Half of Disney’s $60 Billion Plan Going to Theme Parks & Resorts

In a new filing with the SEC, the Walt Disney Company has offered a breakdown on the allocation of its planned $60 billion investment in Parks & Resorts as part of a 10-year investment plan. This post shares the latest details, as the future of Walt Disney World and Disneyland start to come into focus.

For starters, this SEC filing is titled “Disney’s Plan for Shareholder Value Creation” and is part of the ongoing proxy fight with Nelson Peltz’s Trian and that other activist investor that wants to do AI stuff and for theme parks to be treated like regular ole commercial real estate. It’s become apparent that most of you have lost interest in the battle of the board–or have already made up your mind–so we’re not going to fixate on any of that.

Just be aware that this is part of a full 60 page SEC filing that also hypes up the current board and knocks the proposed alternative slates. It also makes the case for Iger’s vision for Disney, discussing studio creativity, streaming profitability, and the future of ESPN. You know, the usual suspects for Disney as the company continues rebuilding.

In the presentation, Disney reiterates its $60 billion investment plan for the next 10 years, which includes capital to expand capacity at Walt Disney World, Disneyland, Disney Cruise Line and the international parks.

Consistent with that, investments will build upon Disney Parks & Resort’s track record of generating outsized ROI (in the presentation, the company notes that Parks & Resorts is the company’s most profitable segment) and will focus on:

- Accelerating storytelling by utilizing its wealth of intellectual property, untapped stories and unmatched creativity

