Disney Plans to Double Investment to $60 Billion in Disney World, Disneyland & Beyond

In a new SEC filing, the company revealed that it will spend $60 billion over the next decade to expand and enhance Walt Disney World, Disneyland, Disney Cruise Line, and its international theme parks. This represents nearly double the amount invested over the last 10-year period, which was a time of significant expansion, as Disney seeks to “turbocharge” its theme parks. This covers what was revealed in the SEC filing, statements from CEO Bob Iger and Parks Chairman Josh D’Amaro, plus our commentary.

This is the latest move in an ongoing story about the Walt Disney Company pivoting away from streaming and legacy media and signaling intentions to bet bigger on its theme parks, which have been the biggest bright spot during a dark year for Disney. It started earlier this year, during the Annual Shareholder meeting when Bob Iger said that Disney is “currently planning now to invest over $17 billion in Walt Disney World over the next 10 years. Those investments we estimate will create 13,000 new jobs at Disney and thousands of other indirect jobs and they’ll also attract more people to the state and generate more taxes.”

It has continued on several occasions since, with both Iger and D’Amaro hyping up the future of the parks and indicating that significant investment is on the horizon. The tone has been similar in California, where Disney has kicked its DisneylandForward sales pitch into high gear, hoping to get approval from Anaheim in the near future. All the while, many diehard Disney fans have been understandably skeptical about whether the company is sincere or if this is more bluster and hype without any substance. So let’s start by addressing that…

We’ve long “warned” fans against taking at face value everything Disney says in marketing materials. The company is incredibly adept at corporate communications, masterfully employing wordsmithery to excite fans. Disney always stays on the right side of the puffery versus false advertising line, but most fans recognize this for what it is and weigh marketing materials accordingly.

However, this was not a press release or even the recent Destination D23 fan event. This comes from a Form 8-K filing by the Walt Disney Company with the United States Securities and Exchange Commission. In this case, that matters a lot.

There are no rules about what Josh D’Amaro says on stage at Destination D23. Anything goes. He could go out there and slander the good name of Figment, claim that Dino-Rama is an exemplar of themed entertainment, or that CommuniCore Hall is going to blow your minds. Sadly, law enforcement officers could not rush the stage to apprehend him for any such remarks, however false and inflammatory.

But this is a legal filing with the SEC, and its rules prohibit companies from fraudulent, false or misleading statements to investors. This prevents Disney or any other company from releasing reports with inaccurate data or executives from making knowingly false claims that analysts and investors might rely upon.

For its part, Disney tries to shield itself with a long disclaimer about forward-looking statements on its investor relations pages. There’s a lot of language there and it’s worth reading yourself, but the bottom line is that forward-looking statements are “made on the basis of management’s views and assumptions regarding future events and business performance as of the time the statements are made.”

However, circumstances and plans could change due to different strategic initiatives or other business decisions, as well as from developments beyond Disney’s control (see March 2020 or Wall Street’s shifting sentiment towards streaming). Yada yada yada.

The point is that that are legal standards for forward-looking statements and SEC filings; what’s here is the current plan but is subject to change as conditions evolve. In other words, you shouldn’t necessarily rely on an “announcement” about plans that are a decade out. Conversely, it’s not total nonsense meant to excite and hype up fans, either. In this context, that would literally be fraudulent.

In short, the Walt Disney Company would not make such a bold statement about investing $60 billion in Walt Disney World, Disneyland, Disney Cruise Line, and the international parks if that was not the company’s current plan, or if there were no viable financial means for accomplishing said investment over the course of the next decade.

Against that backdrop, here’s the statement that the Walt Disney Company provided to the U.S. Securities & Exchange Commission about its updated Capital Expenditures plans for its theme park business:

The Walt Disney Company is providing the following update regarding its plans for capital expenditures at its Disney Parks, Experiences and Products (“DPEP”) segment. The Company is developing plans to accelerate and expand investment in its DPEP segment, to nearly double, as compared to the previous approximately 10-year period, consolidated capital expenditures for the segment over the course of an approximately 10-year period to approximately $60 billion in aggregate, including by investing in expanding and enhancing domestic and international parks and cruise line capacity, prioritizing projects anticipated to generate strong returns, consistent with the Company’s continuing approach to allocate capital in a disciplined and balanced manner.

