14 Ways to Save Money on Your 2024 Disney World Vacation

Here’s how to save money on your 2024 Walt Disney World vacation, with tips & tricks for cutting costs on hotels, dining, souvenirs, and more. With these recommendations, you can trim the fat from your budget and get the most out of your travel dollars, with our 14 best tips to do WDW less expensively. (Updated November 24, 2023.)

Fair warning: it won’t always be easy–and “less expensively” is not the same as “inexpensively.” To the contrary, Walt Disney World vacations are more expensive than ever due to a combination of price increases and lack of discounts. If you haven’t visited in a few years or ever, you might be in for sticker shock when pricing out a trip on DisneyWorld.com.

That’s the bad news. The good news is that “revenge travel” is finally fading, and costs are coming down. In addition to that, discounts have already started to improve at Walt Disney World, and it’s highly likely that many more special offers are on the horizon. With that in mind, here are other ways to save at Walt Disney World in 2024…

Regardless of your finances, it’s never a bad idea to consider ways to save more money. For some of you, cutting spending may be the only way you can afford a trip to Walt Disney World. For others, spending less might not be strictly necessary, but rather is a way to fund a slightly longer trip, a second Disney trip, or simply not waste money unnecessarily. (No one wants to do that!)

We have been in both positions. Although we’re able to splurge on trips now, I still vividly remember the days or ordering an extra bun so we could “split” a double cheeseburger at Cosmic Ray’s. These days, we pay careful attention to our spending and make every effort to get the most bang for our buck. After all, those wasted dollars could be the makings of another trip!

Here are some of our recommendations for saving money on your Walt Disney World vacation. Not all of these things will be for everyone. We each value different aspects of our trips differently, and what is unnecessary for some might be make or break for someone else.

These are just possible ideas, not across the board recommendations for everyone. Cost-cutting is not a good idea when it’s at the expense of the fundamental experience–if you cut things that are important to you, don’t be surprised if the amount of fun you have is negatively impacted.

We’ve arranged this list so that the best options are at the top, but there’s obviously a ‘your mileage may vary’ element. For example, if you’re basically a Coca-Cola guzzling polar bear, maybe #2 would save you more than #9. (Then again, you can use #9 to get your Coke fix, so maybe not.) Anyway, we’re getting ahead of ourselves–here’s the list…

14. Arrive Monday, Leave Friday

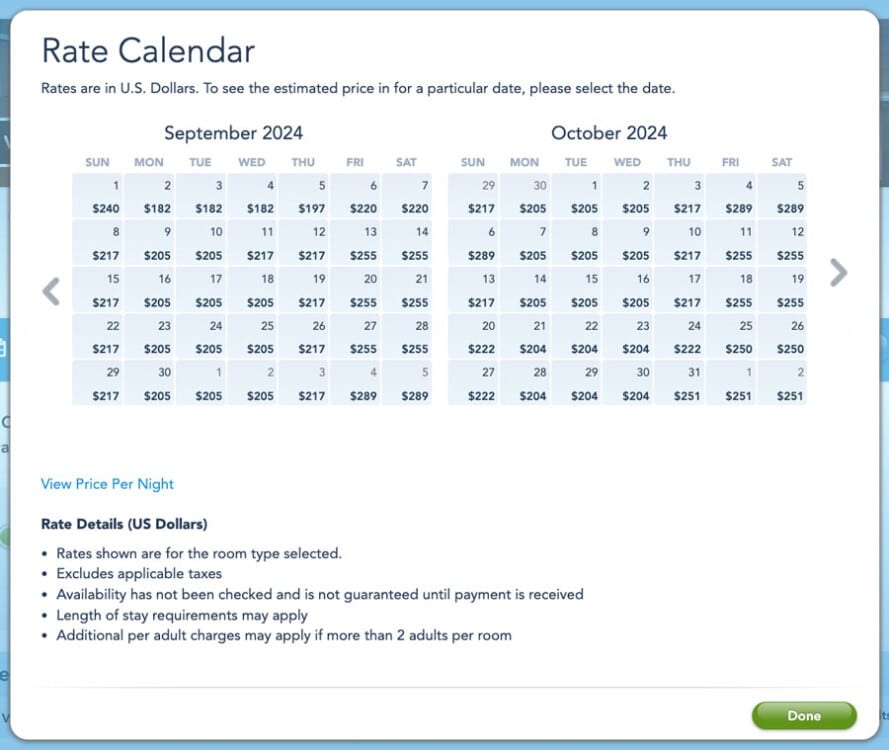

Stated differently: skip weekends. Above is the room rate chart for Pop Century in Fall 2024, and as you can see, the rates are cheapest on Monday through Thursday nights. This hotel is not an outlier, nor are these months. In fact, holiday weekends and busier times are even worse–with a larger gap between Fridays through Sundays and Mondays through Thursdays.