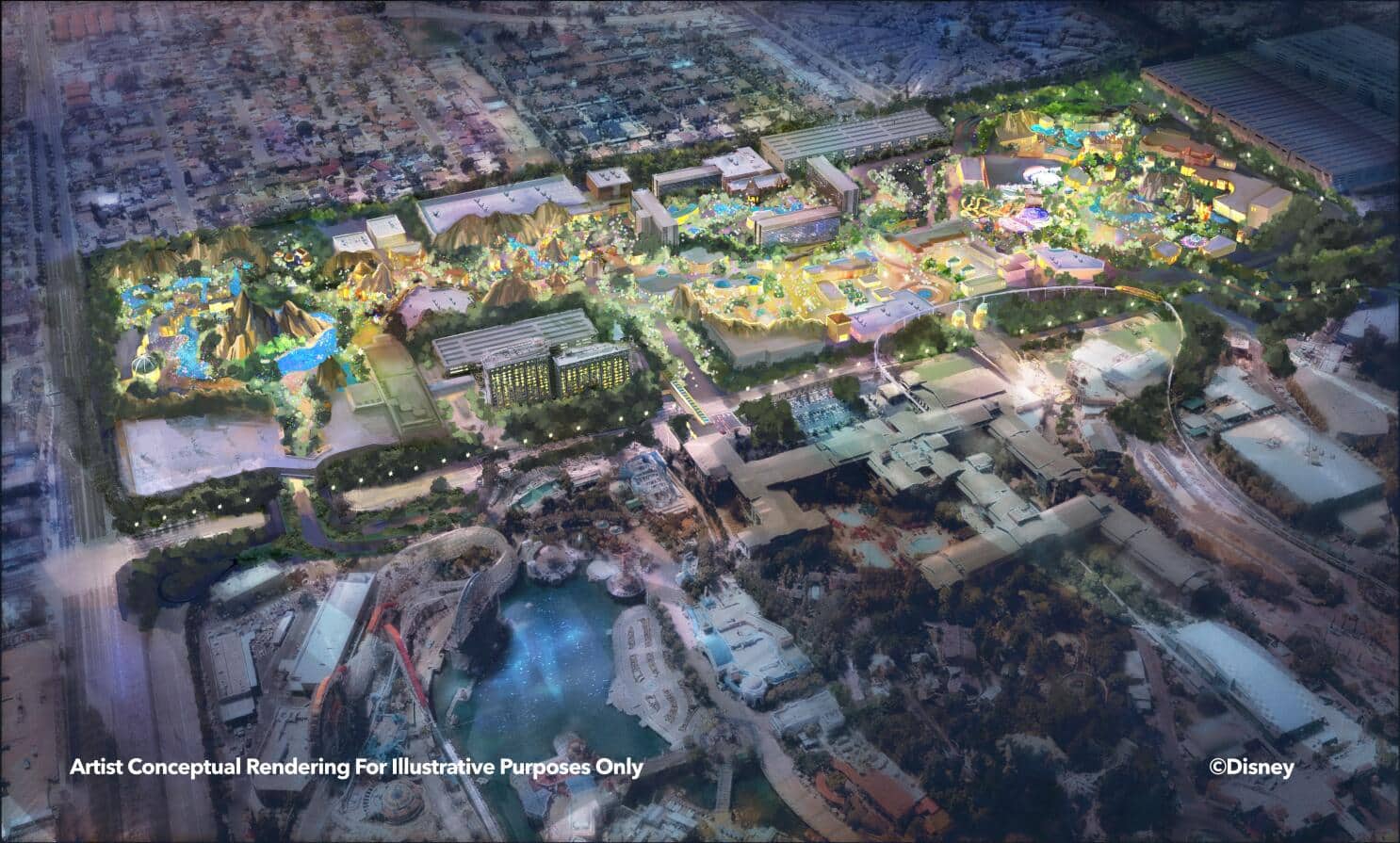

- Expanding footprints: Disney has over 1,000 acres of available development parcels across the six existing resorts in North America, Europe, and Asia

- Investing in innovative technology to improve the guest experience

- Reaching new fans around the world: for every park guest today, there are over 10 consumers with Disney affinity who don’t visit the parks in a given year

Disney further elaborates that its 10-year investment plans are to “create magical new experiences and refresh existing infrastructure.” The company further states that approximately 70% of the plan is earmarked for capacity-expanding investments.

Breaking this down further, Disney indicates that 50% of the capital allocation plan is for theme parks and resorts, 20% is for Disney Cruise Line or “other” and 30% is for technology and maintenance.

It’s probably obvious, but they’re getting to the 70% ‘capacity-expanding’ number by adding together theme parks with cruises/other. The remaining 30% is for technology and maintenance. What, exactly, does all of this mean? Let’s break it down a bit.

First, you’ve probably heard part of this before. On the earnings call a few weeks ago, new CFO Hugh Johnston said that “approximately 70% [of the $60 billion plan] is earmarked for incremental capacity expanding investments around the globe.”

Bob Iger added the following: “We’re already hard at work at basically determining where we’re going to place our new investments and what they will be. You can pretty much conclude that they’ll be all over, meaning every single one of our locations will be the beneficiary of increased investment and, thus, increased capacity, including on the high seas, where we’re currently building three more ships.”

“I’m not going to really give you much more of a sense of timing, except that we’re hard at work at getting these things basically conceived and built. And we’ve got a menu of things that will basically start opening in 2025, and there’ll be a cadence every year of additional investment and increased capacity,” continued Iger.

It seems like each time there’s an update on this, a single new nugget of information is shared. In this case, it’s the 50/20 breakdown between the theme parks and Disney Cruise Line. Well, technically cruise ships slash other.

My guess is the “other” here is the other components of Disney Signature Experiences, which is DCL plus Adventures by Disney, Aulani, Storyliving, Golden Oak, and Disney Vacation Club. I’m not convinced DVC investments would pull from this bucket rather than theme parks and resorts, but I don’t know enough to have an informed opinion. (The others all would, but how much CapEx are they realistically going to need in the next decade?)

From my perspective, this is good news–but unsurprising. When the $60 billion plan was first announced, one of the ways that it was dismissed by cynical Walt Disney World fans was by saying that it’ll probably mostly go to Disney Cruise Line. My take then, as now, was that’s difficult to see happening for two reasons.

First, DCL is wrapping up one expansion cycle and it’s hard to imagine Disney being overly aggressive with further fleet expansion before assessing demand. Second, shipyard commitments are already years out. Disney would be hard-pressed to build several new ships in the next decade even if they wanted. If anything, the 20% number for Disney Cruise Line seems high to me–so I wonder how much of that is going to the “other” areas of Disney Signature Experiences.

In any case, 70% of this $60 billion going towards capacity-expanding investments is good news. For those wondering what this means, it suggests that Disney is going to focus on building new lands and attractions rather than refurbishing existing things or spending money on placemaking.