We believe that the Company’s financial condition is strong and that its cash balances, other liquid assets, operating cash flows, access to capital markets and borrowing capacity under current bank facilities, taken together, provide adequate resources to fund ongoing operating requirements, contractual obligations, upcoming debt maturities as well as future capital expenditures related to the expansion of existing businesses and development of new projects.

This statement is followed by a bunch of slides offering the bases for this aggressive investment–I’ll insert the most interesting of these throughout the commentary below.

In a separate piece in The New York Times, both CEO Bob Iger and Parks Chairman Josh D’Amaro released statements. “There are far fewer limits to our parks business than people think,” Iger told the NYT.

“The growth trajectory is very compelling if we do nothing beyond what we have already committed,” he continued, referring to attractions and ships that have been announced but are not yet operational. “By dramatically increasing our investment — building big, being ambitious, maintaining quality and high standards and using our most popular I.P. — it will be turbocharged.”

Josh D’Amaro addressed potential risks of betting big on theme parks, and pointed to the resilience of the theme park through past periods of uncertainty and turmoil. He noted that customers had come flooding back when Disney parks reopened during the pandemic.

“Every time there has been a moment of crisis or concern, we have managed to bounce back faster than anyone expected,” D’Amaro said.

When asked by the New York Times how Disney would spend the $60 billion, D’Amaro declined to offer specifics. He instead noted that Disney movies like “Coco,” “Zootopia,” “Encanto” and others had not yet been incorporated into the company’s parks in meaningful ways.

“Imagine bringing Wakanda to life,” he added. “In terms of bringing the latest Disney-Marvel-Pixar intellectual property to the parks, we haven’t come close to scratching the surface. And we have learned that incorporating Disney I.P. increases the return on investment significantly.”

As bullish as I am on the future of Disney Parks & Resorts (and if you’ve read any of my commentaries this year, you know I am very bullish), I’m also not convinced that the Walt Disney Company will spend $60 billion on Walt Disney World and Disneyland (etc.) in the next decade.

There are several reasons for this, with the very first being that the company quite simply has too much debt and not enough liquidity to front-load spending. This means that whatever the 10-year plan is for Disney’s Park & Resorts, it’s necessarily backloaded. As anyone who has been around the block with the original “Disney Decade” or the DCA expansion or the EPCOT overhaul or…well, about half of the announcements at the last few D23 Expos…the more remote the timeline, the less likely something is to come to fruition.

My guess would be that the company’s intention is to switch gears and focus on Parks & Resorts once Hulu and ESPN are sorted out (bought and/or sold), the streaming segment attains profitability or at least stops hemorrhaging hundreds of millions of dollars per quarter, and some of the debt is paid down.

Some or all of those things pretty much have to happen before meaningful CapEx can be spent on Walt Disney World. That alone puts the start of this work in late 2024 or 2025. This doesn’t mean Disney won’t announce big plans earlier, but we likely won’t see significant construction on anything until then.

I think it’s fairly safe to say that actual CapEx investments totaling $60 billion are currently planned for Walt Disney World, Disneyland, DCL, and the international parks over the course of a decade. But that spending probably doesn’t start in earnest until October 2024 or maybe even 2025.

If we had to break the next decade into 5-year segments, my guess is that even the current plan doesn’t call for $30 billion and $30 billion in each of those 5-years. It’s probably more like $20 billion and $40 billion, and with a disproportionate part of the $20 billion in the near-term being spent on cruise ships and the international parks. It’s also fair to say that’s the most optimistic projection, and a lot could change, potentially impacting and reducing that number.

Then there’s the thing that will change: Bob Iger won’t be CEO to see this through to completion. The good news, at least from my perspective, is that Iger will be there to start this spending, as the board recently extended his contract through December 31, 2026. I know there are a lot of Iger haters out there, but hopefully this proposal causes at least some of them to reevaluate and see him in a new light.

More meaningfully, it’s good that there will not be a CEO change prior to the start of this $60 billion investment. A new CEO always makes their mark on a company, and one of the easiest and most concrete ways to accomplish that is via theme park plans. If Iger were still leaving at the end of next year, I’d say it’s entirely possible that none of this comes to fruition, as the next CEO could simply change their mind and opt to invest elsewhere.

