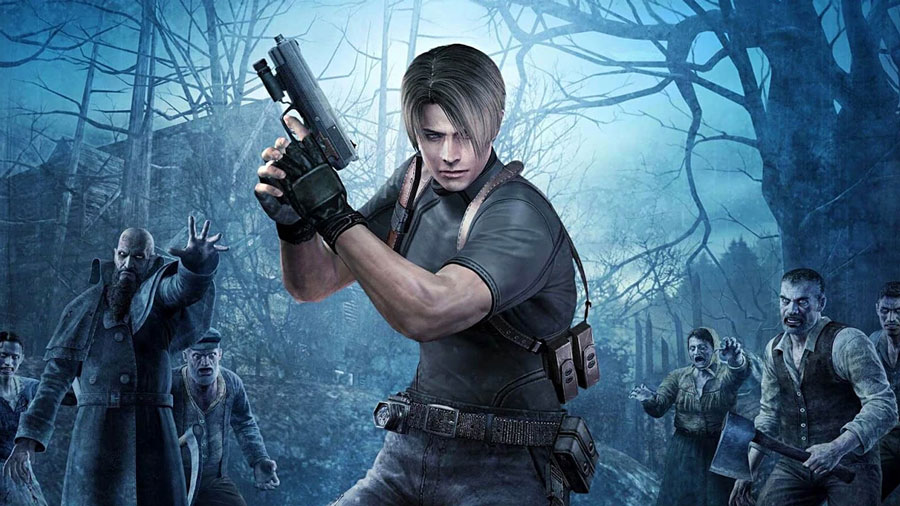

Capcom or Square Enix – This one is out of left field, but it’s the acquisition we think Iger should make–not one that he’s even remotely likely to actually make. Microsoft and Sony have gone on a shopping spree this year, and they aren’t the only ones.

Video game industry consolidation has resulted in hundreds of billions of dollars in mergers and acquisitions as the industry consolidates. While the FTC has filed an antitrust case against Microsoft to challenge the its $69 billion acquisition of Activision Blizzard, plenty of other deals have gotten done this year. Industry insiders have said that more such deals are likely on the horizon.

Video games are a blind spot for many people, and that’s undoubtedly true for readers here. With that said, it’s important to remember that one’s own interests and cultural relevance are not necessarily the same. To that end, I want to provide some context as to video games are such a big deal.

In the last decade, the gaming industry has grown consistently, a trend that accelerated in 2020 when everyone was stuck at home. Just last year, the global games market had $180 billion in revenue, making it bigger than Hollywood and the music industry combined. Major game franchises like Grand Theft Auto, Fortnite, and Call of Duty generate billions in revenue, dwarfing Avatar, Star Wars, and Marvel’s top films.

For all of his dealmaking prowess and success in fostering the growth of Disney’s business units, Bob Iger has unequivocally failed at establishing the Walt Disney Company as a major player in the video games space. After losing nearly $1.5 billion, Iger shut down the company’s in-house gaming division, Disney Interactive, back in 2016.

Iger also conceded during a 2019 earnings call that Disney is “not particularly good” at self-publishing games, and was satisfied with licensing its IP to third parties, like Electronic Arts. Being satisfied partnering with EA is like outsourcing restaurants to McDonald’s. Sure, it gets the job done and is efficient, but is it really what’s best for the Disney brands?!

To be fair, this is not just an Iger or a Disney problem. Hollywood as a whole overlooks the current market and future potential of video games, something captured incredibly well in “Hollywood’s Video Game Blind Spot” by Matthew Ball (one of my favorite writers about Disney, gaming, the multiverse, and more).

Given its current debt load and the market caps of major video game studios, Disney likely can’t go after the type of developer it would like, such as Electronic Arts, Roblox, or Epic Games. However, two companies are much more realistic possibilities: Square Enix and Capcom. (While I’d personally love to add Konami to that list, they’re so mismanaged that I don’t see the point.)

