Bob Iger Beats Peltz in Battle for Board of Disney

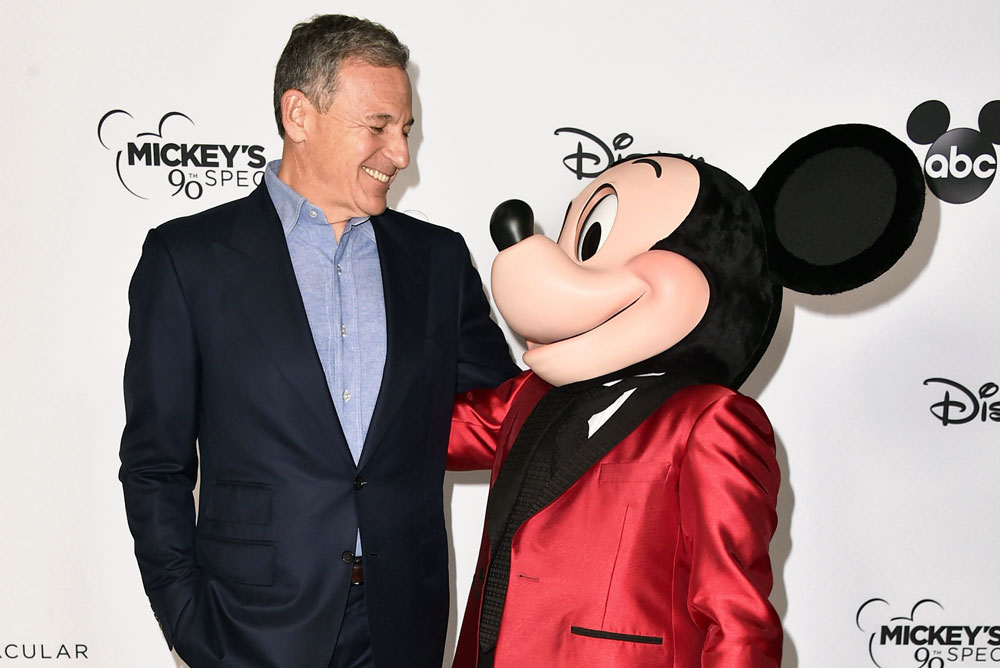

The Walt Disney Company’s proxy fight with Trian Group (and, I guess, Blackwells Capital) is over. CEO Bob Iger and the current board have prevailed over Nelson Peltz and Jay Rasulo (and whoever Blackwells proposed). This discusses our thoughts about the vote and what it means for the future of Walt Disney World and Disneyland investments.

The outcome of the vote was announced during the Walt Disney Company’s 2024 Annual Meeting of Shareholders on April 3, 2024. Disney announced that the company’s slate was elected by a “substantial margin” over both the Trian and Blackwells slates. The exact results were not reported, but will be in the coming days as numbers are finalized.

This followed months of an increasingly hostile proxy fight. In the home stretch, Peltz and Rasulo did interviews and roundtables that took a less deferential tact towards Bob Iger and struck a far less cordial tone. Far from innocent in the ordeal, the Mouse took the gloves off, so to speak, with their own videos and collateral that cast aspersions on Peltz and Rasulo.

The Walt Disney Company announced that its full slate of 12 directors has been elected by a substantial margin over the nominees of Trian and Blackwells at Disney’s 2024 Annual Meeting of Shareholders today. Final voting tallies are subject to certification by the Company’s independent inspector of elections, and preliminary and final results will be included in the Company’s reports to be filed with the Securities and Exchange Commission in the coming days.

Shareholders voted to elect all 12 nominees recommended by the Disney Board: Mary T. Barra, Safra A. Catz, Amy L. Chang, D. Jeremy Darroch, Carolyn N. Everson, Michael B.G. Froman, James P. Gorman, Robert A. Iger, Maria Elena Lagomasino, Calvin R. McDonald, Mark G. Parker, and Derica W. Rice.