Another tangent, but I suspect this increases the likely of Josh D’Amaro being the CEO-in-waiting exponentially, as he’d provide continuity in these aggressive plans. (I still think the best approach is an Eisner-Wells type of scenario, with Josh D’Amaro or Tom Staggs paired with someone at the top who has media experience–Kevin Mayer, for example.)

With all of that said, we thought it might be worthwhile to put $60 billion in context to help illustrate what it could buy for Disney’s Parks & Resorts. Obviously, that’s a lot of money–especially when you consider the fact that the original Dino-Rama cost at least $437 to build. Its replacement will probably add a “million” to the end of that number.

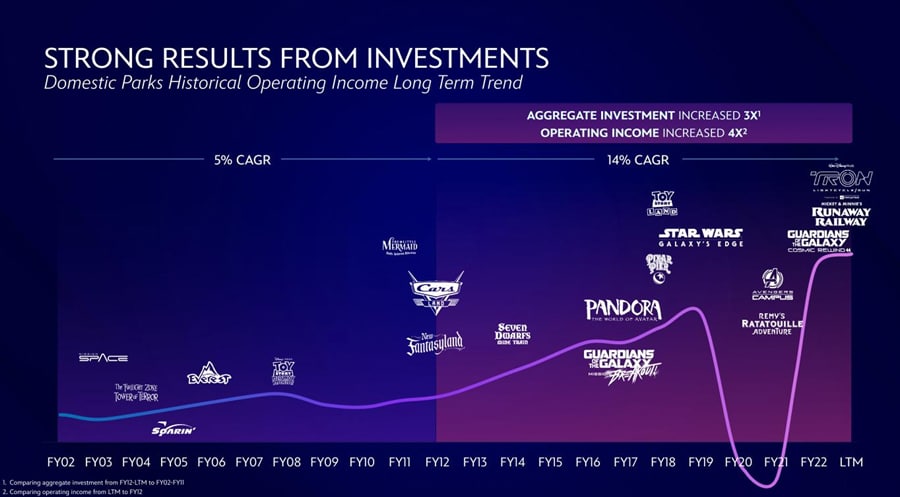

We’ll start by putting this into the context of CapEx numbers for the Parks & Resorts segment as a whole, which includes Walt Disney World, but also Disneyland, Disney Cruise Line, the international parks, resorts, and more.

We’re going to discard the last few years. Some of the reasons for that should be obvious, given the disruptions and cost-cutting that has occurred with the EPCOT overhaul. There’s also the fact that one development cycle has been winding down for Walt Disney World, while the new cruise ships have been contributing outsized costs.

Instead, we’ll look at 2017-2019. That was during the peak of the most recent expansion and occurred at a time (mostly) prior to spending on the new DCL ships. In 2017, the company spent $2.4 billion on CapEx for the domestic Parks & Resorts. In 2018, that number increased to $3.2 billion. In 2019, it peaked at $3.3 billion. These are just the totals for the U.S. based Parks & Resorts, including Disney Cruise Line. There’s a separate line-item for the international parks (minus Tokyo), and the total costs in Hong Kong and Shanghai are shared by local operating partners.

In an SEC filing last year, Disney indicated that the company planned to increase total capital expenditures from $4.9 billion to $6.7 billion. That whopping 37% spending increase would’ve been across the entire enterprise, not just domestic parks. (Again, the new DCL fleet is the big near-term expense.) Unlike other divisions of the company, Parks & Resorts has not really been targeted for aggressive cost-cutting this year. And for good reason: they’re the company’s biggest bright spot right now!

As for what $60 billion over a decade could buy, let’s start with what we think it will not buy: we (still) do not expect a 5th gate at Walt Disney World. This has seen rekindled interest in the last year, but we’re still highly skeptical for all of the reasons discussed in that post.

Of course, this could be wrong. If you’re just having fun doing blue sky daydreaming, have at it. Personally, I’m skeptical that the company would opt for building a brand new theme park with all of the necessary infrastructure, rather than building out the existing gates. Not only that, but Disney has repeatedly signaled that expansion of the existing parks is the plan.

