What Disney World Can Learn From the “Summer of Women”

Last year, women were a juggernaut. Fueled by Taylor Swift, Beyoncé and Barbie, females dominated pop culture and had a massive economic impact as consumers. It’s only natural for Walt Disney World and other businesses to wonder what lessons they can learn from the “Summer of Women” and “Swiftonomics.”

During her Eras Tour, Taylor Swift tapped into the spending power of women eager to splurge on in-person communal experiences, travel, and seeing their idol live. The singer-songwriter, named by Forbes the second-richest woman in the U.S. music industry, smashed records for ticket prices, crowds of fans and revenues.

The Federal Reserve stated that Swift’s tour helped stimulate travel and tourism. The resiliency of consumers attending is said to be a contributor to inflation. The Eras Tour could generate up to $4.6 billion in consumer spending for the U.S. economy in total. According to Bloomberg analysis, Swift’s total net worth crossed the $1 billion mark in October; she’s one of the few entertainers to reach that status based on just her music and performances.

It wasn’t just Taylor Swift’s Eras Tour that had a massive boost to consumer spending and the U.S. economy. Beyoncé’s Renaissance Tour and Barbie were also hugely impactful, cultural touchstones. Together, those women’s tours and “Barbenheimer” added $8.5 billion to U.S. output in the third quarter of this year, per Bloomberg Economics.

Concerts by Swift and Beyoncé could add nearly $6 billion to gross domestic product this year, while “Barbenheimer” is projected to add about $3.1 billion in consumer spending and exports. Collectively, that would raise annualized real personal consumption expenditures and GDP by 0.7 and 0.5 percentage points. That’s unprecedented for 4 entertainment offerings.

As a result, economists nearly doubled their forecast for growth in the July-to-September period, partly as a result of those spending gains. It’s worth noting that this was all before the Eras Tour concert film shattered box office records. It’s also before the concert comes to streaming starting on December 13 for $19.89. The concert film was an ‘event’ release in theaters, and it’s safe to expect the same, somehow, on streaming.

You’ve almost certainly seen countless headlines about Taylor Swift’s economic impact and record-breaking success of pretty much everything she’s done. None of this is really news at this point, nor is it related to Disney. But stick with me…

The real story here isn’t Taylor Swift or Beyoncé or Barbenheimer. What fueled this summer’s spending is partly a tale of pent-up demand for entertainment coming out of the pandemic, but that’s only a small piece of the puzzle. We’ve been discussing revenge travel and pent-up demand here for 3 years, and it’s largely exhausted as of 2023.

The bigger story is about the dominance of women as consumers. Swift and company’s summer of women is not a one-off; it’s the culmination of economic and demographic shifts that have been under way for a decade or more, due to women having children later in life (if at all), female wage increases, and shifting household gender roles.

Median weekly earnings for women in full-time and salaried roles have climbed 28% over the last five years to $1,005 in the third quarter of this year, according to U.S. Bureau of Labor Statistics. Workforce participation among women ages 25 to 54 increased to 77.6% this year per BLS stats, up from 74.5% a decade earlier, while the percentage of women with children under 18 who work also rose during that period.

This is notable not just because it’s an all-time record, but because it quickly reversed the growing gender and parental status gap that emerged during 2020. If current trend-lines hold (and they should given the red-hot labor market), expect that record to be broken again in 2024.

Women are not simply making traditional decisions about purchasing products and services that are a ‘public good’ for the family. They are now using their growing purchasing power for discretionary spending on things and experiences specifically for themselves that bring them joy. And their power as consumers, as exhibited above, is being underappreciated by many companies.

For over a year, I’ve had a post in draft titled, “Are Demographics Disney’s Destiny?” (The answer is yes.) Then came the massive successes of those concert tours and Barbenheimer. Then I read an interesting article in the Wall Street Journal, “Women Own This Summer. The Economy Proves It.”

During the last decade, Walt Disney World invested heavily in Star Wars and Marvel. This is completely understandable. These were colossal acquisitions for the company, absolutely massive franchises, and neither had much of a presence in Walt Disney World prior to the last 5 years. Not only that, but the parks arguably lacked offerings that appealed to those core demos.