Guess what else more or less tracks with the above rate chart? Walt Disney World ticket prices, airfare costs, and even rental car prices. It’s not just this one (large) component of your trip that costs more–it’s pretty much everything!

This is the latest addition to our list, but honestly, it’s not revolutionary advice. A critical mass of Walt Disney World visitors have already voted with their wallets, which is what prompted our post, Why Are Weekends So Slow at Walt Disney World? To be sure, it’s not all about tourists skipping weekends. The lowest tier of Annual Pass that’s incredibly popular with Floridians blocks out Saturdays and Sundays. Most targeted ticket deals do the same.

Nevertheless, it’s worth share this for those who don’t look at resort rate charts or comparison shop and just price out a vacation package. Even if you have to visit during a busier season (see #1), you can reduce the cost by simply choosing the right days of the week.

13. Stay On-Site

This is going to buck conventional wisdom, which is that it’s cheaper to stay off-site. When looking at hotel rates in a vacuum, that’s absolutely correct. Central Florida has a surplus of hotels, and you can score decent accommodations for $50 to $75 per night–far cheaper than comparable rooms at Walt Disney World. At the other end of the spectrum, luxury hotels in Orlando are a fraction of the price of on-site Deluxe Resorts.

Our most recent hotel stay was at All Star Sports and, honestly, it exceeded expectations. The rooms at the All Stars have recently been remodeled and the grounds are fun for kids. These are still very much budget motels that would not fetch rates this high if they were simply ‘real world’ hotels.

These are the cheapest hotels at Walt Disney World, with rates that are frequently $125 to $150 after discounts. That’s still at least $25 to $75 more expensive than their off-site counterparts. (This range varies widely, depending upon demand, season, and occupancy. Walt Disney World hotel prices do not spike with real-time demand, whereas other Central Florida hotels do.)

However, these are not apples to apples comparisons! Pretending like on-site hotels are the same as off-site ones, and rates should be set accordingly, overlooks the first three rules of real estate. More importantly, it overlooks the on-site perks and ancillary costs of staying off-site.

Specifically, if you stay off-site, you’ll pay for parking at the parks and transportation to them. This is a direct monetary cost, and one that closes the gap quickly. You will also pay indirectly in terms of time, both due to the commute and by not having access to on-site perks such as Early Entry. Don’t dismiss that as “only” 30 minutes–it can be a huge head-start, especially at EPCOT and Disney’s Hollywood Studios.

For our recent All Star stay, we paid ~$130/night during the holiday season after discount. That was only about $30 cheaper than other options. It would have easily cost ~$50/day for transportation and parking, were we to stay off-site and incur those costs–making the total cost for the cheapest off-site hotel more than the cheapest on-site hotel.

In short, spending a little more upfront on your hotel can potentially save a lot over the course of the trip–while also having a superior experience and getting more done in the parks, in a more efficient manner. This is not to say that staying on-site is always for everyone–it’s not. In fact, we frequently stay off-site and recommend others do as well. Rather, it’s to suggest that you take a holistic view of costs and benefits, rather than simply a cursory glance at sticker prices. You actually need to do the math and take everything into account.

Which brings us to #12 on the list, which is arguably the biggest and best piece of money-saving advice for Walt Disney World…

12. Never Pay Full Price for Hotels

For most people, hotels are the single most expensive component of a trip to Walt Disney World. If you plan on staying in a Deluxe Resort, your hotel could eat up more than half of your entire vacation budget. While we love the Deluxe Resorts, we hate their pricing, and (frankly) think they are not worth their rack rates. We have four alternatives to paying full price for Deluxe Resorts, with the best option last, so you have plenty of options if you “need” posh accommodations.

First, consider “downgrading” to a Moderate Resort. Two good options for this are the new Gran Destino and Caribbean Beach Resort. Both are essentially “Deluxe Minus” hotels, albeit for very different reasons. Gran Destino has upscale amenities, fine dining, and feels reminiscent of a Las Vegas tower.

By contrast, Caribbean Beach has beautiful grounds, a relaxed setting, and efficient transportation via the Skyliner gondolas. The rooms and dining aren’t on par with what you’ll find at Deluxes, but this is a distinctly Walt Disney World resort, and it shows. It’s now often overlooked, but perfect for anyone wanting a relaxed setting for their vacation and easy access to Epcot and Disney’s Hollywood Studios.