“We are immensely grateful to our shareholders for their investment in Disney and their belief in its future, particularly during this period of great change in the broader entertainment industry. We are fortunate to have a highly qualified Board of Directors who possess a profound commitment to the enduring strength of this company and an enormous amount of experience and expertise, including succession planning. I’m thankful for Bob and his exceptional management team, as well as Disney’s employees and Cast Members around the world, for continuing to deliver for consumers and shareholders throughout this distracting proxy battle,” said Mark Parker, Chairman of the Board, The Walt Disney Company.

“I want to thank our shareholders for their trust and confidence in our Board and management. With the distracting proxy contest now behind us, we’re eager to focus 100% of our attention on our most important priorities: growth and value creation for our shareholders and creative excellence for our consumers,” said Bob Iger, Chief Executive Officer, The Walt Disney Company.

The waning week of the battle for the board also saw leaks of vote totals. The Wall Street Journal reported that Trian was ahead when just over 22% of votes were cast last week, largely by individual and other smaller investors. In response to the WSJ reporting, a spokesman for Disney said leaking an early vote count was “a highly inappropriate attempt to sway votes.”

Then this week brought another report from the WSJ that Disney was winning with over half of votes cast and another from Reuters that enough votes had been cast that Disney had safely secured victory. It stands to reason that institutional investors are what pushed Disney over the top and were the outcome determinative factor between last week and this week.

Vanguard owns 7.8% of Disney shares and voted in favor of Disney’s slate. BlackRock, Disney’s second-largest shareholder with 78 million shares, supported Disney. With 9.3 million Disney shares, T. Rowe Price also announced they support Disney. That left only State Street and Geode Capital Management, the company’s third and fourth-largest shareholders, as unknowns.

By contrast, billionaires Bill Ackman and Elon Musk, who own a combined 0% stake in Disney, both endorsed Nelson Peltz in the eleventh hour of the proxy fight. Activist investor Ackman wrote in a lengthy tweet that Peltz would be “greatly additive” as a member of the board. He called the leaked votes “highly inappropriate” and stated as fact that Disney had leaked the vote total to influence the vote. (Note that the early voting leaked both when Disney was down and up, and Disney also complained about it.)

I’m no billionaire genius, but I think it’s fairly safe to draw conclusions based on Vanguard and BlackRock along with other institutional investors supporting Disney. It would have taken a fairly insurmountable early lead among small shareholders to overcome the institutional support for Iger.

Don’t feel too badly for Nelson Peltz, because in this battle, everyone wins. This is Trian’s second proxy fight with Disney, with this one starting only days after the company’s stock reached a 52-week low. Since Peltz and Trian called off the original Save Disney remake last spring, Disney’s stock price tumbled from around $113 per share to around $80, the lowest level in a decade. Hence the proxy fights in the first place.

The day before the shareholder’s meeting, Disney shares closed at $122.82. That’s up 55% from the aforementioned low of $80. The stock has jumped 36% year to date, compared to a 9% gain for the S&P 500. Peltz bought most of his shares at the lower end of that range, and has profited tremendously on the gambit, even after accounting for the costly proxy fight itself.

A lot of disenchanted Disney fans are going to be disappointed with this outcome. I know this both because we’ve heard from many of them, and the first WSJ article with the leaked vote total strongly suggested the same. Individual investors and small shareholders–many of whom are fans or former Cast Members–were giving Peltz and Trian a slight edge. They weren’t doing that because they love Bob Iger and the current board!

While I personally do not agree with them, I can understand this perspective. We’ve heard from countless jaded (former) fans in the last several years, unhappy with Disney’s direction for any number of reasons. Even if you disagree with this and think Disney is somehow better than ever, it’s impossible to dispute that this sentiment is widespread and underpinned by several reasons. Look no further than Is Disney Ruining Its Reputation? and Disney’s Reputation Falls Further for coverage of the company’s self-inflicted brand damage and loss of fan goodwill as a result.

There was a brief bit of renewed hope when Chapek was ousted and Iger returned, but that honeymoon ended early–probably by this point last year–as fans didn’t see the changes they wanted. Although Bob Iger and current management have made some noticeable improvements, the consensus is that it’s too little and too slow. Along with that, Iger is increasingly drawing more criticism for past missteps.