It made sense to spend an estimated $1 billion-plus on Star Wars: Galaxy’s Edge and several hundreds of millions of dollars on Guardians of the Galaxy: Cosmic Rewind. You could say hindsight’s 20/20, but it probably was less savvy to drop several hundreds of millions of dollars on Star Wars: Galactic Starcruiser. But whatever.

The point is that the biggest attractions and lands added to Walt Disney World during the last round of expansion were Star Wars and Marvel. I’m hesitant to draw broad generalizations based on stereotypes–anyone can like anything–but these are male-centric properties in terms of consumership. If you love them and you’re not a male, that’s fantastic! But the above conclusion doesn’t require stereotypes–we have statistics.

Survey after survey shows a gender gap in Star Wars fandom, with about a 60/40 split at the casual level and a deeper divide among the seriously invested. The numbers are closer with Marvel, but also murkier–different surveys cover comics and the MCU, while some lump the two together.

Nevertheless, MCU audiences are majority-male, white, and millennial. (I didn’t realize this, but Marvel’s bigger problem, at least according to the data, is disinterest among Gen Z.) Even Avatar is slightly more popular with men based on box office receipts, which is another big addition from Walt Disney World’s last development cycle.

These numbers are closer than they once were. Disney has made a concerted effort to attract underrepresented audiences since the Star Wars and Marvel acquisitions, and that has paid off–at least in terms of narrowing the survey divide. This is one strategy, albeit with uneven results at the box office and via streaming minutes. In fandoms, capturing new demographics without alienating old ones is a delicate needle to thread, which should be evident to anyone who has spent any amount of time online.

One lesson that can be learned from Taylor Swift is that women have a massive amount of purchasing power. It makes financial sense to meet these consumers where they are and offer distinct entertainment aimed at them, rather than simply attempting to make male-centric media more appealing to women, too. Casting a wider net can make sense, but so too can using different nets entirely.

As it relates to Walt Disney World, this is interesting because the template for such an approach already exists: Tokyo Disneyland. Japan has long been contending with an aging and shrinking population, along with fears that it’d fall off a ‘demographic cliff.’

Japan has served as a cautionary tale for other countries (or a preview of the future) for the last few decades. Since peaking in the late 1980s, Japan has endured multiple ‘lost decades’ of economic stagnation and a shrinking workforce. A third of Japanese people are now over 60 years old, and Japan has the oldest population in the world due to that and a low birth rate.

How Tokyo Disneyland grapples with this has been a topic of countless academic pieces, articles, books, and OLC executive interviews. One big way is Tokyo DisneySea, which was built and originally marketed as a mature foil to Tokyo Disneyland. This is evident both in its core designs and the more adult early advertisements.