If you want an actual Deluxe resort at a Moderate price, your best option is renting Disney Vacation Club (or DVC) Points. Here’s our top recommendation for the best, safe, and least expensive option for DVC point rental. If you want to know more, we cover the exact steps for doing this, and why we recommend it, in our Tips for Renting Disney Vacation Club Points post, which offers a great way to stay in Deluxe-caliber on-property rooms for significant savings.

Perhaps the most straightforward way to save on accommodations is simply booking a stay at the third-party Swan & Dolphin, which is located on-site within walking distance of Epcot and Hollywood Studios and actually offers better perks than Disney’s Value and Moderate Resorts. As we discuss in our Swan & Dolphin Review, these hotels are incredibly nice, just lacking in “Disney” theme. Yes, they have a bunch of annoying fees, but the net price is still significantly less expensive than the nearby Boardwalk Inn or Yacht & Beach Clubs.

11. Skip Genie+ and Lightning Lanes (Sometimes)

Genie+ and Lightning Lanes are Walt Disney World’s line-skipping options, which are controversial as they’re essentially paid FastPass. While these can save you a ton of time, they are also clunky systems that can cause you to backtrack or wait around for return times. Everything you need to know is covered in our Guide to Genie+ and Lightning Lanes at Walt Disney World.

From a money-saving perspective, that covers when not to buy Genie+ or Individual Lightning Lanes. While many Walt Disney World fans are outraged over and have boycotted Genie+ and Lightning Lanes, that’s not our perspective. We aren’t “for” or “against” the system. Rather, we recommend utilizing these options strategically (alongside itineraries, rope drop, early entry, etc.), and not wasting money on Genie+ or Lightning Lanes when they’re not necessary.

To that end, check out Best Time-Saving Strategies for Walt Disney World, which is the result of extensive ‘testing’ to determine the best and worst ways to beat the crowds as of this Christmas. Genie+ is only the clear winner at Magic Kingdom. In the other 3 parks, there are superior strategies for saving time waiting in line. Even Disney’s Hollywood Studios, which has a lot of popular rides with long lines, has equal or better ways to beat the crowds.

10. Avoid Upcharges

We love Mickey’s Not So Scary Halloween Party and Mickey’s Very Merry Christmas Party, and have attended these events every single year that they’ve been held since 2007. We wouldn’t miss either one of them, and that’s despite both parties roughly tripling in price during that time and getting more crowded.

Likewise, we think the After Hours events are good hassle-free ways to accomplish a lot. Just recently, we recommended After Hours at Disney’s Hollywood Studios as the easiest way to beat the crowds there, better than Early Entry, Genie+ and Lightning Lanes, or staying late on a regular night. So, what gives?

The reality is that none of these things, or any other upcharges, are necessary in order to have a great trip to Walt Disney World. There are always alternatives to beating the crowds or outsmarting the masses. When it comes to planning and social media, there’s a pervasive sense of FOMO that drives many people to spend large sums of money on unnecessary experiences at Walt Disney World. Planners see other fans rave about these things or how quickly the events/reservations sell out, and assume they’re must dos.

That is not true. While many upcharges will enhance your trip, they’re far from necessary to having an enjoyable vacation. To the contrary, most of them are (objectively) not worth the money. Sure, they’re a fun splurge–but if your vacation dollars are limited, you should absolutely put those towards the core experience (tickets, hotels, dining) rather than the extravagences.

Consider the demand for upcharge offerings at Walt Disney World a form of keeping up with the online Joneses (or Kardashians, these days). This is exacerbated by certain popular experiences booking up quickly, but that’s less a reflection of quality and demand than it is limited supply and the FOMO machine. Don’t buy into the hype–it’s almost always exaggerated.

9. Skip the Disney Dining Plan

The Disney Dining Plan returns in 2024, with price increases for adults and (surprisingly) price decreases for kids. It’s just as controversial as ever, and incredibly polarizing. Some Walt Disney World fans love it and others hate it. This blog’s official position is that the Disney Dining Plan is neither good nor bad, but has the potential to be either depending upon your specific circumstances and how you use it.

To that point, we’ve already written a lengthy article about When You Should Buy & When You Should Skip the 2024 Disney Dining Plan! This weighs the strengths & weaknesses, and helps you determine whether the Disney Dining Plan is right for you and your family.

One thing we can tell you without knowing anything about your unique situation is that the Disney Dining Plan will not be the cheapest way for you to eat at Walt Disney World. If paying bottom dollar is your bottom line, look elsewhere. The Disney Dining Plan is a splurge that can save you money if you dine a certain way, but there is literally no one who won’t do better by using other money-saving strategy for meals.