Regardless, $60 billion is conceivably enough for 5th, 6th, and 7th gates at Walt Disney World, in theory. That’s especially true if they cost as much as Tokyo DisneySea (~$4 billion upon opening in 2001) or Shanghai Disneyland (~$5.5 billion upon opening in 2016). If it’s the cost of Universal’s Epic Universe, Disney could build over a dozen new gates!

Speaking of which, it’s already clear that Disney won’t have any “answer” to Epic Universe when it opens in Summer 2025. They simply aren’t capable of building anything that quickly, so it’s already too late. About the best they can probably do is delay Tiana’s Bayou Adventure to 2025 or lean heavily on entertainment to attempt to counter Epic Universe.

I doubt many Walt Disney World fans want to hear this, but rightly or wrongly, Disney does not seem overly concerned with Epic Universe. This announcement is not fueled by fears about Universal–it’s due to the unrealized potential of the Parks & Resorts, and it being pretty much the only business segment that has overperformed.

I’ll also add that claims that Universal is going to “eat Disney’s lunch” are not even remotely grounded in reality. Average guests (infrequent visitors or first-timers) don’t experience destinations on the sole basis of what’s brand new. Nevertheless, as a hotel business that also operates theme parks, Walt Disney World cannot be comfortable losing overnight guests to Universal. Even a 10% reduction would be a big blow.

Back in realityland, a 5th gate at Walt Disney World probably would not cost that little unless it were done in the spirit of the OG Walt Disney Studios Park in France. Construction costs aren’t what they were in the early aughts in Japan or even a decade later in China. Disney doesn’t do anything nearly as efficiently as Universal.

On top of that, this is all of the CapEx over the course of a decade and it’s also for all of the Parks & Resorts businesses around the world, which means every theme park and hotel (minus Tokyo) as well as all of the cruise ships. We already know Disney Cruise Line is spending big in the near future, and it’s likely that there are more new lands on the horizon at Disneyland Paris and Shanghai Disneyland.

Suffice to say, maybe 30% of this $60 billion will be spent at Walt Disney World–or around $20 billion. Even if a new park could be built for $6 billion, that be a big chunk of that total, and would necessitate CapEx reductions in the existing 4 parks as compared to the last decade. Given that, there’s every reason to believe the plan is expansion to the existing parks rather than development of a new one (or two).

With that in mind, what could that $60 billion buy in terms of expansions to the existing parks? Well, beyond working backwards from the above nationwide numbers for past CapEx, it’s tough to say. Disney doesn’t typically announce the cost of specific attractions or lands, so all we have are rumors and estimates of those.

As a general proposition, take whatever you’d expect a new ride to cost and increase that number significantly. The amounts spent by regional theme parks or even Universal are not even remotely insightful for the exorbitant expenses Disney somehow manages to incur. (To everyone who thinks the company hasn’t been investing money in Walt Disney World, you are wrong. The real question is whether they’ve been spending the staggering sums wisely.) Some of this is evident in the finishing and details, but definitely not all of it.

Rumors pegged the total cost of Guardians of the Galaxy: Cosmic Rewind at around $500 million (corroborated by Bloomberg), which would make it one of the most expensive attractions ever developed. Some estimates put the entirety of Star Wars: Galaxy’s Edge at $1 billion (each); that was prior to completion, with development costs shared between the coasts, and before Star Wars: Rise of the Resistance was delayed. It would not surprise me in the least if each Galaxy’s Edge ended up costing closer to $1.5 billion when all was said and done.

Back in 2010, the Los Angeles Times reported that each version of the Little Mermaid dark ride would cost $100 million, which was viewed by fans as a staggering sum at the time but now seems decidedly average. Radiator Springs Racers reportedly cost over double that by the time Cars Land was finished. (The entire DCA overhaul was originally billed as costing $1.1 billion, but ballooned far beyond that.)

Outside of the United States, we have a better idea of specific attraction and land costs because other parks actually announce them. There’s been a lot happening in Japan over the last several years, and OLC releases specific budgets in its annual reports. From that, we know that the Tokyo Disneyland expansion that included Enchanted Tale of Beauty and the Beast, Fantasy Forest Theatre, and a Baymax spinner cost approximately $750 million US.