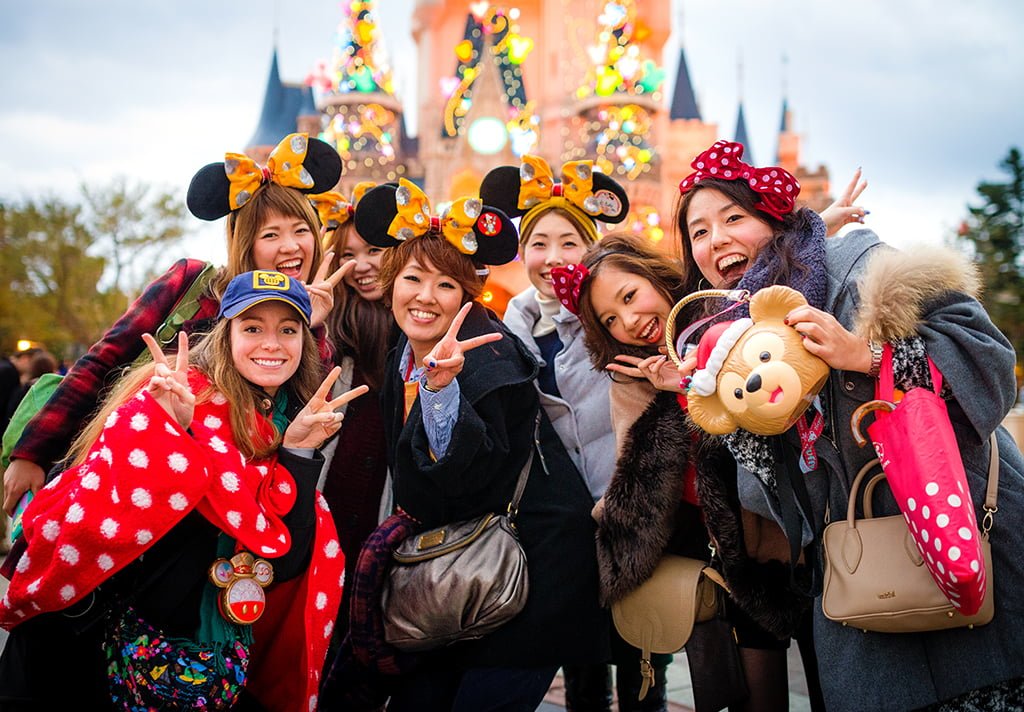

More significantly, Tokyo Disneyland aggressively attempts to appeal to women. OLC long ago recognized that its guest profile was predominantly female–a number that has been 70-78% of guests in the last decade. Children make up a relatively small percentage of guests–10% to 17% in the last decade.

In particular, Tokyo Disneyland is tremendously popular among Japan’s young full-time working women, many of whom have plenty of disposable income. These women “have become a major target market, with unique ‘cultural styles of consumption and self-expression,'” according to Harvard Magazine. “One such style is burikko, or pretending (buri) to act like a child (ko). Another is kawaii, or ‘cute.’ Together, these behavioral codes create the favorite expressive idiom…kawaiiko burikko, or pretending to be a cute child.”

Just about every unique wrinkle of Tokyo Disney Resort and decision made by OLC is with the young working woman demographic in mind. The Duffy Phenomenon, seasonal offerings, ticket types, and which attractions have been greenlit and which have not. Although OLC has never offered a formal explanation as to why they passed on Cars Land, Star Wars: Galaxy’s Edge, or any number of other recent expansion proposals they’ve been pitched, its guest profile is undoubtedly a big reason why.

This is why Tokyo Disneyland recently opened Enchanted Tale of Beauty and the Beast, Happy Ride with Baymax, Mickey’s Magical Music World, and Minnie’s Style Studio. With less than 10% of guests being under the age of 11 in its most recent guest profile report, it’s probably safe to say these attractions are not actually aimed at small children.

Ditto the blockbuster Fantasy Springs port-of-call at Tokyo DisneySea. This new area is themed to Frozen, Tangled, and Peter Pan, with attractions that are mostly boat rides. All kid-friendly rides…that are not aimed at actual children.

To be sure, it would be reductionist to say that all of this is aimed exclusively at women. Kawaii culture is big across demographics in Japan, “Danshi Disney” (boys’ trips) are growing in popularity, there’s also the aforementioned aging population to consider in developing new attractions–and much more. But the numbers speak for themselves, and there’s little denying that OLC is building with its visitor stats front-of-mind.

To some extent, Walt Disney World is also doing this. Many of Walt Disney World’s most successful and lucrative merchandising initiatives–Spirit Jerseys, Loungefly, Pandora charms, color trends, ear headbands–have skewed towards millennial women with disposable income. So they’ve at least learned from the Tokyo Disney Resort merchandising team!

The main lesson that should be learned by Walt Disney World from Swift’s ‘summer of women’ is that this demographic is powerful, and catering to it with merchandise alone is small-scale. It’s also arguably superficial, skimming more money from guests who already visit instead of capturing new ones. No first-timer is planning a trip to Walt Disney World for the release of a new Spirit Jersey. Some would if their favorite film turned into a ride.

As you’ve likely heard, Disney (allegedly) has Plans to Double Investment to $60 Billion in Walt Disney World, Disneyland & Beyond. Prior to that announcement, Bob Iger Revealed a Plan to Invest $17 Billion on Walt Disney World Expansion. However you slice it, that’s a tremendous amount of money that’ll be dumped into Walt Disney World over the course of the next decade. It definitely means Animal Kingdom expansion and almost certainly means new lands in Magic Kingdom and elsewhere.

A very sensible thing would be building lands or attractions that appeal to millennial women, based on movies from the Disney Renaissance that were popular when they were kids. I would’ve argued for this one year ago–Swift’s summer of women just vindicated it.

This demographic has purchasing power and childhood nostalgia, and is going to be a strong consumer for years to come during their prime earning years. (There’s some dumb desire to pit millennials and baby boomers against one another, but really, the former is a reverberation of the latter; they’ll also inherit a lot of boomer wealth.)