Walt Disney World loves the Disney Dining Plan because it results in a minimum spend on food and locks guests into eating on-site (by extension, it makes DDP users less likely to venture off-site at all, meaning a lower likelihood of visiting Universal). It’s incredibly advantageous in creating a captive audience, which is why Disney is willing to offer up potential savings on meals via the DDP. In the most reductionist terms, it’s kind of like a discount for buying in bulk.

If you don’t lock yourself in via the Disney Dining Plan, you open the door to a variety of money-saving options. You could do a couple of dinners off-site or in on-site third party hotels. The Orlando area has an excellent (and underrated) food scene, and our List of Great Restaurants Near Walt Disney World covers options that aren’t too far from the parks. This includes everything from spectacular steak to an Italian restaurant with old school EPCOT Center bloodlines.

You could also prepare breakfast in your room, pack snacks, and so much more. With that said, our recommendation here is not going overboard with this. Dining off-site or preparing every single meal in your hotel room would waste a ton of time–and time is money at Walt Disney World. (It’s important to realize the value of your time and not be too much of a cheapskate!) There’s also the reality that certain Disney restaurants are a ton of fun or serve delicious food and enhance the quality of your Walt Disney World vacation.

With that in mind, if you do skip the Disney Dining Plan, here’s another way to save money on food without sacrificing on vacation quality or wasting a ton of time…

8. Grocery Delivery

Thanks to big box retailers entering the market, grocery delivery is faster, cheaper and easier than ever. About the only thing that’s more simple and straightforward is buying groceries from gift shops at Walt Disney World, but holy cow, is that more expensive!

We cover all of the ways to get groceries in our Tips for Buying Groceries at Walt Disney World post, with our current favorite being Walmart Plus. If you don’t want to use a grocery delivery service or visit a store, and just need smaller snack, another option is mailing yourself an Amazon package (details here).

Many of you probably don’t want to cook on vacation, and that’s completely understandable. That is NOT our recommendation, anyway. Instead, it’s a good idea to order items for a cold and quick breakfast in your room. This kills multiple birds with one stone. It’s cheaper than eating in the parks or your hotel food court, it’s faster and more efficient, and offers the opportunity to eat a well-rounded meal with fruits, vegetables, and other healthy options you might not get at Walt Disney World restaurants.

As covered in How to Avoid Getting Sick at Walt Disney World, eating a good breakfast can be a gamechanger. There’s also the opportunity cost, or lack thereof. With a few exceptions, breakfast is the weakest meal at Walt Disney World. You aren’t missing much–unless you enjoy powdered eggs and rubber bacon–by eating breakfast in your room. Put that saved money towards better lunches and dinners!

The one-two punch of renting Disney Vacation Club points and doing grocery delivery can pretty easily cut the cost of your Walt Disney World vacation in half. (If not save you even more!)

7. Use Credit Cards

This one could rank higher, but we recognize it’s not for everyone, and also comes with an opportunity cost (if you use the points at Walt Disney World, you can’t use them elsewhere). Nonetheless, we think leveraging credit card rewards can be a great way of getting “free” airfare or hotel rooms…or just paying for some meals.

Many proponents of saving money are opponents of credit cards. This is ludicrous. I will acknowledge that others have dramatically different views when it comes to credit cards, but we view them as glorious tools that, like water balloon launchers, have the potential for humans to abuse and misuse.

We have earned tens of thousands of dollars in rewards on credit cards, without ever paying a cent of interest (although we have paid annual fees on certain cards). We cover which credit cards we recommend using to save money on travel in our Best Credit Cards for Disney Travel post.

Beyond travel-specific credit cards, getting a good “everyday” credit card for daily purchases can be a great way to earn money that you can earmark for vacations. This gives a different meaning to “saving” money, but it’s an idea nonetheless. Rather than using the Disney Chase Visa credit cards that are popular with many Disney fans, we recommend cards like the Chase Freedom Rewards or Amex Blue Cash for everyday use. Also, you don’t necessarily want to avoid cards with annual fees–quite often, the added perks or superior cashback or other rewards more than offset the fee.

These cards have better reward rates, and you can allocate their cash back to your vacation account, or use the rewards for airfare or other components of a Walt Disney World vacation. Just because rewards aren’t in the form of a Disney gift card doesn’t mean that you can’t save them for Disney. Hate credit cards if you want, but there’s no arguing that paying your balance off in full each month and using credit cards responsibly can save you money.