There are obvious examples of what this could mean. If Disneyland builds World of Frozen as a Fantasyland expansion or Pandora in some of the space opened up as part of the DisneylandForward proposal, that’s capacity-expanding. When the Beyond Big Thunder project for Magic Kingdom firms up, that’ll be capacity-expanding. A new World Showcase pavilion would be capacity-expanding. Ditto a new ride replacing dead space in Animation Courtyard.

The new attraction (rumored to be a roller coaster) now under development adjacent to Zootopia is capacity-expanding. Building a Marvel E-Ticket at Hong Kong Disneyland would be capacity expanding. Same goes for developing the expansion pad on the far side of the new lake at Walt Disney Studios Park.

But it’s probably a bit more complicated than that in actuality. Changing Rock ‘n’ Roller Coaster Starring Aerosmith into a theoretical ‘Taylor’s Version’ of the ride or one set in Wakanda probably is not capacity-expanding. However, the overhaul from Ellen’s Energy Adventure to Cosmic Rewind arguably was capacity-expanding for EPCOT, because it’s essentially an entirely new ride and it replaced something unpopular. What about Tropical Americas in Animal Kingdom? Probably a bit of both.

This brings us to the 30% for technology and maintenance. It sort of went without saying that if 70% was for capacity-expanding additions, then 30% was for updates that did not expand capacity. But now it’s listed as a line item–technology and maintenance–and that’s viewed as concerning by some fans.

It shouldn’t be. This does not mean maintenance in the sense of the annual closure to Kali River Rapids. It’s not upkeep, regular ride refurbishments, or overnight preventative maintenance. Those are not CapEx, they’re operating expenses. While Walt Disney World very much needs to be spending much more on routine maintenance, it largely should not be coming from the $60 billion.

Technically, for these investments to qualify as CapEx, they’d need to extend the useful life of the attraction. (And I assume this is the standard being used since this is for investors and filed with the SEC.) The Rock ‘n’ Roller Coaster example above? It wouldn’t qualify if they’re simply changing out the prop…but it’s a potentially different story entirely if the ride system or infrastructure is replaced.

Another example would be Spaceship Earth. If Imagineering went in and simply added the Story Light stuff, that shouldn’t qualify. But if they also replaced the track and ride system, it would. And that’s more likely than not what would happen, since Spaceship Earth has been overdue for a major overhaul for the last 5 years. That would not expand capacity, but it would fall into that 30% bucket.

Pretty much every attraction that could conceivably be reimagined is at a point in its lifecycle where more than just the thematic elements need to be updated. It also makes sense to make infrastructure updates that improve reliability and extend the useful life of the asset.

All of this bears mentioning because the first half of the decade is going to be fairly heavy on reimaginings. Zootopia in the Tree of Life, Indiana Jones Adventure replacing DINOSAUR, whatever’s up with Test Track, and other yet-to-be-announced transformations. (As I’ve said before, my money is on Rock ‘n’ Roller Coaster being next up, and possibly Journey into Imagination.)

This is almost necessarily the case if Bob Iger’s comment about an annual cadence is correct. We’ve all seen how “quickly” Disney builds new lands and attractions. Even if construction started today on a Villains Lair beyond Big Thunder (it won’t), the opening date wouldn’t be until 2027 at the absolute earliest. By contrast, they could close DINOSAUR towards the end of this year or early 2025 and have Indiana Jones Adventure ready by 2026. Whatever the plan is for Rock ‘n’ Roller Coaster could be accomplished even faster.

None of this should be a huge surprise. Iger previously indicated that the $60 billion in spending on Parks & Resorts over the next 10 years would be backloaded. Josh D’Amaro has made comments that they want to grow the footprints of the parks while also improving utilization within them.

We’re absolutely going to get reimaginings–and most of those will come from this $60 billion bucket. Just want to temper expectations a bit, while also covering how that 30% on tech and maintenance could be a good use of funds, especially at Walt Disney World which is in need of ride updates.

Personally, I still think this is a fairly positive development. That 50% of $60 billion being earmarked for capacity-expanding additions in the theme parks is still $30 billion. That’s a lot. Granted, there are other theme parks in the world, but whatever is built in Hong Kong and Shanghai only requires a partial investment from Disney. (None of the money spent on Tokyo Disney Resort comes from Disney–that’s all profit.)