It’s probably not just women, either. I don’t have supporting survey data, but I’d hazard a guess that there’s a fair amount of crossover appeal and sentimentality for most Disney Renaissance-era and more recent Disney and Pixar movies. It’s also not just single women, men, or couples–although those are huge, growing demographics to which Disney should be doing more to cater (see Japan as a preview of the future). Millennial parents undoubtedly want to share their favorite films and characters with their kids, too.

It’s absolutely wild that there are no real rides for Beauty and the Beast, Aladdin, The Lion King, Pocahontas, Hunchback of Notre Dame, Hercules, Mulan or Tarzan at Walt Disney World. That list could likely be extended to include Lilo & Stitch, The Emperor’s New Groove, The Incredibles, Tangled, Up, and other Disney and Pixar films from the aughts. Disney Villains would be another one that’s not necessarily from any time period, but is popular with this audience.

This is not to say Walt Disney World should exclusively target these “older” intellectual properties for its expansion plans. For a number of reasons beyond the scope of this post (including demographics!), it makes sense to add more Moana, Coco, Encanto, Inside Out, Frozen, Zootopia, and more recent releases from the Disney+ era.

It’s completely understandable that Disney would want to build attractions from active franchises that move merchandise and perform well in terms of key metrics, like minutes streamed. But the argument for building these attractions doesn’t need to be made. It’s self-evident and probably the default. (There’s a reason several of the above keep appearing in concept art teases and are mentioned in interviews with Bob Iger and Josh D’Amaro!)

Characters and movies from the 1990s and earlier that are “dormant” properties are a harder sell. They’re not actively moving as much merchandise, doing big Disney+ numbers, or performing well on whatever metrics matter to the company. But I wouldn’t be surprised if many of these are among the best-selling Loungefly bags, for instance.

It’s crazy that this even needs to be written. Peter Pan’s Flight and Seven Dwarfs Mine Train, rides based on movies that are over a half-century old, typically average the highest wait times in Magic Kingdom. Current box office, minutes streamed, or merchandise sales are hardly conclusive of attraction popularity or drawing power (and one of the reasons I dislike consumer products being lumped together with theme parks).

Perhaps I’m wrong, but I’d assume attractions and lands based on evergreen characters and movies that stand the test of time are the safer bet and surer thing. Synergy with new releases is important, to be sure, but better suited for seasonal entertainment or shorter-lived shows.

A final lesson that Walt Disney World could learn from Taylor Swift, and perhaps this is the bigger one (but again, this started as an article about demographics) is that people crave communal, in-person experiences. The good news is that this is exactly what Walt Disney World is–and the enduring popularity of this type of ‘tentpole’ activity could be part why the company plans to invest $60 billion into Parks & Resorts.

Nevertheless, it bears mentioning because Walt Disney World has spent the last decade-plus making the communal activity of theme parks less so in ways big and little. The Play Disney Parks app, for example, takes guests at least partially out of the tactile world and into the virtual one. Then, of course, there’s the suite of features in the My Disney Experience app that cause guests to bury their faces in their phones.

Look, I’m not a technophobe. Features like Mobile Order, Walkup Waitlist, and more are fantastic (and potentially important for an aging population!). But there’s a delicate balance. I don’t know exactly where that is, but I would argue that Genie+ does not find it, whereas FastPass+ mostly did. This might also partially explain why pre-booking of Lightning Lanes is making a return next year–perhaps the lesson has already been learned. (It’s also why the suite of ‘virtual’ features in these apps are largely unpopular.)

The bottom line here is that Walt Disney World should lean more into its core quality as a communal, in-person experience. This is something that people are going to crave more and more as an antidote to the ever-increasingly virtual and isolated media landscape. Guests will still be on their phones–that’s the nature of the beast–but don’t try to compete with or add to that. Let them spend that time as they will, on social media creating content that generates more FOMO for the parks!

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

Your Thoughts

Do you think there are any lessons that Walt Disney World could learn from Taylor Swift? Agree or disagree with our commentary about demographics and catering more towards millennial women? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!