6. Skip the Park Hopper

It pains me to say this since I love Park Hopping, but if you’re on a budget, it might be wise to skip it–depending upon what park ticket discounts are available when you book. It’s tempting to upgrade to the Park Hopper tickets because they usually aren’t that much more, but if you aren’t going to Park Hop much, it’s still a waste. Plus, for your family, the “small” cost of Park Hoppers does add up quickly, and you might be able to save $250 or more simply by skipping the Park Hopper option.

Determine whether this is something you need or can drop in our Tips for Saving Money on Walt Disney World Tickets post. If we were not Annual Passholders, Park Hopping is not something we could live without, but your mileage may vary on that. We like to stay in the park that is open latest, and that usually means hopping to that park towards the end of the day. For us, it would unquestionably be worth the extra cost, even if on a budget, and even if that meant sacrificing something else.

Many guests, especially those with young kids, aren’t staying late at night anyway, and calling it an early night rather than park hopping to the one that’s open latest each night isn’t going to be a big deal to them. If you are on a tight budget, consider how important Park Hopping is to you, and whether you can do without it. The big caveat to this is that not having the Park Hopper option will significantly limit your chances of experiencing Star Wars: Rise of the Resistance. That’s definitely something to consider.

5. Gift Card Hacks

This is one we learned about a few years ago and we’ve been utilizing since. There are a few different methods for saving money on Disney gift cards, and we cover all of the methods in our Tips for Saving Money on Disney Gift Cards post. Unfortunately, the best ‘hack’ of stacking Raise.com plus a Target Red Card to save ~10% has been closed, but you can still save around 5%, which is not too shabby!

You can save money at Kroger, Sam’s Club, and other stores just by making strategic Disney gift card purchases. These strategies undoubtedly work with other credit cards, too. We have cards with rotating 5% back categories and other time-limited incentives.

4. Plan a “Free” Day

There’s some duplicity of meaning in “free” day. Here it means both a day where you don’t have the theme parks on your schedule, and also a day when you focus on things that are free. The idea is that you do something that is actually free in practice, not just in theory.

Do a resort tour (we’re partial to this one around Christmas!), go swimming in your hotel’s pool, or go for a walk around the resort. If you want something fun that’ll offer transportation entertainment, consider our Disney Skyliner Sip & Snack Stroll. We also have 1-Day “No Parks” Walt Disney World Itinerary that provides a plan of how you can enjoy a great day outside of the parks.

If you can’t do an entire day, the upside to this is that it doesn’t need to be the entire day. You can have it be the morning before a hard ticket event (if you feel these events are worth doing in light of your budget) so you don’t have to use a park ticket.

Even if you do have to use a park ticket, if you can stay out of the park for more than half a day, chances are that you’re going to save some money by buying fewer snacks, cheaper meals, etc. On long vacations, we are fans of the free day for recharging your energy for the rest of the trip, so even though this might not be a source of great savings (and we’ll be frank–it’s probably not), we still recommend it.

3. Skip Souvenirs

“Collect moments, not things.” This has become a mantra we’ve adopted over the last few years as we’ve prioritized great experiences over stuff. Mind you, we still buy souvenirs and a fair amount of things, but we’ve gotten rid of a lot of our junk, and buy far fewer souvenirs these days.

If this is a tough sell with your family, look at it this way: how many extra experiences or days in the parks could that souvenir budget buy you? The memories will last a lifetime, that Mickey Mouse bobblehead someone just had to have will wind up in the garage sale or on eBay in a few years.

There are two alternatives to this if you’re not ready to give up souvenirs cold turkey. First, advance-purchasing souvenirs when they’re on sale on Amazon or at the DisneyStore. Pre-purchasing Disney Pins is also popular, albeit controversial (details here). Second, consider making a trip to the outlet near Disney Springs for deep-discounts on parks merchandise–read our Disney Character Warehouse Outlet Tips for info & details.

2. Say No to Soda & Snacks

Large drinks at Walt Disney World are over $5 a pop (no pun intended–used in the colloquial sense, as I don’t want to start a pop v. soda v. coke debate!). If you’re soda-addicted, you could be spending $20 or more per day on soda. I speak from first-hand experience, and I’ll be the first to admit I’m guilty of this.

In looking over receipts from a trip a few years ago, I was so shocked at how much I had wasted on soda that I swore it off at Walt Disney World from then on. Since then, I haven’t purchased Coke in the parks a single time! If you need the caffeine, get your fill of coffee in the morning from your hotel room or get your fix at a restaurant offering free refills.

Snacks are now similarly overpriced, having increased in price more than anything else in the last few years. Don’t get us wrong–we love Dole Whips and other tasty treats, but pretzels, popcorn, and even churros just aren’t worth the hefty prices these days. You don’t need to swear off snacks entirely, but we’d recommend cutting out the ones that aren’t unique to Walt Disney World. If you’re hungry between meals, Mobile Order an entree from a counter service restaurant and share that.