Of that total, it’s safe to say that one-third went to the Beauty and the Beast trackless dark ride. Perhaps more. If Walt Disney World could get a few dark rides of that caliber for $250 million each, they should! Animal Kingdom, EPCOT, and Disney’s Hollywood Studios could each use a high-quality family-friendly people eater.

On a similar note, there’s Fantasy Springs at Tokyo DisneySea. The total investment on that port and its accompanying luxury hotel will be approximately 250 billion yen, or around $2.3 billion US. This makes it the most expensive expansion for any existing theme park ever. (It’ll also allow Tokyo DisneySea to reclaim the crown as the most expensive theme park ever built.)

There’s also the all-new Space Mountain coming to Tokyo’s Tomorrowland in 2027 at an approximate cost of 56 billion yen. This is going to be a $400 million US attraction, and speculation strongly suggests it’s going to use the Cosmic Rewind ‘story coaster’ ride system, minus Marvel. (That checks out given the cost!)

Finally, there’s Treasure Cove at Shanghai Disneyland, which includes the most expensive opening day attraction at that park (Pirates of the Caribbean: Battle for the Sunken Treasure) and cost a reported $450 million US. It’s unknown what newer additions like Toy Story Land (definitely not as much) or Zootopia Land (probably about as much) cost.

That should offer a pretty good idea of what’s possible with $60 billion.

As for what might be built in California, I’d personally bet against anything having to do with DisneylandForward in the next decade. I know this is the thing for which so many Disneyland diehards are excited, but I’ll reiterate once again that this is mostly a long-term land use and zoning plan. All of the attractions and lands that have been teased with that aren’t actual plans, they’re placeholders.

The other reason I’d bet against that is because both Disneyland and Disney California Adventure have ample room for expansion and current lands that are overdue for updates. On the reimagining front, the big one is Tomorrowland…as has been the case for the better part of the last two decades. I’d be willing to bet that finally happens (famous last words).

In addition, there’s the Marvel Multiverse E-Ticket for Avengers Campus. Based on Destination D23, it seems like that’s still happening, but is further down the road. There’s also the Avatar Experience at Disneyland Resort, but who knows where that’s going, or what it even is. Finally, I think Fantasyland expansion is a pretty safe bet over the next decade. My gut says World of Frozen will be (more or less) cloned in California if it’s a success at Hong Kong Disneyland. It should be–it looks gorgeous.

As for Walt Disney World, expect a big chunk of the expansion there in the next decade to be consistent with D’Amaro’s Destination D23 presentation earlier this month. During that, he discussed early concept explorations for Magic Kingdom and Animal Kingdom. The big thing of substance here is the Tropical Americas at Animal Kingdom Plan, which calls for Encanto, Indiana Jones, and maybe Coco to replace Dinoland USA.

That presentation also included a bold proposal for Magic Kingdom growth, albeit with shaky specifics–that portion was much more ‘blue sky’ in what it could entail. That presentation looked at Magic Kingdom Expansion Possibilities “Beyond Big Thunder”, but didn’t offer any specific franchises for that. (Based on process of elimination, we’re guessing this is now going to be Villains-themed…and also maybe Coco, but who knows what else.)

In our Rankings of ALL Walt Disney World Announcements & Destination D23 Report Card, we expressed a lot of optimism about D’Amaro’s presentation, most of which was not shared by other fans. Suffice to say, there’s a lot of skepticism about these possible plans, especially in light of Disney’s not-so-stellar track record in building things that were “firmly” confirmed at past D23 Expos.

I have no clue what else might be on the horizon for Walt Disney World, but I think expansion at the two ‘kingdoms’ consistent with those teased plans, plus a new family-friendly attraction or two in Disney’s Hollywood Studios is likely. Given that D’Amaro mentioned it, maybe we’ll finally see the Black Panther redo of Rock ‘n’ Roller Coaster, or perhaps it’ll take over the abandoned plans for the Play Pavilion at EPCOT.

Personally, I would love nothing more than to see a second phase to the EPCOT overhaul that includes Journey into Imagination, but I won’t let my desires cloud my judgment as to what’s likely. Disney might deem EPCOT “done” at the end of 2023. (Even if they do, attendance and guest behavior will likely dictate otherwise within a few years.)