To that, we’d first remind readers of something we said many times during the phased reopening–that Disney is a big ship that turns slowly. There’s no flipping a switch–everything takes time. Sometimes, too much time. But also and in fairness, you’re never going to see all of the changes you want.

But also and in fairness (again), you were never going to see all of the changes you want under Nelson Peltz or Jay Rasulo either. Part of the appeal of the proxy fight is that Trian never really presented a clear vision for the future of Disney. The proposals were sufficiently vague and open-ended; fans could project their own wishes and desires onto them. Maybe Peltz would be the one to bring back free FastPass, Disney’s Magical Express, or a certain type of content again. Why not? He never said he wouldn’t!

Only one little problem with that: Nelson Peltz is a self-interested activist investor with one and only one goal: increasing the share price and in turn maximizing the value of his investment. It is possible that his goals align with fans–those of investors and fans are not necessarily mutually exclusive.

To be sure, there are things Peltz said during the proxy fight that I really liked! I agree with some of the issues he identified with Disney! But I was also skeptical he had any actual plan. (I can identify problems–doesn’t mean I’m capable of fixing ’em.) Even in its current form as a behemoth multinational corporation, Disney is a uniquely creative enterprise. It’s just different than other companies, and I didn’t relish the idea of an activist investor on the board. (Kind of a fox guarding the henhouse scenario.) Moreover, it’s delusional for any fan wish list to include the words “free” or “lower prices” when it came to this proxy fight. That was never a conceivable outcome.

As I’ve said many times–and I still believe this–I think the proxy fight itself was a good thing. I do think Bob Iger and the current board had become complacent. That there was a lack of focus and accountability, and that the board was on autopilot to some degree. I think a greater sense of urgency was needed in several regards, including runaway spending on streaming and movies as well as lax succession planning and being more cognizant of guest satisfaction in the parks.

It’s hard to say whether this was a natural consequence of Iger’s return or a way to fend off the fights, but Disney did adopt a few of the changes suggested by Peltz–starting early last year at the outset of the first proxy fight. The company is spending far less on content now (and streaming loses have narrowed as a result). Several shake-ups have happened with the board over the last year to have greater structure and focus on succession planning. Major changes were made to improve guest satisfaction and value at Walt Disney World and Disneyland.

A lot has happened in the last year, but our primary focus is theme parks, so the big thing that stands out to us is the company revealing that it will spend $60 billion over the next decade to expand and enhance Walt Disney World, Disneyland, Disney Cruise Line, and its international theme parks. This represents nearly double the amount invested over the last 10-year period, as Disney seeks to “turbocharge” its theme parks according to Iger and Parks Chairman Josh D’Amaro.

Ultimately, as someone who is very optimistic about that coming to fruition (more on that soon) and is bullish about the 2024 D23 Expo announcements, I’m glad Peltz and Rasulo fought…but also pleased that they were defeated. Long term, I have no clue whether Peltz or Rasulo would have had a positive or negative impact on Disney’s board. I don’t think anyone really does–we all just had hopes based on our own wishful thinking and biases about the board and Bob Iger. And that includes me!

Long-term, my worry is that Peltz’s self-interest did not actually align with mine as a fan, that he was just saying what he needed to say to get elected, and he’d make things worse. Current management is certainly not perfect, but I do think they actually “get” Disney, what makes the company special and unlike others, and are trying to do their best to navigate Walt’s legacy with demands of Wall Street. But again, I’m biased like anyone else.

My big near-term concern is clearer and less speculative. That Peltz or Rasulo would be agents of chaos on the board, throwing a monkey wrench into plans that have already been set into motion and leading to words I’ve come to dread in the last few years from Disney: “we’re reevaluating our plans for…”

The $60 billion for Parks & Resorts, along with $17 billion for Walt Disney World and at least $2.5 billion for Disneyland, is real money. There are real plans for how to spend it. Most important of all, the last remaining hurdles have almost all been cleared–free cash flow is improving, other divisions are stabilizing, and issues with Anaheim/California and Florida are either in the rearview mirror or will be within the next two months. Barring something catastrophic (and a new board could qualify), investment is going to begin later this year. The runway is clear…the last thing I want is a new air traffic controller coming in and grounding all flights until he has the chance to shake things up and make his mark.