1. Visit During the “Right” Weeks

We highly recommend traveling during the off-season, or at least non-peak times, which we highlight in our 2024 Walt Disney World Crowd Calendars. The obvious upside to visiting during the off-season is lower crowds. Intuitive but less obvious is that prices are more reasonable. Pretty much everything–from airfare to park tickets to hotel rates to Lightning Lane prices–is cheaper during the off-season.

Walt Disney World has done a decent job of normalizing crowds throughout the year, so there’s no longer a “ghost town” off-season. However, this is accomplished in large part via aggressive discounting. On top of that, some off-season dates (like early November and December, January/February, and early May) are also among the best times to visit Florida in terms of weather. Lower crowds and prices…plus nicer weather–truly the best of all worlds!

In fact, if you cross-reference our list of the 10 Best and 10 Worst Weeks to Visit Walt Disney World in 2024 & 2025 and the Cheapest Dates to Do Walt Disney World in 2024, you should spot a ton of overlap. Once you visit during those sets of the best dates, it’s hard to go any other times. Both because you’ll enjoy Walt Disney World so much more…and because you’ll have a hard time justifying paying a lot more to deal with worse crowds and longer lines!

Of course, there are plenty of other ways to save money on your Walt Disney World vacation, and what works for one party may not work for others. How much you can save all depends upon which compromises you’re willing to make, and what parts of the Disney experience are really important to you. Some people may be able to save a lot, others may find that none of these tips will work for them (others still might already be doing all of these things!). Hopefully, there’s at least an idea or two here that’s helpful to you!

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

Your Thoughts

Do you have any of your own “quick tips” for saving money on a Walt Disney World vacation…or saving for a Walt Disney World vacation? How do you cut the fat from your travel budget? Do you agree or disagree with our advice? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!

Thank you for the cost saving tips, Tom!

My family and I have a few tips that we use to cut costs at WDW. Firstly, we use Marriott points at the Swan & Dolphin, you book 4 nights and get a 5th free. We book-end the Dolphin stay with Disney hotels to get the Disney Magical Express for free.

We order groceries (mostly breakfast items, fruit,

and snacks) at the local Target and have arranged with a CM/local (met through Facebook) who will pick them up and deliver them for a nominal fee.

We bring our own water bottles with filters (Brita) and a Life Straw filter that attaches to the sink. Before heading to the parks, we fill up our water bottles with hotel ice and filtered water. We have filtered water that tastes great and save $$$ on bottled water. It’s also better for the environment!

I buy Disney GC’s with my Target card or at my local Sam’s club, Target saves me 5% instantly using my Red Card. Savings on GC’s at Sam’s Club can be more if you have a credit card cashback/points promo for warehouse clubs.

Lastly, I bought a 5 day park hopper through Undercover Tourist, saving me around $30.

I hope my cost saving tips help someone else too.

See you at the parks!

Good Neighbors hotels are our favorite. The Hiltons are part of Hilton Honors and the Swan & Dolphin are Marriott Bon Voy. We stayed at a Good Neighbors resort entirely on points and only paid parking and taxes. It was a 4 night trip for $128 total. We are planning a second one in fall for a short 2 nights.

I would also add if you decided to do one Disney trip this year actually take 2 then skip the following year. 2 weeks is about the break even point on a platinum AP.

Oh if you are local don’t do a month to month payment plan. Squirrel away Target cards. We pay ours once a year. The 5% really pays off there.

I would also say memory maker really pays off because you can get professional family photos while at Disney for cheaper than a pro photo session. Bring some nice clothes and hit the studio at Springs. We have several frame-worthy shots.

Most of your tips are good, but your article has a few things I disagree with . You both are for Free Dining and then also say skip it to save money. You try to politely say it’s about the experience you are looking for. You should do an article that spells out what a non dining plan trip looks like and what a dining plan trip looks like. I’m what most people would call a cheapskate, but I would say I truly understand the value of the Dining Plan, Park Hoppers, and the Photopass. Yes I can save money, but the experiences are quite different. As far as the Credit Card suggestion, you have never had credit problems. You defiantly are not a fan or even remotely familer with the teaching of Dave Ramsey. “The borrower is slave to the lender”, is a quote from a book I read. Credit cards are just high interest loans with a less than 30 day introductory grace period. If you could afford the vacation and you pay off your cards monthly then why not push the trip back a month and just pay cash. If life gets in the way, and you carry a ballance on your credit from the trip you could wind up paying 5x or much more for you trip, let that sink in for a minute. We have a debit crisis in this country please don’t encourage it.