Both Square Enix and Capcom are highly-regarded developers with their own well-established intellectual property, and past connections to Disney. Capcom also has RE Engine, which is excellent–and adaptable to other properties. (Square mostly uses Unreal Engine.)

Finally, I think I speak for everyone when I say that Final Fantasy or Resident Evil would be perfect fits for new rides in Magic Kingdom. No?! Okay, fine…but can you imagine a Kingdom Hearts dark ride in DHS or Dino Crisis interactive shooter in Dinoland?!

ESPN – I love ESPN. It has had its share of missteps, but it’s still the strongest name in sports and a decent amount has been done to position it as a “Disney” brand. That’s how I view it, and I think that’s how more people would view ESPN were it better bundled with the company’s other products and offerings.

With that said, I do not think Disney should (further) involve itself in betting or gambling. I’m also cognizant of the reality that most sports fans feel differently. Platforms like FanDuel and DraftKings have absolutely exploded in popularity in the last several years. Leagues that used to view gambling as the games’ greatest sin now are actively invested in these companies. You can’t turn on sports coverage without hearing about odds, fantasy stats, or seeing ads for Caesars, MGM, and so forth. ESPN would almost certainly be more valuable if it went down this road, and gave the people what they want.

It would thus seem that Disney is at a crossroads with ESPN, or perhaps an impasse. It could be brought into the fold to better take advantage of synergies, but if that comes with sports gambling, it becomes a brand liability. If ESPN doesn’t get into betting, money is being left on the table and it is vulnerable to competitors eclipsing it.

These aren’t the only concerns and considerations that Bob Iger faces when determining what to do with ESPN, just the ones that are most pertinent to me, personally. Disney’s position in ESPN has been a hot topic among investors for years, as its lucrative contracts with sports leagues have been viewed as an albatross in the cord cutting era. Linear television is in secular decline, but still remains profitable for now.

Only a few months ago, activist investors pushed for former CEO Bob Chapek to spin off ESPN. While they later relented and Bob Iger previously dealt with the same thing–and was unwilling to part with ESPN or other television networks–the fact is that the circumstances are different now. With more broadcast rights coming up for negotiation soon, and both Apple and Amazon signaling a willingness to (more or less) write blank checks for them, perhaps now would be a good time to divest Disney of ESPN.

While this has been the top topic of M&A conversation, I’m still not convinced. The saga of streaming and linear television’s downfall are not yet fully written. The latter does seem like an inevitability at this point, but its downstream impacts are not known. Cable subscribers will go somewhere, as will those advertising dollars. In the grand scheme of media, streaming is still nascent, and will certainly evolve more in the next few years.

Disney is only just dipping its toes into ad-supported streaming, which could be a highly lucrative business–especially with sports audiences attached. There’s a reason Apple, Amazon, and (presumably?) Netflix will be willing to pay hefty sums for sports broadcast rights. Spinning off ESPN could be one of those decisions that looks good in the short-term, but winds up being a squandered opportunity in the long-run.

Hulu – Without any alternative action, Disney is currently set to buy out the remainder of Comcast’s one-third ownership stake in Hulu by 2024 at a guaranteed sale price that values the streaming service at $27.5 billion. Whether it’s worth that amount in the current environment as Wall Street reevaluates the streaming business is an open question.

What is known is that Hulu has more subscribers than Disney+ in North America, attracts an older and more affluent audience (read: higher advertising rates), and earns the highest average revenue per user of Disney’s streaming portfolio. Both objectively and subjectively, Hulu is a strong streaming service that’s more well-rounded than Disney+, even if it lacks the high-profile Marvel and Star Wars franchises. The bottom line is that Hulu’s bottom line looks better than that of Disney+, and that’s important when the division is losing $1.5 billion in a single quarter.

With that said, the sale of Hulu would likely command a bidding war. Even with the growing belief on Wall Street regarding streaming valuations, there’s still frothiness and a fear of missing out on the future of media. Hulu would generate a high sale price, raising cash for Disney as it seeks to cut costs–while also unburdening it of some of the 21st Century Fox acquisition.