Need Disney trip planning tips and comprehensive advice? Make sure to read Disney Parks Vacation Planning Guides, where you can find comprehensive guides to Walt Disney World, Disneyland, and beyond! For Disney updates, discount information, free downloads of our eBooks and wallpapers, and much more, sign up for our FREE email newsletter!

YOUR THOUGHTS

What did you think about Bob Iger and the current board prevailing in the proxy fight? Would Nelson Peltz have been a great additive to the board or an agent of chaos? Think this fight was beneficial for the company and fans at the end of the day? Optimistic that this has pushed Iger to finally get serious about choosing a successor or focus on improving guest satisfaction in the parks? Thoughts on anything else discussed here? Do you agree or disagree with our assessment? This is not the place for politics or culture wars; unnecessarily divisive or provocative comments along those lines will be deleted.

Time and again, whenever profit was placed over creativity and quality, the company has faltered. Pelts is interested in profit first and foremost so I am pleased he was thwarted. Disney needs to do better but hopefully things have been shaken up enough to cause real, positive change.

I remember reading in an earlier report that the institutional shareholders had advised to vote Pelz, what changed?

Nothing changed. The big institutional shareholders Tom mentioned (and others) ignored that advice.

When you see how amazing the parks are in Asia it shows how neglected the US parks are. They have Tron and Guardians of the Galaxy but nothing has been done to increase capacity. They are just replacements of existing rides. They just build more and more DVC hotels but no new rides. We will be not be renewing our annual pass as there is nothing new. When EPIC Universe opens Disney will suffer.

“Major changes were made to improve guest satisfaction and value at Walt Disney World and Disneyland”. I am truly at a loss as to what those major changes are. The parks experience is considerably diminished in terms of what was, 10+ years ago, maybe even 5. Genie+ clogs the standby lines and everything costs way more, and this is not just normal inflation. Iger and his team, and Chapek is part of that team, are the worst CEO and leadership team in the company’s history. Even the maligned

CEOs and leadership between Roy/ Walt and Eisner built Epcot and kept Walt’s legacy in tact. Iger’s legacy is bland themeless resorts, less park entertainment (no night time parades), and acquisitions. Looking forward to his departure.

Now that the ‘threat’ is over, what will keep the current leadership from returning to complacency? They appear focused on ever-increasing profits while minimal attention is paid to guest and employee experience, so why not back to squeezing everyone for every last dollar?

For the “too woke” people. Please stop. The misuse of the term is ridiculous. If you don’t like what Disney is producing then why not move on? The world is changing to be more inclusive and I have no issues with more people being represented. You may want to go back to the 1950s, but many of us do not.

My God could you imagine if he won? The next movie would be Uncle Remus kissing an unconscious Pocahontas.

Thank you, Heather. That was actually my 2nd biggest fear with Peltz— he was an elderly culture warrior who was going to start attacking Disney from within every time they made even a minor gesture of inclusivity towards any group other than MAGA voters. (My first biggest fear was that he was only in it to milk the Disney cash cow and would demand to keep squeezing families that visit the parks.)

Disney may need to find big themes that draw in conservative leaning skeptics (and their kids) but what they do NOT need to do is cater to the the reactionary tastes of octogenarian billionaires…and if they tried they would alienate a huge chunk of their imagineers, creatives, and front line cast members.

Maybe not all the way back to the 50’s, but the 90’s were great.

The 90s movies, even Disney movies going back to the 50s were all very political and had lots of messages in them, you just didn’t have Fox News telling you that was a problem yet.

If I go see a movie it had better have a message or a point. If you want movies with nothing to say go watch Minions or that terrible Mario movie that had no story. There are 10 fast and the furious movies. There’s plenty of mindless garbage out there. That’s never been what we’ve come to Disney for.

People need to stop listening to culture war grifters trying to dumb everything and everyone down.