We know that the company plans to spend about $2 to $3 billion on Disneyland. Even before the $60 billion number was released, Disney said that $17 billion is earmarked for Walt Disney World. They haven’t mentioned that number in a while, but this should confirm that it’s probably pretty close to accurate–if not an understatement of the investment.

Disney is only spending $12 billion on cruise ships (and other) plus $3 billion on Disneyland. I’d bet that another $4 billion combined is destined for the Asia parks, which might seem low, but they’re wrapping up developments and whatever is spent only partially comes from Disney’s coffers. Disneyland Paris is the biggest wildcard, as investments there are really starting to pay off–so maybe another $5 billion there? (Wouldn’t surprise me if they bet even bigger on DLP.)

No matter how you slice it, it seems to me like Walt Disney World will see at least $17 billion in investment. (Maybe the $17 billion is just for capacity-expanding additions, and they’re also getting another few billion for maintenance and tech?) After accounting for inflation significantly increasing costs, that’s about on par with the decade that brought us Pandora, Toy Story Land, Star Wars: Galaxy’s Edge, Cosmic Rewind, and TRON Lightcycle Run.

Also in that same decade, untold sums were spent on road and other infrastructure work as well as (figuratively and literally) dumped into a pit at EPCOT. It wouldn’t surprise me in the least if the amount spent on things that did not expand capacity at Walt Disney World over the last decade was above 40%. If there’s a better roadmap for the next decade and money is spent more carefully, it could go even further. (Here’s hoping for no new global pandemics that throw monkey wrenches into plans midway through!)

With all of that said, I don’t want to be accused of painting an overly optimistic picture. My biggest fear when seeing that 30% amount for tech and maintenance is a repeat of the MyMagic+ and NextGen boondoggle, where billions of dollars are blown on interactive junk and attempts at avoiding building new attractions. (One of the good things about Iger still being around is he knows that was a mistake and hopefully learned from it!)

Technology is important and Disney does have a patchwork of legacy IT systems. Those will require investment over the next decade, and probably fairly significant sums. That money obviously should be spent–just as Disney should improve infrastructure consisting of roadways, sidewalks, and so forth. It’s unsexy, but it’s important. I just hope they spend it carefully and we don’t get another Genie itinerary builder that keeps sending me to the carrousel for my first ride of the day. A complete and utter waste of time, talent and money.

Another concern is the backloaded nature of the capacity-expanding additions. One truism with Disney is that phase 2 never happens, because budgets get cut or real world events intervene. All it takes is a recession and Wall Street could get spooked and look for Disney to undertake shortsighted austerity measures. And Disney would, because they’re beholden to investor whims, unfortunately.

The good news is that, in the here and now, Wall Street wants theme park investments. Disney Parks is the one big bright spot for the company. The division has been resilient, even as literally everything else has faltered. The issue isn’t a desire to actually spend money on theme parks. Disney has that in spades. The problem has been the money part of the equation. They did not have the free cash flow. They do now, or rather, will by the end of this fiscal year. It is going to happen. Finally.

I know this is probably going to be an unpopular opinion among jaded fans who are skeptical of Disney’s current leadership and direction. I also know I’m more bullish than the average fan who has been burned before and is now (understandably) in wait and see mode. But from my perspective, Iger and D’Amaro both saying the same things about expansion and future developments for over a year now reinforces that there are substantive plans, and it’s not just posturing or hollow hype. The money has been the issue, not the appetite for expansion.

The stage is set for an absolutely colossal 2024 D23 Expo. One with more than just a bunch of “what ifs?” or daydreaming–and instead actual concrete announcements and timelines for both Walt Disney World and Disneyland expansion (along with reimaginings). Of course, that assumes all goes well with the proxy fights and Iger’s turnaround continues at its current trajectory. Time will tell, I suppose.

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What do you think of the Walt Disney Company’s plans for the Parks & Resorts? Excited that 70% of the “turbocharged” investment of $60 billion is for capacity-expansions? What about seeing $30 billion earmarked for theme parks? Think 30% for tech and maintenance is too much or about right? Do you agree or disagree with our assessment? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!