I’m familiar with Dave Ramsey. I wouldn’t say I’m not a fan, as I think he serves a purpose, but his advice is reductionist and not always accurate.

For instance, he stresses discipline…but somehow that doesn’t include the discipline to leverage credit cards for their perks and rewards while not paying off the balance in full each month?

I would have to agree with Tom on this one. You can use credit cards and not carry a balance month to month but still benefit from the card perks. If one Isn’t disciplined to pay it off before it rolls over and fees are imposed then of course this is not a good option

Tom, I opened a jetblue+ card that gives you 100000 points after spending $6000 EASY.

cost. 10 night stay at Poly rented from DVC ($4400)

4 7 day base tickets from undercover tourist ($1952)

10 $100 Disney Gift Cards from target ($950)

saving. 10 nights at Poly from DVC Vs WDW. (2550)

4 7 day ticket from undercover tourist Vs WDW ($88)

10 gift cards from target ($50)

4 roundtrip tickets from jetblue FREE ($1300)

4 roundtrip free baggage ($280)

11 days at WDW priceless

Thanks for the article! We do many of these and typically pay off our trips using Disney gift cards to get the gas perks from our grocery store. I’m hesitant to do that for our upcoming trip in March because we may decide to cancel last minute and then I’ll have a ton of money “stuck” on gift cards. Any ideas on how to work around this?

We use the middle tier Southwest Visa card and the lowest tier Disney Rewards Visa Card for our trips to MCO/WDW from Texas. Companion pass is a huge perk, especially this year with the 6 month extension, and I can get direct flights from my home airport which makes for a great weekend getaway. Though my Costco card gets a much higher percent back (up to 5% if using Costco Travel), I typically use the DRVC for WDW trips because the card allows me to finance those vacation payments over 6 months at 0% interest and keep my spare cash earning money at a higher rate through other investments. The DRVC also gives you 10% off merch over $50, which is easy to do at WDW. Much like y’all, we pay off everything each month to avoid the interest and keep the credit utilization low (except when I can get 0%). We’ve used the gift card hacks with 5% off at Sam’s and 5% back with Discover combo and gotten some pretty great discounts that way.

I’ve experimented with “getting my money’s worth” out of the DDP during free dining (comparing to list price) and managed to succeed, but I had teenagers on the team who didn’t mind eating everything so I think that’s a little biased.

I have a hard time saying no to park hopper though, especially with Skyliner running. It’s a great deal if you plan to visit more than one park per day and are staying for more than a few days, and an easy way to “park swap” if one park is getting overcrowded (which always happens to me at MK around 11am). The only time I go without it is on a quick 1 or 2 day trip.

The are are so many fun free things to do! Now that we stay with family nearby, we can make longer trips and have more “free” days. We’ve walked around Art of Animation and taken the drawing class; we went to Wilderness lodge to watch fireworks and the electrical pageant–before it got dark, we rode the boat around the lake. We always enjoy an evening walking around the Boardwalk too. And of course, a monorail tour. We pin trade at each of these places with pins we bought cheap on ebay (must be genuine disney pins through a reputable seller). We love free and cheap stuff!

Gift card hacks that give you money back in other ways is fine, but I like immediate results. I use my Disney credit card to buy Gift cards from BJ’s. There norm is 4% off plus the 2% I get back on my credit card. Around Christmas time the discount can be around 6-7%. And if you’re a big spender, a friend of mine gets offers of up to 10% off when he buys $5K or more at one time. Combine that with 2% on your credit card, TiW, Military, passholder, DVC, etc… discount, and I have been able to save up to 25% or more on my vacations. Too bad you can’t use gift cards when buying special event tickets online. You do have to call in order to use the gift card, they do accept them. AND, for Military folks, use your gift cards at shades of green to save another 7-8% in tax. My wife does regard me as the king of Disney discounts.

We used the Harris Teeter/Kroger 4x points coupons when buying gift cards. $500 card ( to make a payment on our trip) = 2000 points so $1.00 off 35 gallons of fuel twice. We fill up both our vehicles at the same time to maximize the full amount. $70 off the cost of fuel I would pay for anyway is more than the 5% off at SAMS Club. Also, we’re not that hungry walking the park all day so we split breakfast or lunch. The meals they have at quick services are much larger than what we eat normally. He picks one I pick the next, and water is no charge, it’s fun!

We are staying in a Home Away condo 20 minutes away from Disney I freeze bottles of water (with some water taken out first). We take a cool bag with home made sandwiches, sodas, fruit etc and the frozen water keeps everything cool in the rented locker 12 dollars until we are ready to eat and we even get to drink the water lster in the day.