When you stop playing the song Zip A Dee Doo Da or are afraid that saying “ladies and gentleman, boys and girls” will be offensive, you are too “woke”. Woke has a new modern definition so the small minority “please explain what woke is” crowd are just playing word games. Disney has crossed a line a bit too far and needs to rethink things.

I am not sure Iger winning is necessarily a good thing for the small investor. . The reason there was a fight to begin with from small investors and others is because they don’t like the way Disney is going. And I sort of have to say I agree with them. I still enjoy going to Disney but when I go there, it feels very dated and borderline run down. And then let’s not get started on how iger wad on the wrong side of things during the actor ms strikes he demonstrated typical corporate greed with his comments.

this will eventually put you out of a job, tom. goodbye disney, hello epic universe

Peltz pushed Iger, “the boy who cried Parks”, to say whatever was necessary to win. Universal Epic will push Iger to actually do something.

One thing I know is Iger doesn’t do anything for money anymore. He has plenty of that.

From here on out it’s all about legacy.

Here’s hoping his ego will make the Parks shine.

Stock is already down more than 3% on the news. The stock was at $120 back in 2015. The dividend in 2015 was higher than it is today. So there hasn’t been any return to shareholder in the last 9 years!

Why does Disney charge out of state tourists more for a 4 day pass than a yearly pass to Florida residents? Those yearly passholders save spots for others they know and they bring in their own food. Tourists spend thousands of dollars at Disney but get treated like crap.

My children hate Disney Plus. They’d rather have Netflix. Disney might come out with a show they like but it is usually for just 8 or 10 espisodes then gets canned.

I agreed, Disney has gone too woke for me. They try to push an agenda instead of what they used to be. I think most agreed that staying out of political and social agenda and just getting back to basics that made them successful would be better for business. Pricing has gotten way out of control and Universal provides a better option @ 50% of Disney price structure for comparable entertainment / vacation experience.

That’s a contradiction though. You are complaining about lower stock prices, yet asking why they charge more to non-locals. Profit. Almost all tourist industries offer local discounts. This question has been asked and answered numerous times. Tourists spend way more per day than pass holders. It makes sense that Disney would try to capitalize on that revenue.

Well when Blackrock and Vanguard, the two companies that push for all this garbage back you, you really don’t have to produce a damn thing to win do ya. At this point what difference does any of this make. These people don’t care how much money is lost, it’s just greedy billionaire and millionaire’s fighting over office politics. They don’t have to make good movies anymore, the parks don’t have to be clean, guest satisfaction can be low, rides don’t have to work, and they can preach their politics in the every single thing they make, and it’s all good, just cut jobs, raise prices and do away with perks, and add micro transactions to everything and boom, all good. I mean “Walt Disney’s legacy” like who really care about that anymore? None of them can hold a candle to him, flaws and all, and they can just tell you whatever and you’ll believe it. Not thinking Peltz was necessarily and by the way, just to be clear, this is all a joke.

Respectfully, the vast majority of Blackrock and Vanguard holdings are due to their massive index fund portfolios. They can neither divest or invest more than what their index is tracking. Additionally both Vanguard and Blackrock have programs that allow you to use proxy voting if you own certain index funds.

For the voting shares they do control; their singular goal is to make money for their shareholders. They voted the direction they thought would result in the longest term gain.

At the end of the day, Disney exists primarily to make money; as do all other companies in America. This is capitalism.

Agree with this, and I’d also add that literally no one has as done as much to democratize investing as John Bogle and his investment company, Vanguard. It’s not billionaire activists (or whatever), and they are not in the business of losing people money. To the contrary, you’d likely be hard-pressed to find any long-term Vanguard investors who have lost money.

Thanks for your reporting and commentary on this – interesting stuff. In my middle age and given the last almost-decade, I’ve come to really worry when people become so unsatisfied that they will basically vote for whomever or whatever, just for the sake of disruption. Glad the proxy fight is done and hope it lit a bit of a productive fire!

Very well written analysis on the proxy vote. Peltz is a self interested shark who never had any real coherent solutions. Probably would cut costs in an attempt to lift the stock price. Certainly no friend to the park fans.

I have my issues with Iger and company but very pleased they prevailed here. J