Nobody has ever in any way made a good suggestion for any change to RRC. Flat out, they all suck. No, RRC needs to stay as it is. Unless they extended the track to make it longer…

Meh, nothing burger. I will believe it when I see it and not see half the rides broken down at the same time in MK for hours….example yesterday, 3/14. Yes, I have the screen shots to prove it and a Disney fan friend is staying at a resort there now and was at MK to confirm. Count me in the jaded Disney fan column.

We live 35mins away and have the top pass so we go very frequently along with being DVC members. I go enough to know Csuite isn’t going to do anything the fans want. As soon as they scare off the proxy fight they’ll conveniently forget all the promises and pay themselves $100m salaries while expensing out their yachting costs to their Disney expense accounts and nothing meaningful to fans gets finished. And yes, we cancelled our Disney+ subscription last week when they changed their ads being displayed. Did they even consider customers might pay an extra dollar or two a month to not see ads before they implemented it like Netflix and Amazon Prime does? I know they get hammered for nickel and diming but this would be a situation where the precedent had already been set. Perfect example of Csuite not truly caring about what the customers actually want.

Also, why did the WDW welcome sign fade so fast, they just painted it 2 years ago? Don’t they know they have to use Florida Paints brand or something like that to prevent fading from the sun? Cost cutting is ruining the brand.

This is super exciting! I wonder if they will announce a big Epcot overhaul? LOL! A lot of Epcot is in dire need of attention.

Wasn’t really sure where to post this so I’m just posting on a recent article so that it is maybe seen (sorry it’s off topic!), and I’m hoping someone can assist. My husband, son, and I are going to DW for 6 nights, but my husband is not going to go to the parks. I booked it as a package so that I can take advantage of the 0% financing with my Disney Visa card. How can I add my husband to the hotel reservation? I’ve searched online and called and spoken with a cast member. The Cast Member said the only way (without doing a room only reservation instead) is to add him at the front desk on arrival day. But he said that then, he may have “day guest” privileges only and therefore not have access to the pool (even though he’s staying with us all 6 nights?). Does anyone else have experience with this? Surely this is a common situation. It seems overly complicated

Without knowing any of your specifics let me just give one example of an alternative way to go.

Tom books a $3,000 trip thinking “I’ll pay $500 a month for 6 months.”

If Tom can set aside $500 every month he’s better off going to Target, using a Target red card and getting $500 worth of Disney gift cards for $475. He just saved $25 and that $3,000 trip now costs $2,850 ( That’s $150 his wife Sarah can spend for him). But Tom can bring that trip cost down further. Disney’s offering excellent deals on room only bookings and they’ve just released a good deal on tickets too. For a 6 day stay, the 4 day special ticket fits the bill.

One of those off days take the kid horseback riding, miniature golf, kayaking, Hoop De Doo and make use of transportation to explore other resorts for lunch.

And hubby doesn’t have to climb over the gate to use the pool.

PS Depending on what resort you’ve chosen he shouldn’t have trouble getting into the pool.

Just some ideas.

Thanks! We potentially could save it ahead instead of paying incrementally after the trip with the free financing. And definitely good to know that he probably wouldn’t actually have trouble accessing the pool! That seemed odd to me.

The latest WDW attraction additions have been galaxy rewind and Tron light cycle / run. It’s time for some excellent slow moving dark rides akin to Sinbad’s Storybook Voyage. I am also a huge proponent of the Main Street U.S.A theater project that was sadly canceled. I really liked Mickey and the Magical Map in Disneyland, and the Magic Kingdom would be a wonderful place for something like that. However, it seems Disney is loathe to create many new experiences that require paying for more entertainment cast members. My absolute dream would be for them to create some more park specific IP. The truth is, Zootopia was a nice movie and all, as was Encanto, but they really aren’t “timeless” films that warrant their own lands (although my family is partial to Luca)! Original IP in the parks would do just as well in the long run. Why not create the attraction first and THEN create the movie/tv show? Also, EPCOT really could use a lot more help than it received. What seemed like would be a “renaissance” for the park has really been quite lame, with many large show buildings still sitting empty or being repurposed in insignificant ways.