Yes to the credit Card recommendation! We opened a new Chase card, booked the vacation package with the new card, and got a sign-up bonus that we cashed in for three free round trip airline tickets!

You know what, I just love Disney land, It’s actually one of my most favorite places. I have just seen Disney land on T.V. and on the internet, I have never been to Disneyland. It’s my dream to visit Disneyland just once. Anyways, your tips are great and very interesting. Such a unique post. So, Thank you for sharing this great post. Please do keep sharing.

is uber code still valis? i will go in AUG2019

Collect moments, not things. This is right, we travel to enjoy the moment we are in the place, not buying things. Souvenirs are quite expensive and can cost much as you expected.

We use our Disney rewards card to pay for medical expenses then submit the receipt for FSA reimbursement. We immediately pay off the charge to the card from a checking account and, when the FSA check comes in, it goes right into the checking account. In other words, free points.

Enjoy this blog. Some of these tips might actually be repeated from you, Tom.

Take advantage of the free souvenirs…..the Sorcerer cards at Magic Kingdom, for example. Not only is this a fun activity, the cards make great souvenirs. Make sure everyone, adults included, get their cards for the day. Park maps are also fun to look over once you are home. If you are not big eaters, the portions are definitely large enough to share. My daughter and her daughter and husband easily share the large breakfast at the resort. Buying the souvenir refillable cup at the resort also saves us….refills of soda, coffee, and tea for our entire visit, and the cup goes home with us.

Thanks for this info. I found an app that rewards you with a Disney gift card for going in stores and scanning products. I am almost a quarter of the way to a $50 Disney gift card by just doing 5 minutes of scanning products as I pass by them. The app is Shopkick. I make myself not buy any product I don’t need. You get more kicks for purchases. Hope this helps some people get an extra card to use.

We split counter meals or order a children’s portion. At walk up counters no one sees whether you have a child seated waiting for you to bring their meal or not. An adult 8 piece chicken nuggets and fries is definitely enough for 2. We also split sodas especially since you can get refills.

If you are a Dvc member there is a dvc member station in Epcot by imagination where there is free soda and snacks. And you can bring a guest. Not sure if similar locations are in the other parks.

We also bring snacks, granola bars etc which are usually sufficient between breakfast and dinner.

We Always bring breakfast when staying at a dvc resort, even it we have to by from the gift store. Is a bowl of cereal really a problem on vacation? Gets you out to the parks quicker and ends up cheaper than dining in a restaurant.

We get fl resident weekday annual passes and apply for various credit cards that give bonuses. Our $288 renewal annual weekday pass ends up costing $88 if we apply for a credit card with a $200 bonus! Just have to search for them and meet spending requirements. And it doesn’t have to be a Disney credit card which charges an annual fee!

Hey Tom – I just had a thought about the Disney Dining Plan, and why it’s so appealing to people (including me) even though in most cases it probably doesn’t save you money.

It seems pretty clear to me that there’s a huge psychic cost in “reaching for your wallet.” That is, the AMOUNT of money a person pays is frequently less “costly” to the person than the NUMBER OF TIMES a person pays. I think about how irritated I get at video games that are “free to play” yet constantly charge me small fees to continue playing – even if the total cost is lower than a one-time up-front purchase, it irritates me a lot more. I think there’s a functional “overhead” cost to the very act of paying for something that has little to do with the dollar amount itself. There are times I would honestly rather pay twenty dollars once than one dollar fifteen times, even knowing it’s a 25% savings.

This was the genius of Disneyland’s original A-E ticket books – the parks felt CHEAPER when you paid for a single book rather than on a per-ride basis, simply because you paid LESS FREQUENTLY.

Not sure if this changes anything really, but after reading about Walt’s rationale for switching to ticket books in 1955, I realized this is a very real phenomenon. Anyway, thanks for your blog!

On the gift card front, the most efficient deal I’ve found was through BJ’s. Around Black Friday, they were offering discounts on their various gift cards with the largest available gift cards being the $50 cards offered for $45.99, an 8% discount. We weren’t BJ’s members, so we had to buy a membership. They had a $10 online membership, making that a no-brainer. In the end, we bought 21 gift cards to pay our DVC dues for $975.79 ($965.79 of gift cards + $10 membership), a net discount of about 7.07%.

But wait! There’s more!

My wife has an old Chase Freedom card offering 5% cash back on wholesale clubs in the final calendar quarter of the year. As such, we received $48.79 cash back on that purchase.

In the end, we ended shelling out $927.00 for $1,050.00 worth of gift cards, a net savings of about 11.7%. Pretty nifty.