Everything else will likely be less exciting. There’s no way Walt Disney World goes through another development cycle without adding significant hotel and timeshare capacity. There already have been rumblings that Reflections – A Disney Lakeside Lodge is on again, and I’d expect confirmation of that before the end of this year. Maybe before the end of this fiscal year, even.

Infrastructure costs also aren’t cheap, and some of the numbers I’ve heard for recent roads and other work are shockingly high. I doubt Skyliner expansion is being seriously considered, and I certainly hope another boondoggle like the NextGen/MyMagic+ initiative isn’t. Disney needs to build actual attractions, not waste money on smoke and mirrors.

Ultimately, our view is that it’s time for the persistent pessimism to give way to optimism when it comes to the future of Walt Disney World. We’ve been bullish since last year’s D23 Expo, and while a lot has changed since, our sentiment and the underlying reasons for it remains the same. It also helps that Chapek is gone and both D’Amaro and Bob Iger have repeatedly expressed bullishness on big expansion at Walt Disney World. Sure, we still don’t have concrete plans, but all of these teases would not be happening if this were purely bluster or good PR.

Obviously, actions speak louder than words, and it might be hard to take these claims at face value given all of the scaled back plans, cancelled projects, and the fact that it took how many years to clone a short roller coaster in an empty warehouse. That’s fair. There’s also the reality that Walt Disney World continues to outperform, and investors have begun to take notice of its success. This coupled with Wall Street souring on streaming means Disney may finally start to bet bigger on its theme park business.

In light of all that, it truly feels like we’re standing on the precipice of the next big development cycle that will once again start at Animal Kingdom (just like the last one!) and play out in this same fashion with major new additions to each park coming online between 2026 and 2031. Let the Disney Decade 2.0 begin!

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What is your reaction to the Walt Disney Company’s SEC filing indicating that it plans to “turbocharge” investment and double CapEx to $60 billion on Walt Disney World, Disneyland, DCL, etc. in the next decade? Think this can be reconciled with the near-term cost-cutting or the company’s debt load? What potential plans or projects have you most and least excited? Anything you’re hoping does not end up coming to fruition? Do you agree or disagree with our assessments? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!

Thanks Tom! Another great read. I am always optimistic about Disney, I think that’s the whole point. There is always so many positive experiences waiting there for us, focus on those and enjoy!

Just back from a super busy week at Disneyland and optimistically looking forward to a World trip this spring.

$60 billion. Lots of money. When expanding the Magic Kingdom beyond Big Thunder Mountain with new areas themed to Coco, Encanto and/or Disney Villains, shouldn’t they take it to the next level and incorporate a brand new Deluxe Resort as a way to enter this new developed Land of the Magic Kingdom. Imagine being able to leave your hotel and immediately being immersed in these Coco or Encanto themed areas, after which you continue your way towards Frontierland and beyond.

If this is enough to make Quarterly Results Wall Street panic for a moment, I’m excited!

Fool me once, I’ll believe it when I see it.

FIX FIGMENT!!!!

Tom–you have often described WDW as a, ” as a hotel business that also operates theme parks…” I assume this is because the hotels generate more revenue than the parks but I’d love to hear you expand on this. At the same time you have said that Disney is not great at running hotels, compared to Marriot, for example. Seems like a bit of a paradox.

I hope you are right about them copying Frozen Land at DLR. It looks incredible !

I am optimistic too. My hope is that they allocate some of the funds toward the following; Spaceship Earth, imagination ride and pavilion, new monorails, a night time MK parade, renovate the Contemporary and make it a flagship resort, and clean-up the Land pavilion. My BIG wishes are for a large MK expansion, and more high capacity, continuous loading dark rides in every park that DO NOT require a virtual queue or paid lightning lane. Attractions to absorb guest in Hollywood, AK, and Epcot are desperately needed. My one small wish (pun intended) is that they find a way to run Wishes every so often, maybe add some projections to it.

Good point about continuously moving dark rides. Those really absorb crowds.

Literally agree with all of this.

Some of it’s an inevitability (Spaceship Earth overhaul), while it seems like the ship has sailed on other things (Contempo refresh). I’d be very happy with half that list plus the AK & MK plans, and other stuff we don’t yet know about.