The streaming industry is likely to see consolidation in the coming years, as several services do not seem viable on their own and have had little success gaining traction and market share. Perhaps more than any other streamer, this is true for NBCUniversal’s Peacock, which makes parent company Comcast the most likely buyer (in addition to the potential seller) of Hulu.

Comcast CEO Brian Roberts has been hot and cold on the idea of a Hulu acquisition. Prior to Iger’s return, he called Hulu a “phenomenal business” and one that “Comcast would be interested” in purchasing. He also indicated that Hulu would see “robust” action if it were put up for auction to sell at fair market value, which would be higher than what Disney has contracted to pay for it in 2024.

However, the circumstances have possibly changed as of December 2022, with Comcast undertaking its own cost-cutting measures. NBCUniversal CEO Jeff Shell said he believes the company will sell its stake to Disney. “We think [Hulu is] worth a lot of money because it’s sold on a full-control basis [and] there’s no indication that anything else is going to happen than Disney writing us a big check for the asset in 2024,” Shell said.

Candle Media – I will level with you: I’m not particularly familiar with Candle Media’s core business and it’s not one that interests me all that much. Candle Media is, as the name suggests, a media company. That part does interest me. In essence, Candle Media is a next-generation content company with a portfolio (thanks to its own aggressive acquisitions) of independent content companies and creator-driven brands. The output ends up all over the place, everywhere from more “traditional” locations like Netflix to more “emerging” ones like TikTok.

My (potentially antiquated) view is that investing millions or billions of dollars on creator-driven studio for the production of social media content is folly. In a quest for relevance or dominance or who knows what, Disney already went down that road several years ago, buying Maker Studios for a ridiculous sum. Part of Candle Media’s approach seems to be replicating that, but on a smaller scale. And in fairness, one of the co-CEOs of Candle Media definitely “gets” TikTok–he briefly served as its U.S. CEO. It’s possible that a leaner business with a hungry, startup mindset can do better in this space than Disney.

But that’s really neither here nor there. The purpose of Disney acquiring Candle Media would be a talent acquisition, plain and simple. Co-CEOs and founders Tom Staggs and Kevin Mayer were previously top candidates to replace Bob Iger as CEO, before both unceremoniously exited (at different times) after being passed over. In addition to them, Candle Media has several seasoned Disney veterans who could be brought back into the fold.

There are a lot of (public) unknowns here, including the relationship between Bob Iger and Candle Media’s founders. Even in re-reading Behind the Scenes at Disney as It Purged a Favorite Son, it’s still unclear whether it was just the board or them and Iger who previously lost faith in Staggs. Even less is known about the circumstances of Mayer’s departure, but it seems like an open-and-shut case of him being passed over in favor of Chapek, and seizing on what seemed like a golden opportunity to helm TikTok. Until it wasn’t.

Whatever the circumstances, there exists this ideal scenario of Staggs and Mayer returning to Disney to be co-CEOs. I wrote about this even before Iger returned, but recognized it was likely bad fanfic given the circumstances. That is, until Chapek was fired and subsequent revelations came to light that Disney’s board actually approached Staggs and Mayer to return to Disney to be co-CEOs. That scenario couldn’t work because it would’ve acquired Chapek to acquire the company that would bring aboard his replacements.

Now? Iger knows he only has 2 years and hitting the ground running with succession planning could be aided tremendously if he brought back two candidates who were previously groomed for the role.

Hasbro or Mattel – Similar story to the Capcom or Square Enix acquisition above. Disney has had licensing deals for its princesses, Cars, Toy Story, Star Wars, and other franchises with both companies in the past–and present. It would seem that as a result of that, there has been near-constant buzz over the last decade about Disney acquiring one of the two companies and bringing toy production in-house.

As with Candle Media, I don’t understand the toy industry nearly as well as video games, so I’m admittedly a bit out of my element. Nevertheless, as a company that likes having an integrated flywheel, it makes sense that Disney would want complete control over this huge area of consumer products.