Great post, Tom! I agree with the overarching conclusions here, and would add that I think the macro situation at Disney parks is contributing to the missed opportunity to claim women’s disposable dollars. In addition to family vacations, I take 1-2 girls trips a year with my high school bestie and college roommates. Disney has factored in largely, primarily due to the nostalgia we share over our teenaged trips together. In the past 7-ish years, it’s become increasingly obvious that we can take extremely cool, non-Disney vacations for less or the same amount of money, and often with much less hassle. It’s difficult not to consider a long weekend sampling cicchetti and listening to street opera in Venice for the same price as a dinner at Jiko and a few nights at the Caribbean Beach. On the other hand, I would call out that many women I know are a bit intimidated by traveling to unfamiliar cities and countries. They love the relative safety offered by a WDW stay, and would definitely appreciated being better catered to. I agree that more/better Renaissance-era attractions would be appealing, especially if they could include throwbacks to the parks of those days. (Never going to miss an opportunity for plugging Dreamfinder and Figmen!). I would also shout out (into the wind) the importance of bringing entertainment and nighttime spectacles/parades into the parks. I’m in complete agreement that a return to communal, interactive experiences is necessary! Recognizing that “women” is a massive, diverse category, my personal take is that I have zero desire to “pretend to be a cute child” and have never been interested in Loungefly or spirit jerseys, but I really, really, really miss the Adventurer’s Club and whatever the modern version of the Comedy Warehouse, Mannequins, etc., could look like.

Without the economic output and her shared interest and love of Disney, our DVC contracts and multiple trips would not happen. We are definitely stronger together and can do way more. I’m all for the things and activities that make her happy and dutifully sat through Barbie, and carry her Lululemon bags through Somerset Mall. Therefore more things at Disney directed towards their female guest is something I can get behind. Suggestions: stick with the princesses, Starbucks, and Stitch (girls seem to really like Stitch for some reason). In addition to Tommy Bahama and Nike, get some Lululemon Disney branded apparel. And maybe it is time for a Rocking Roller coaster featuring Taylor Swift.

I should have more clearly mentioned that” her” is my wife.

So when is Taylor Swift going to replace Areosmith on RocknRoller coaster?

THAT would be genius!

Can you imagine the merchandise they would move! Crazy!

Enjoyed reading this article!! Great thoughts. I completely agree with you, too. This is another topic but another thing I don’t think they are addressing is the splitting interests of Gen Z. My kids were born in 2006-07 and there is very little in the parks that were new when they were growing up. They never put anything permanent in for anything popular during that era, in Walt Disney world, other than Frozen and Ratatouille really. They just put in that Moana thing (just as Gen Z goes into high school and college) They do love guardians so that was a huge win for every demographic. What do they think Gen z grew up on? Things like Phineas and Ferb, Lightning McQueen, Pixar golden age, etc. I see DL has added some of it – Pixar, cars, incredibles, etc. I just don’t see WDW doing it so it looks to me like they are skipping Gen Z at WDW and going on to the stuff that came out for when Gen Alpha was kids, such as Encanto, etc. I think going back and adding legacy Disney IP that we ALL grew up with, from Gen X and down (everyone always forgets Gen X exists but we are the parents of Gen Z) is a way to satisfy the millennials (and women as discussed here) and include those older and younger. (Since Gen Z grew up on streaming, they had access to every show starting in like middle/high school). But when my kids were preschool we still watched cable/PBS etc. anyway i don’t blame the parks for going with tried and true older IP. I just worry about the nostalgia that Will bring in Gen Z when they get older. They have a negative view of corporations and Disney as a company to a degree. It’sa really fine line to walk and I don’t envy Them!! For now (and maybe the foreseeable future based on economy) gen z doesn’t have any purchasing power so I understand focusing on older ppl with more money. I enjoyed learning about Tokyo DL as I didn’t realize it was such a high adult attendance. Sorry for writing a book

“(everyone always forgets Gen X exists but we are the parents of Gen Z)”

I suspect the same thing will happen with Gen Z. Just like Baby Boomers and Millennials are a pair, so too are Gens X & Z. The difference is that Boomers had tremendous purchasing power, and so too do Millennials (that’ll only increase as they inherit boomer wealth).

In any case, I wouldn’t say Disney has done a bad job incorporating those properties into the parks. Frozen has a solid presence, so does a lot of Pixar, and more Moana is likely on the horizon. They could definitely do better, though, I agree.