You are so right about continuously loading rides. Those really absorb crowds !

If they brought a version of Wishes back I would cry tears of toy. Still tied with Illuminations for my favorite nighttime spectacular Disney has ever done.

My other very unrealistic hope is that they do something more with Starcruiser, or try building a more scaled down RP-focused attraction from the lessons they learned. They can pick whatever franchise they want. Cost aside, Starcruiser was an incredible thing, and those that went are pretty universally sad that it’s closing. Seems terrible to just let it rot, and there’s a lot of amazing tech in there.

Tom I’m curious if you have any predictions for what will be next at DLR with this new investment! The only thing I can think of that we’ve heard news of is the E ticket in Avengers campus… any other ideas whether actual predictions or just fantastical hopes?

My predictions for Disneyland are about two-thirds of the way down, below the Arendelle photo.

More fully elaborated on here: https://www.disneytouristblog.com/wakanda-frozen-lands-teased-for-disney-world-disneyland/

Thanks, Tom – insightful as always. A couple of things:

1. “He could go out there and . . . claim that Dino-Rama is an exemplar of themed entertainment . . . .” And he would be 100% correct! But I digress.

2. I agree completely re a fifth gate. It would be lunacy. Today, Hollywood Studios has a grand total of 9 rides (defined as “get in a vehicle and move”), and Animal Kingdom has a total of 8. I fully recognize that there’s a lot more to a theme park – especially a Disney theme park – than just rides, but those are pathetic numbers. They need to add 4-5 rides minimum to each park before they even think about a fifth gate.

It will certainly be interesting to see how this plays out. I suspect your thoughts on timing are pretty close to correct. We’ll see!

While I have lots of thoughts on everything above, I think Wakanda at the planned Play Pavilion would be a surefire hit and a great fit for Epcot. One of the biggest themes in both Black Panther films involved the scientific knowledge and innovations of the Wakandan society – there are strong parallels with the original vision of Epcot as a utopian, futuristic community with science at its core. And while Wakanda isn’t “real”, its cultural traditions and aesthetic qualities are drawn from actual central African cultures – something that’s conspicuously underrepresented in World Showcase.

So a “Play Pavilion Featuring Shuri’s Lab” would be a perfect way to meld Marvel IP with futurism, edutainment, and fun.

Looks like a version of this (likely leaning more toward “edu” than “tainment”) opened at the London Science museum last year, so there’s already a precedent to build up on. See below:

https://thedirect.com/article/black-panther-letitia-wright-lab-museum-photos

Went in august for the first time in 10 years . Had a great time but definitely the place had issues. Far too many rides were breaking down . Which takes you straight out of the magic . Our last day we went on 5 rides (magic kingdom ) they all broke down .

They need to invest in the good attractions they have . Whilst ditching some of the dated rides. Need to bring back a new great movie ride. Get rid of the muppets .

Also they need more shoes , parades and entertainment. This is where Disney is truly magical

Get rid of Muppets???

you should be banned from this site!

As a lawyer whose job includes filing 8-K, I geeked out so much that you actually posted a blog that explained forward looking statements.

I agree this is incredibly exciting. I am guessing more aggressive expansion of the cruise line may be underway. The Adventure signals they want to start venturing into international markets with the cruise line and I could see them building dedicated ships for the UK (based on the success of the pandemic UK staycation cruises) or Australia (where they are soon going to be doing similar sailings this year).

But $60 billion is so much money it feels like they may be talking about a new theme park. I agree no fifth gate in Florida, but a midwest or Canadian park or another international one could be in the cards.

A question I have is assuming we are going to get some more attractions built is will Disney be building it in the miniland style of one or 2 new attractions 1 smaller and 1 big e ticket that seems to have become the pattern over the last few years.Pandora and Galaxy’s Edge have been good additions overall but I can’t help but feel something is ‘missing’ from these types of lands. I suppose I could also have leveled against this against universal for the Diagon Alley for Potter. I’m guessing part of this is just you cant invest that much money into a land of 3-4 attractions in case of failure? Do you think that we might just get expansions into the current lands for example one or 2 more rides into world showcase as I think a new pavillion is probably in the never going to happen realm at this point but they could put a ride into the expansion spaces from the current ones if there is an IP disney wants.