Toys have been integral to Disney’s business–and that of the companies Iger has acquired–since the very beginning. While it’s impossible to say what Walt Disney would do were he alive today, I think it’s probably more likely that he would’ve wanted full control over merchandising than some of the forays into other assorted and unrelated businesses.

Toys based on the company’s most beloved characters and intellectual property certainly seems, on its face, more integral to Disney’s core business than ESPN or any number of brands Disney currently holds. On the other hand, Disney does have a lot of debt and is much more likely to be a seller than a buyer right now, so unless it unloads Hulu and linear networks, it’s highly unlikely that Iger makes a deal to acquire Hasbro or Mattel.

Need Disney trip planning tips and comprehensive advice? Make sure to read Disney Parks Vacation Planning Guides, where you can find comprehensive guides to Walt Disney World, Disneyland, and beyond! For Disney updates, discount information, a free download of our Money-Saving Tips for Walt Disney World eBook, and much more, sign up for our FREE email newsletter!

YOUR THOUGHTS

What do you think Bob Iger will do when it comes to mergers and acquisitions in the next 2 years? Think he’ll make Disney a buyer, seller, or both? Or, do you think Iger is back at the helm to sell the whole company? (Not covered here, but we’re willing to dissect the Apple “rumors” if there’s interest.) Are you bullish or bearish about the company’s future as the Walt Disney Company enters its 100th year? Think things will get better or worse throughout 2023? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!

I would buy Lego if I was Disney. You get Lego movies and the games and the parks, You could make a big Legoland in Disney World.Lego is private company and easy to buy even if they buy 50% but buy it.Work on restoring the Magic at the parks for children.If Disney didn’t go into media it would already have Lego.Disney needs cash and debt free or reduction so spinning off some of it media is a must.Does Disney need Hulu when it already has Disney+ I need to work with Bob

People need to stop saying Disney paid 71 billions for Fox. They sold there 40% stake in Sky to Comcast for 15 billions and the regional sports to Sinclair for 10 billions before the deal ended. They also sold there stake in A&E in Europe to Hearst media. So they must have paid more like 45 billions in the end. They were kinda forced to sell all those assets which means they were ready to contract a much bigger debt.

.

Thanks for your information . i am read your article i am very impressive.

I’m glad to see Bob Iger back in the drivers seat. (Goodbye Chapek!-enjoy your golden parachute- Thanks for taking part of our dividend with you)

Wish we also had Michael Eisner too.

I think the grandiose plans for new ventures are good but not as important as the parks themselves. The parks are truly Walt’s legacy to guests. The cartoons, movies add to the Magic for sure, but the parks make the Magic come alive. Sadly, this Spark has been lost in last several years. Higher prices, diminishing staff, loss of quality in parks, and ever increasing building of hotels that seem great but never live up to the plans set for them. Stuffing the parks with boorish, circus side show loving boobs, really loses the Magic for the real Disney fans who continually support and visit the parks, but now find it dirty, over commercialized, and less Disney than it has ever been. My dividends are way down, and my interest in the parks is shrinking too due the loss of interest in the parks by Disney hierarchy.

Mr. Iger, take reins and restore quality experiences to the Disney parks. Bring back Disney run shops and restaurants, bring back quality products and souvenirs for your guests. Stop this rush to add a new hotel every month and concentrate on maintaining and improving what you already have.

We Disney fans will respond in kind, with increased visits, purchases, and use of restaurants and hotels. We bring extended family to the parks every year from 500 miles away (us) to over 3000 miles away. We own at DVC and try to visit 3-4 X each year and enjoy the place and reconnect with the Magic Mr Disney and Mr Eisner promised us. Like I said, bring it back snd we Disneyphiles will respond positively.

Disney should buy Lionsgate for it’s production facility and library ( hunger games, twilight could be used in park attractions too ). If for no other reason to keep it from their competitors. They also should buy controlling interest in the A&E networks. They already have 50% of the company. Hulu has everything except non-scripted content that A&E has bunches of