On Star Wars you said that Disney was done but there is a rumour going around about some sort of expansion of Discoveryland into a Star Wars mini land although possibly giving us back Et La terra De La Lune for Space Mouuntain. Not sure what you think on that I agree for the second spot its going to be not Star Wars in the Studios for Paris although it might be the 28 LA Olympics by the time we hear an announcement at this rate of building it!

“Turbocharge” lol. I’d like to believe this but just retheming splash is gonna take like 3 years. I don’t get how universal is going to have a new gate in less time then it took for them to do a walkthrough water feature .

I believe at least half of the CapEx is meant for maintenance. Dinoland needed a retheme. Journey into Imagination needs an update. Test Track is getting an update. Adventureland needs another attraction to pull away crowds. What is going on at Animation Courtyard? These are just a few areas Disney ignored longer than they should, and only Disney World.

Plus, we have inflation. If Disney spent $30 billion this past decade, and if the next decade has the same inflation rate, Disney would spend $42 billion doing the same style of updates.

Many of the changes at Disney were wonderful in the past decade, and we should love the changes coming in the next decade. We should temper our hopes for new lands and parks.

“Plus, we have inflation. If Disney spent $30 billion this past decade, and if the next decade has the same inflation rate, Disney would spend $42 billion doing the same style of updates.”

This is a very fair point. Construction costs have already skyrocketed since the last phase of development.

My counter-counterpoint to that would be that Walt Disney World wasted a ton of money in the EPCOT overhaul. If they simply spent in a more disciplined manner, and actually built the projects as planned when they announce them, they could stretch the budgets further even with inflation.

Tom, your enthusiasm is adorable. Sincerely, I hope you’re totally right about it all. Now I’m just thinking, my kids will be graduating high school in 2032 and 2033 . . . husband turns 65 around there . . . I hope we’re able to still scoot around in ECVs and get onto these attractions by the time they’re actually finished! LOL. Epic graduation trips for the kiddos though if it does pan out.

P.S. I hope they redo the Reflections outside look. I know it’ll probably be a tower, but can’t they incorporate trees or something tall and cool into the design since they wanted to incorporate Pocohontas and the woodsy vibe initially? Someone creative with an engineering degree MUST have a clue how to get something better than this sticky Marriott in the woods they planned.

P.S.S. You KNOW I want Skyliner expansion everywhere. My fantasy “Blue Sky” is Skyliner running between SOG and Poly 2.0, maybe with a detour to the back of MK’s Villain’s Land and a cool separate entrance and Villains-themed DVC right near the back entrance. License to print money! Iconic second entrance to lighten the load after the fireworks/park closing hubbub. Epcot has the front entrance for buses and cars and the World Showcase for boats and Skyliner. Why not do that for MK? Divert the crowd to Maleficent’s Lair.

I’d be shocked if the Skyliner expands, but who knows. It has been quite successful at reducing bus usage and increasing the nightly room rates that WDW can charge at those resorts. However, I don’t see anywhere else for a cost-effective Skyliner to go that would have a similar impact as the first one. Maybe if they build another resort by Coronado?

So I might have ‘adorable enthusiasm’ for a lot of things…but not that. Would love to be wrong, though! We’re huge Skyliner fans! 🙂

Very insightful as always, Tom! I’m excited for the details of this stuff to emerge over the next year/few years. Going by the positivity of some of the Disneyland Paris stuff in that slide deck, I’m thinking they won’t be done once Frozen and the lake etc. open. What’s your bet re: the replacement for the proposed mini-Galaxy’s Edge at the Studios park? I guess it could always turn out to be… mini-Galaxy’s Edge after all, but that wouldn’t be very exciting.

“What’s your bet re: the replacement for the proposed mini-Galaxy’s Edge at the Studios park?”

Total shot in the dark, but a land based on Walt Disney Animation Studios movies. If there is something that could cheaply be cloned from Fantasy Springs, maybe that. Beauty and the Beast (also cloned from TDR) could make a lot of sense, as could the Lion King.

I have zero inside info, but would bet on one of those 3 things. I think Disney is largely done investing on Star Wars stuff.